Here’s the full quote:

“We don’t have an immediate crisis in terms of debt. In fact, for the next 10 years, it’s gonna be in a sustainable place.”

Oh my… I have a theory maybe I will expand upon someday, but the gist is this…Homo-Sapian, for some reason has evolved in a way that the vast majority of us are just atrocious accountants…period. I’m not bragging…I’m an atrocious engineer, artist, mechanic, photographer….plus a couple hundred thousand other things that I’m just plain bad at… So I state this as a fact…Perhaps 1-2% of the population is born with the genetic tools necessary to be a decent accountant.

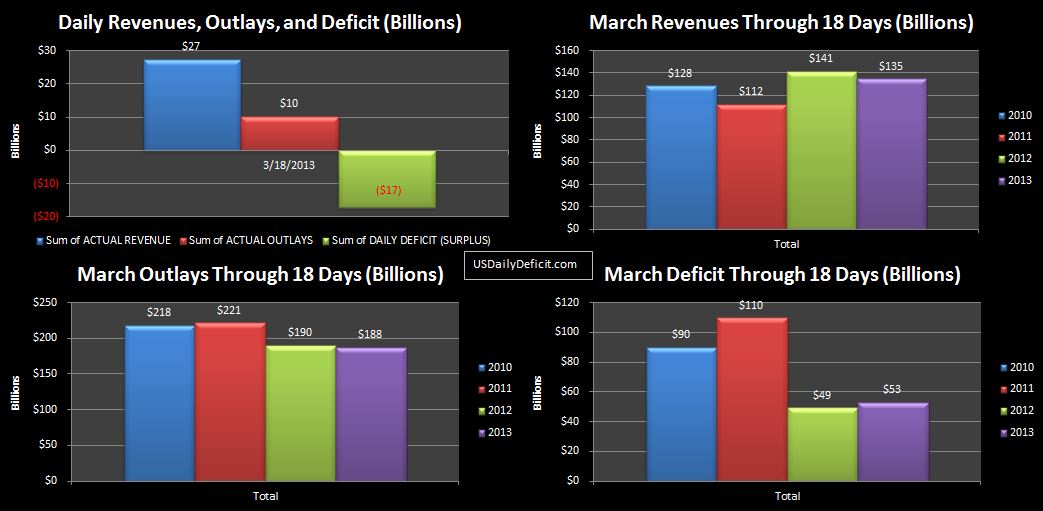

The President, and probably all but half a dozen or so in congress clearly lack those tools, which goes pretty far in explaining how the heck we went about accumulating $17T in debt….and can still look at a camera with a straight face and say…well, you know, in my expert opinion, we have another decade or so to figure this one out.

Ladies and gentlemen….I have some news for you….in another decade, at this pace, the debt is going to damn near double again…to around $30T. As an Uncertified Public Accountant with a mediocre skill set I have a really hard time believing a) we make it that far, or b) that we have time…even if our President realized there was a problem, to fix it. Truth is, we probably crossed that bridge at least a few years ago.

As such, it is now inevitable that on and off balance sheet liabilities will be defaulted on in the not so distant future. Social Security and Medicare will be at a minimum receive haircuts in one way or another….benefits will be decreased, retirement ages will rise, and the ability for individuals to force the public to pay millions in end of life care in their quest for immortality will stop. Same goes for Government and Military pensions. The debt itself will also be defaulted on, either outright a-la Greece, or perhaps more likely, simply be inflated away as real inflation hits double digits while the clowns at the BLS continue to print CPI at 2% or less.

I won’t predict a time frame…it could happen tomorrow or it could happen a decade from now… What is certain is that it will happen…on that the math is crystal clear. With this not so surprising quote from the president, we are now assured that we as a country are incapable of even recognizing we have a problem, much less making the painful steps required to right the ship. The first rule of holes is to stop digging…instead, we are bringing in the heavy equipment. I will note that I am not expecting the apocalypse, the collapse of society, or even a Ron Paul presidency…just change as a new acceptance of reality sets in and people stop believing in the economic fairy tales that have been written in the last 75 years. The time to short tulips has finally arrived!!