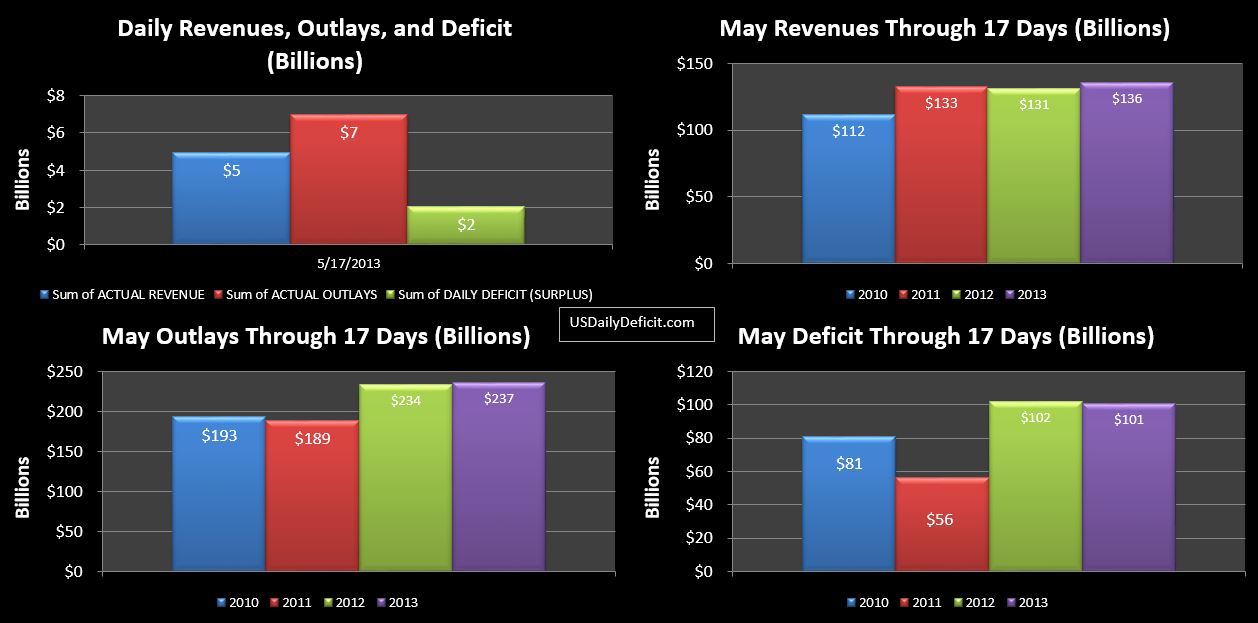

The US Cash deficit for 5/17/2013 was $2.0B bringing the May 2013 deficit through 17 days to $101B. Nothing particularly interesting to see…revenue and cost are more or less inline with last year.

Now…on to the fun stuff. As we discussed last week, heading into the expiration of the debt limit deal, cash was looking pretty low….that is still the case, ending down a bit at $34B. Debt subject to the limit as of 5/17 stands at $16.699T….which I presume is now the new debt limit. From here on out, the only was to get cash is to receive it from taxpayers, or, via “extraordinary measures” move certain parts of “intragovernmental” off of the balance sheet…freeing up room to issue external debt.

At first, I thought this was simply going to be impossible, but I penciled it out, and while it still seems like a stretch, I can see a scenario in which we make it to September…heavily dependent on strong revenues, $60B from Fannie Mae, and about $150B from “extraordinary measures”.

I’ll do some more analysis soon…short on time right now, but basically the timeline is greatly extended by expected June and September surpluses. It looks to me like the most difficult part is the next 2-3 weeks….making that $34B last until the Fannie Mae and June quarterly revenue starts to flow in in the second half of June. Stay tuned!!