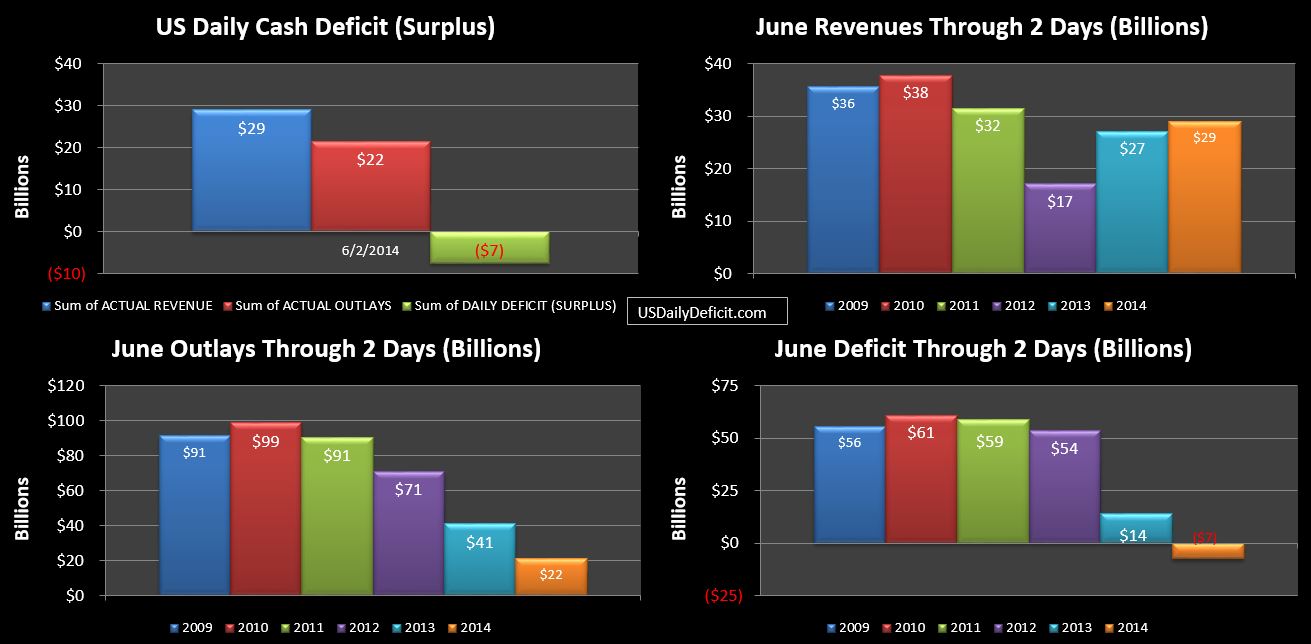

The US Daily Cash Surplus for Monday 6/2/2014 was $7.5B.

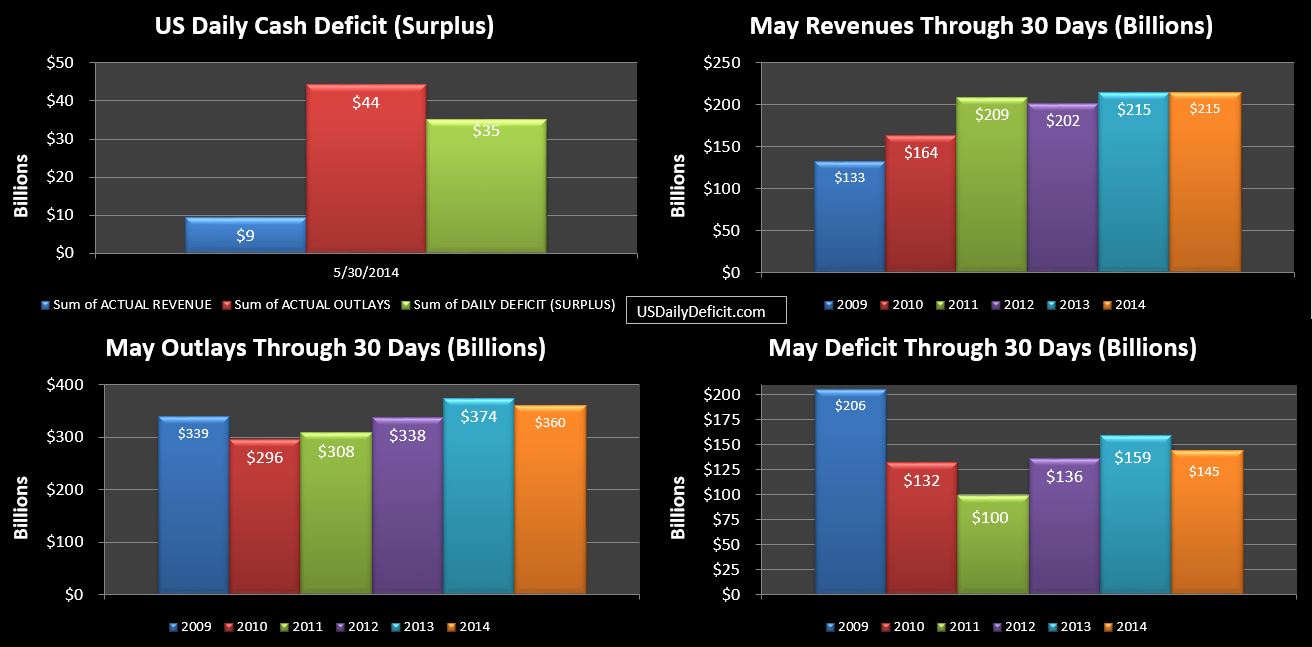

First…timing…as is standard, I will be comparing June 2014 vs. June 2013 primarily on day of week, which requires me adding one day to sync up 2013. For example, today, we are comparing Monday 6/3/2013 to Monday 6/2/2014. Since both months start off on a Monday…we should get a pretty good side by side comparison all month long…until the very end where 2014 picks up an extra business day…Monday 6/30/2014. Monday’s generally have pretty strong revenues say $10-15B…so 2014 has a definite timing advantage…and all else equal we might expect a 4% revenue gain just on timing. Of course all is not equal…Last June received a $50-$60B revenue boost from Fannie Mae (though Treasury booked it as a negative expense…officially) that won’t be repeating itself. And who knows what is going to happen with tax deposits…which started the year off strong but have posted two months in a row under 2%… Bottom line, there are a lot of moving pieces and while revenue is just about certain to end up down…primarily I will be looking at tax deposits and backing out last year’s Fannie Mae windfall.

We start off June on a good note….though that will turn around tomorrow as round one of June SS payments go out 6/3….around $25B. Revenues start out at +$2B…not too shabby, and the deficit looks much improved, but most of that is the first SS payment is included in 2013, but won’t hit 2014 until tomorrow…where things should more or less normalize.