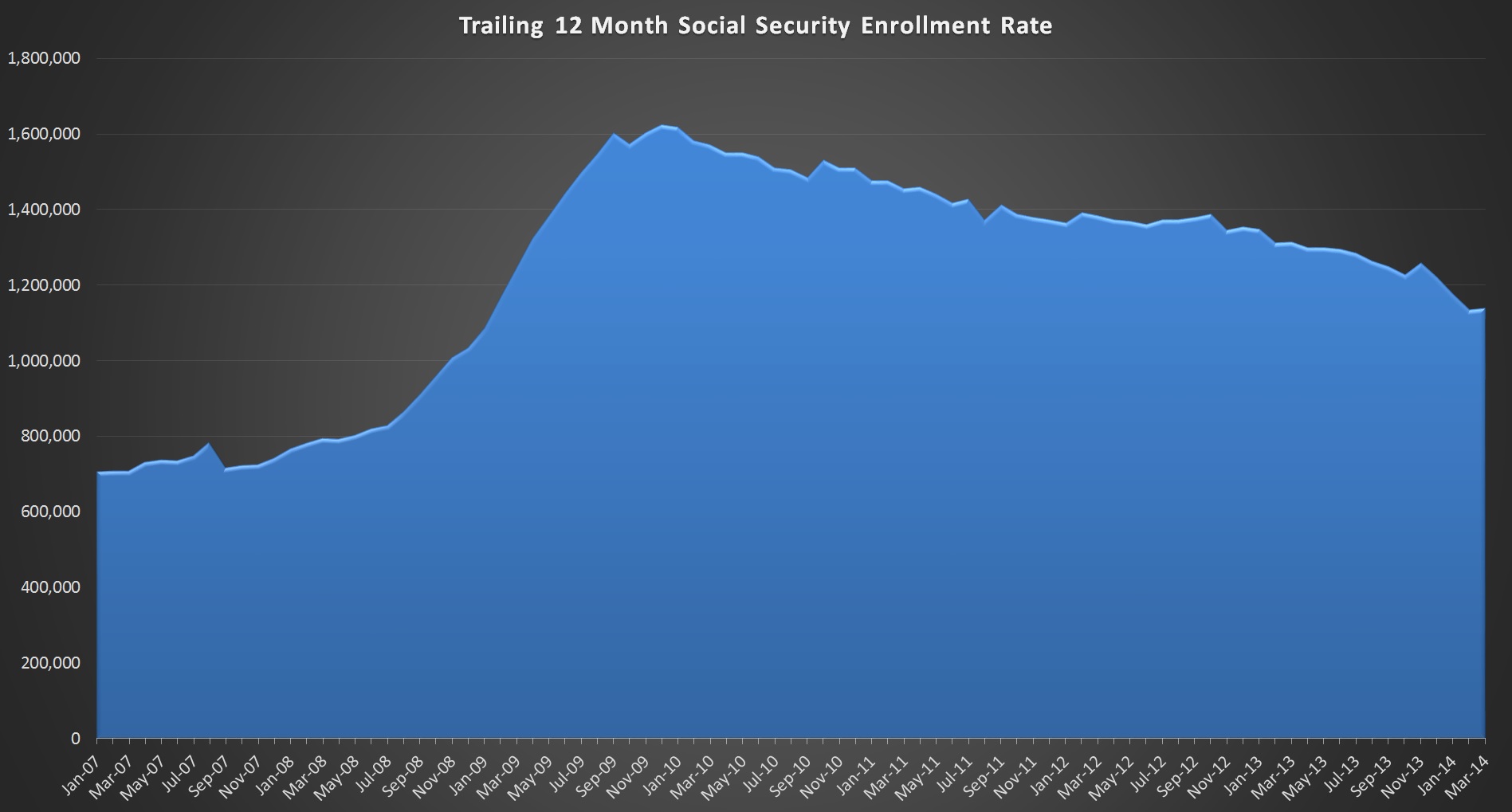

In March 2014 the SS rolls added 143k to the headcount bringing the total to 58.341M. This compares to a 138k add last March, breaking a 4 month string of improvement.

