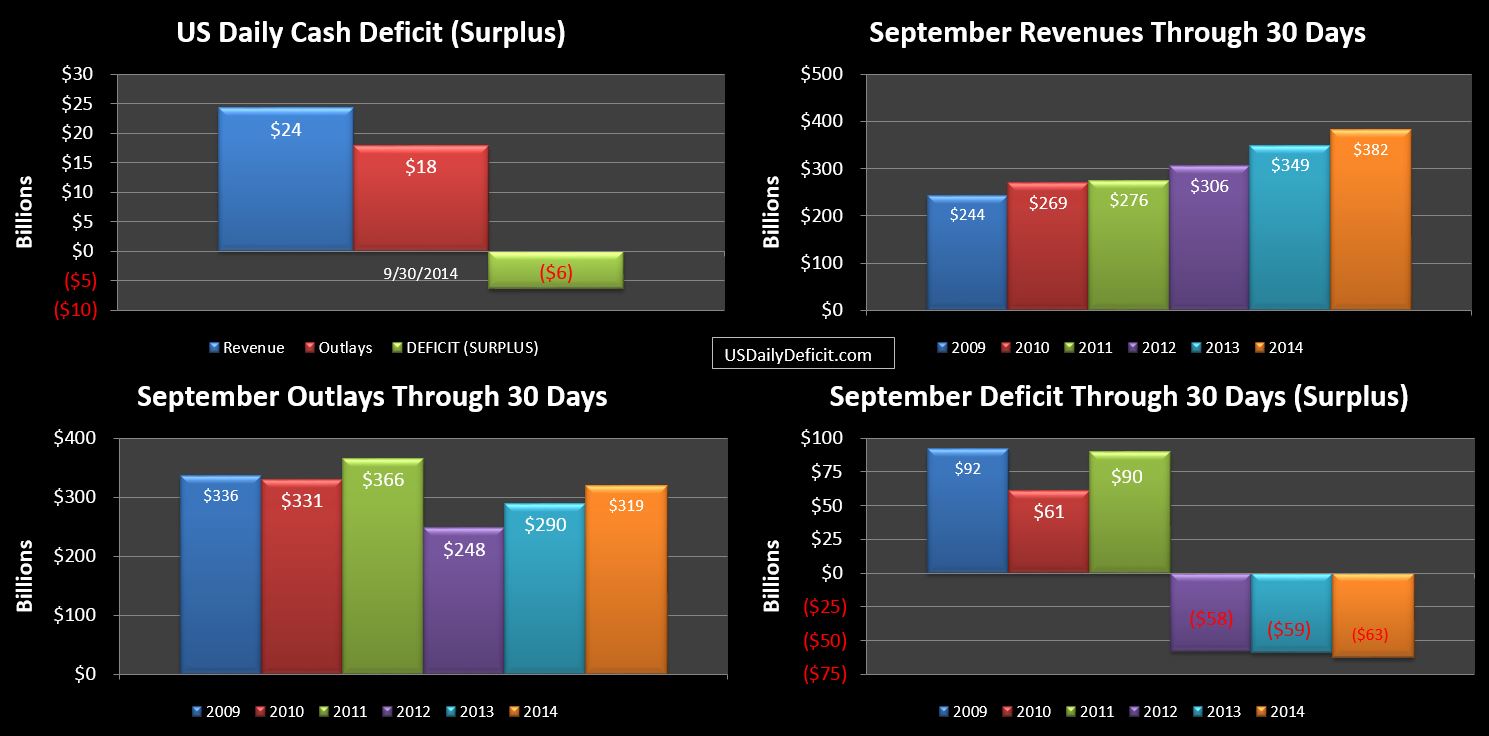

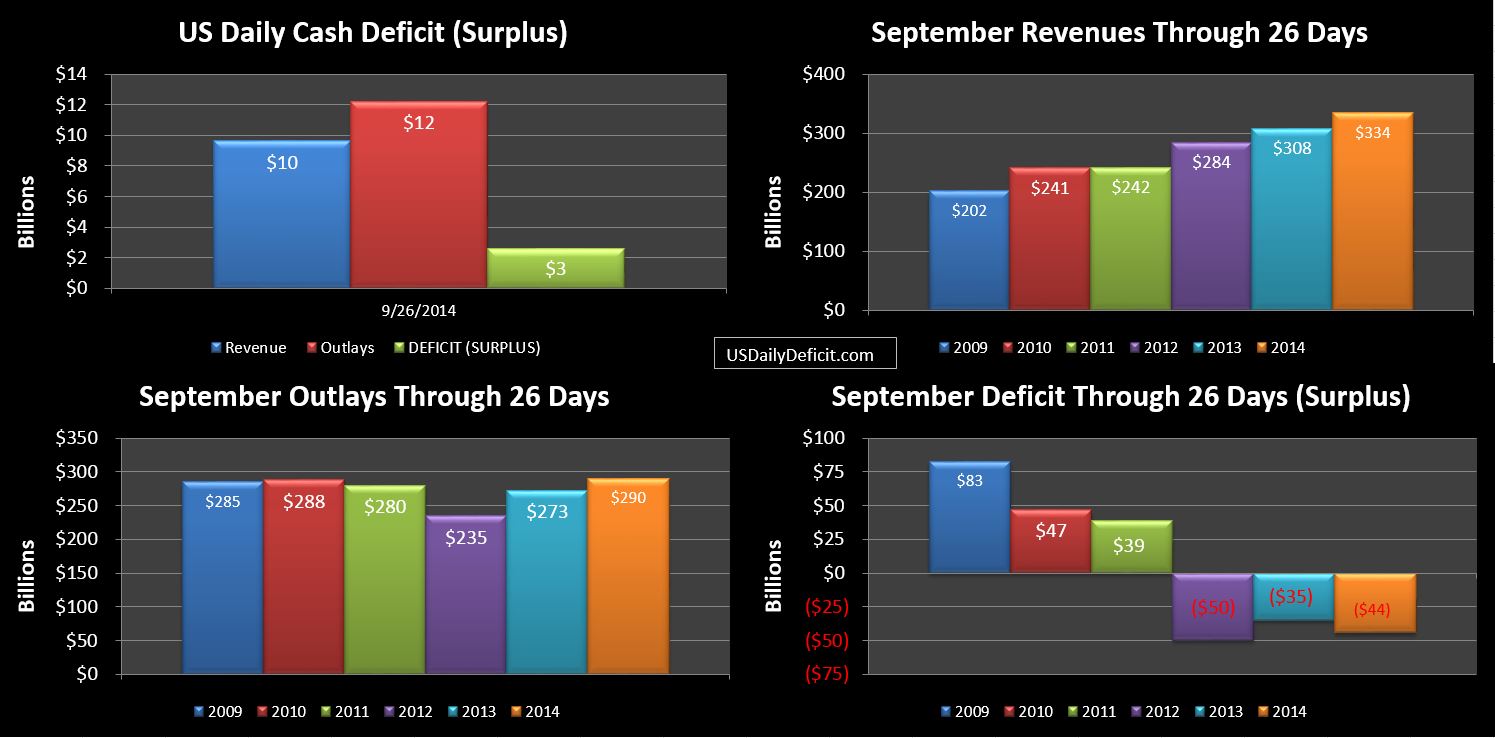

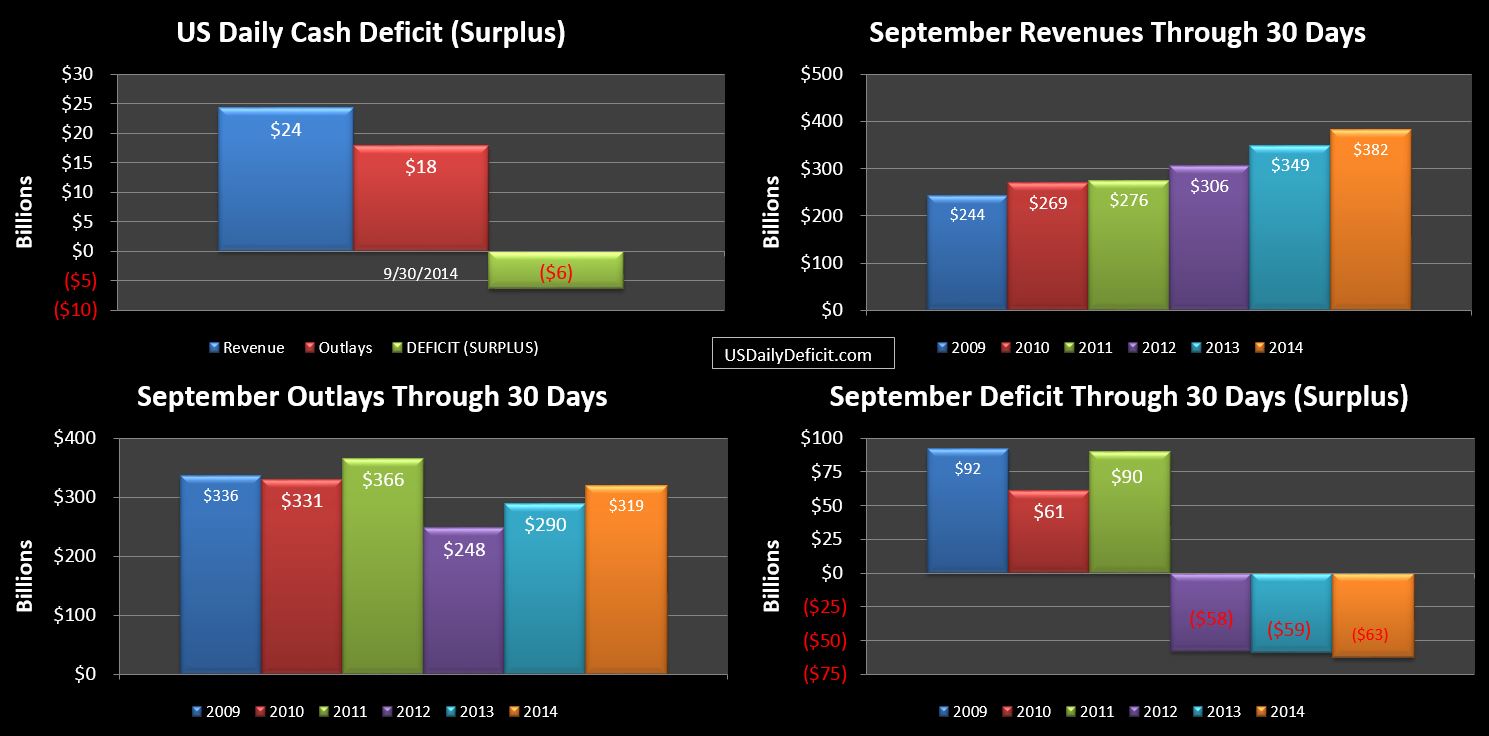

The US Daily Cash Surplus for Tuesday 9/30/2014 was $6.3B bringing the September 2014 surplus to $63B for the full month compared to a $59B surplus in September 2013.

It was an interesting month….Revenues were up 9.5% on solid corporate taxes and excise taxes. Outlays on the other hand were up 10.3%, mostly due to timing that shifted $18B from August to September (compared to last year) but also bonafide growth, including Medicaid up 31%….$6.6B.

GSE dividends….which I’ve been mentioning lately came in at a very dissapointing $5.6B…..compared to 14.6B a year ago and $10.2B just last quarter. My guess….Freddie and Fannie’s