The April 2014 SS numbers are in and we added 130,874 people to the consolidated headcount just barely edging last years 130,724 add by 150 people. The total consolidated enrollment now stands at 58.472M…good for 18.38% of the population.

So in the big picture, we are still plodding along at an annualized rate adding about 1.1M people a year….pencil that out assuming new benefits at a rate of $1500/month, that’s about $20B per year…a big chunk of the programs ~50B growth rate….with the rest being primarily the COLA adjustments which are small, but being applied to a huge base.. At that rate, assuming everything else in the entire budget is frozen…we need about 1.6% annual growth in revenues just to stay even….or about what we just saw in April.

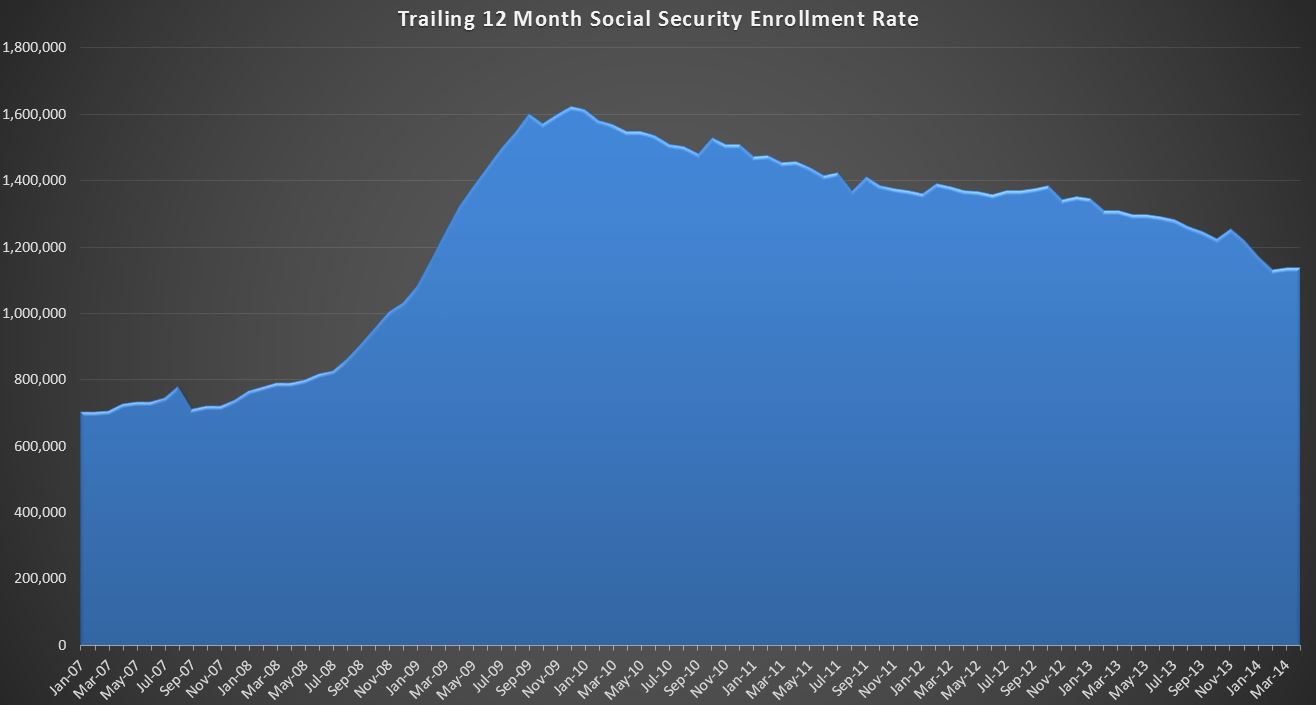

But the real reason I watch this series is because I am watching for a material change in the enrollment trend. Clearly we don’t have that this month. What we do have is two months of essentially no YOY change against over a 4 year trend of moderate decline. Two months in a row isn’t particularly alarming, but a few more would definitely be interesting.