It’s just a one month break in a downward trend dating back to the last peak in December 2009 at 1.6M, so it’s nothing to get excited about either way. The rolls are growing by over 1.1M people per year, and cash outlays are growing at 8% annually, which is a combination of additional people, COLA adjustments, and new retirees coming into the system with higher monthly payments than the people they are replacing.

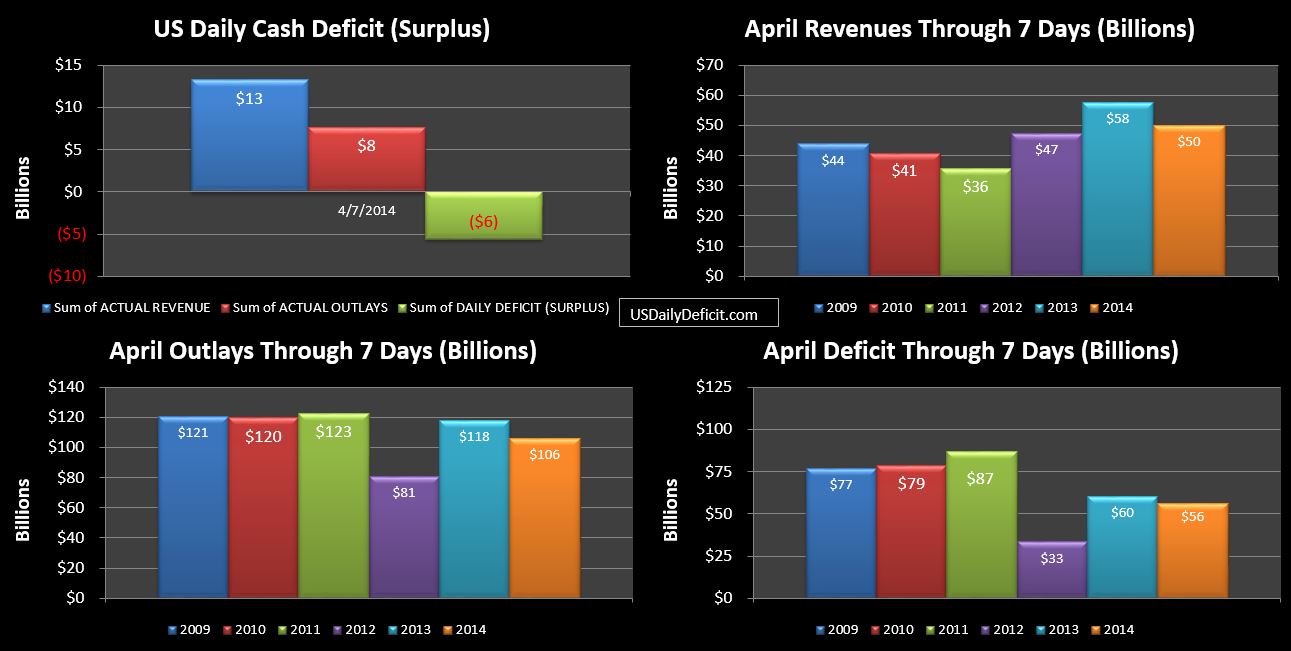

As I’ve explained before, I monitor this series primarily to look for signs of a new spike similar to what we saw between 2008 and 2009. If this correlated with a decrease in revenues, we would have a pretty clear sign that a recession is either already in progress or imminent. As it stands, we see neither. Revenue is at all time highs and growing at about 12% through the first 100 days of 2014. Retirements…while still high historically, continue to trend down….slowly. It’s clearly too soon to declare that everything is going to be ok, but even I must admit….things have been a lot worse.