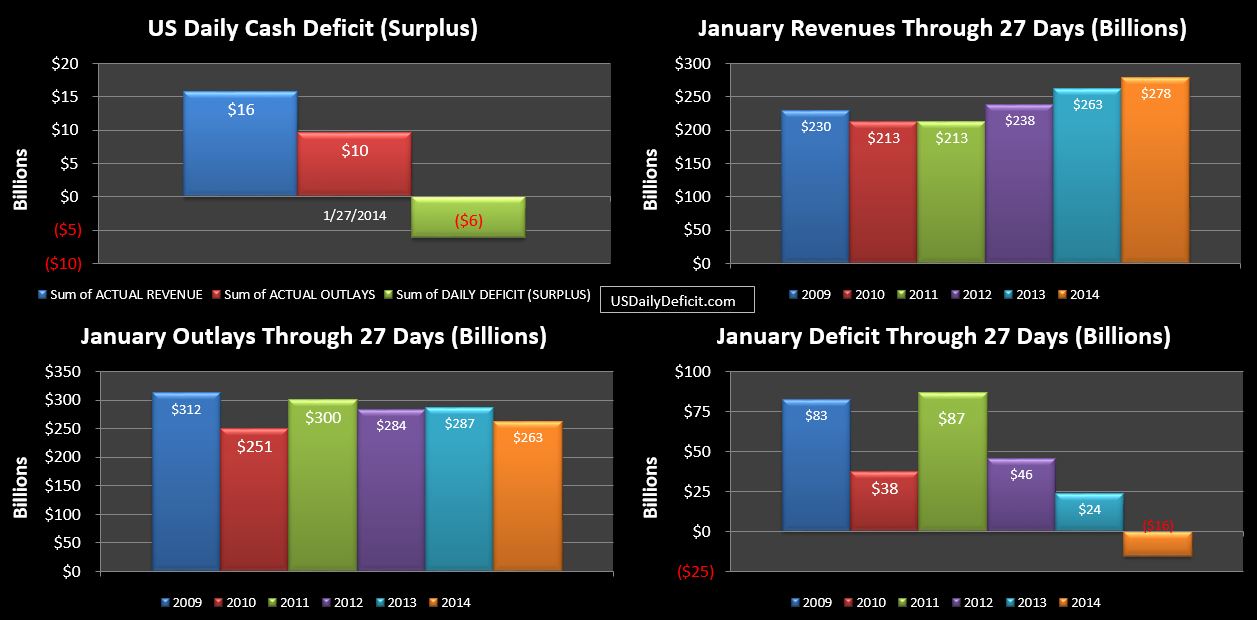

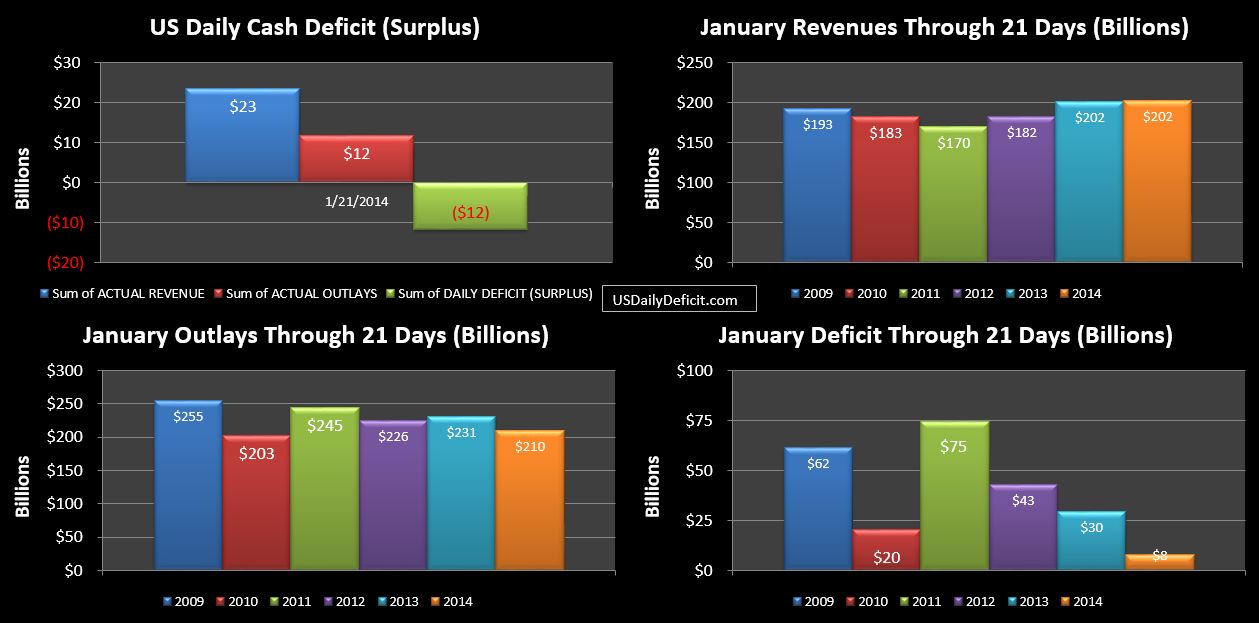

The US Daily Cash Surplus for Monday 1/27/2014 was $6.1B…pretty much in line with last year…Monday 1/28/2013 at $5.5B. this brings the January Surplus to $16B with 4 days remaining.

As it stands…Revenue is at $+15B….which we will likely see grow, perhaps as much as $10B due to the extra day remaining in Jan 2014 compared to 2013. Outlays, on the other hand are about $-24B….for now. The extra day will likely shave about $10B off of this…and payments due 2/1 that will be paid Friday 1/31 should push this the other way by a healthy margin, making January look worse, but February better.

There is still quite a bit of uncertainty, but the January deficit looks like it will end up right around $20B…+/-$10B or so…. Quite coincidentally….I threw out $25B earlier this month as my wild A$$ guess….though it looks like I may have missed big on revenue and outlays….only to have them net out…. We’ll find out next Monday when the 1/31 report is released