accountants are running out of ways to fake income with journal entries. That’s bad news for the deficit because in 2013 Fannie/Freddie contributed about $130B of “revenue to federal coffers. At this pace, 2014 will be lucky to break $40B…..and 2015 could be half that assuming a $5B/quarter pace.

However, despite the GSE disappointment, excise taxes came out of nowhere to save the day from $11B last year nearly doubling to $20B, including $13B over the last two days of the month.

At the end of the day….it was a pretty good month.Revenue….+9.5%, up $33B YOY, and it was solid across the board including taxes withheld, not withheld, corporate and excise taxes, and all despite a pretty big GSE miss. For revenue, this is the best month in the last six. In fact, if we look back to April when the apparent slowdown began, April-August combined ran at only +0.5% good for a $7B YOY gain. Admittedly….this period in 2013 was tainted by Fannie/Freddie payments, but the numbers are legitimate. Compare that to just September at +$33B.

After pulling out timing, outlays were up ~3% or so…which is actually what I would expect typical growth to be, but definitely a divergence from the flat outlays we have seen for the last 4-5 years. So the question I have….is this an anomaly….or are revenues picking back up after a soft patch? Stay tuned!! I don’t have an October forecast finalized yet, but it’s likely to be in the ballpark of $100B…more than enough to wipe out September’s surplus and kick off FY2015 with a bang.