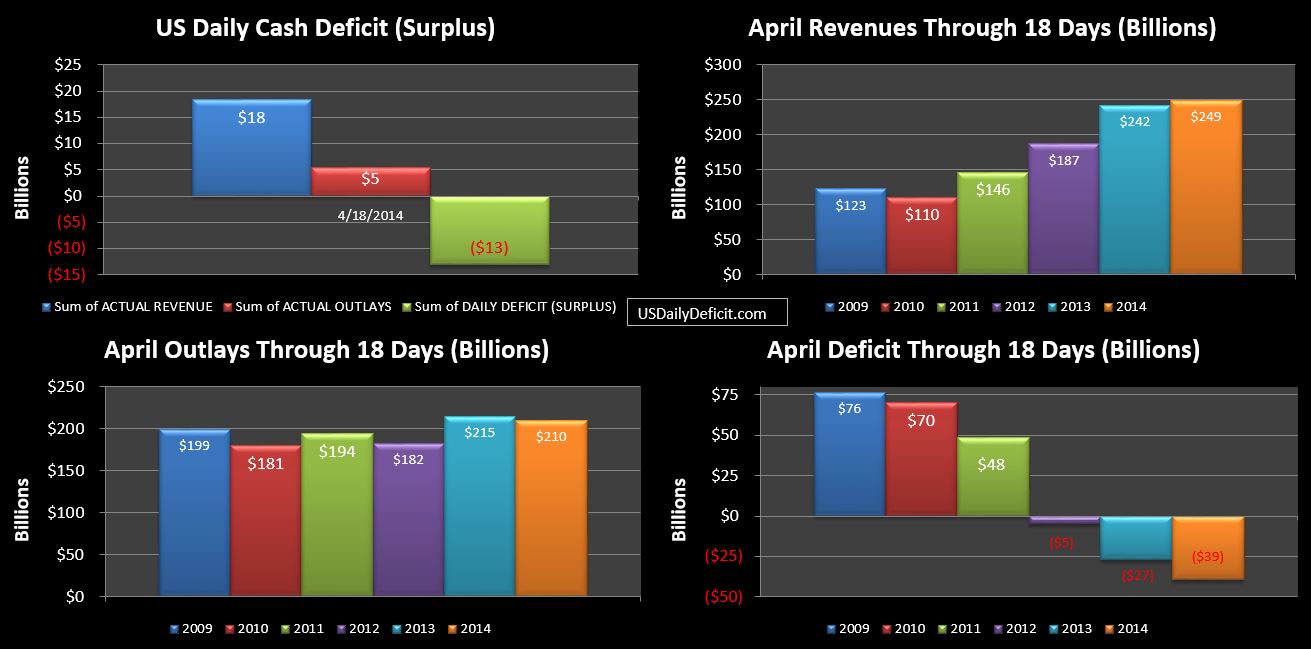

The US Daily Surplus for Friday 4/18/2014 was 13.1B pushing the April Surplus through 18 days to $39B.

Another OK day….but not impressive. Our YOY revenue is sitting at only +3%. Compare that to 2013 vs 2012…where through 18 days we were sitting on a +29% YOY revenue. Clearly….April 2014 is not looking like April 2013…where a 27% revenue surge set the stage for an impressive rest of year. Still…the truth is we don’t need another huge April to impress. As I discussed back then…stringing together 2 25%+ YOY gains in a row was always highly unlikely. Topping last year would be a small victory in itself, though obviously we’d prefer to do much better.

Just a few weeks ago I put forth a 13% YOY revenue gain in my $180B surplus forecast…..pretty much sticking with the +10% we’ve been seeing and adjusting up a bit for timing. I suppose that is still quite possible….but we’re going to have to see some progress quick…starting with Tuesday which should come in strong if patterns hold. Absent some late month surprises, we should have a pretty good idea how the month will end up by Wednesday…stay tuned.