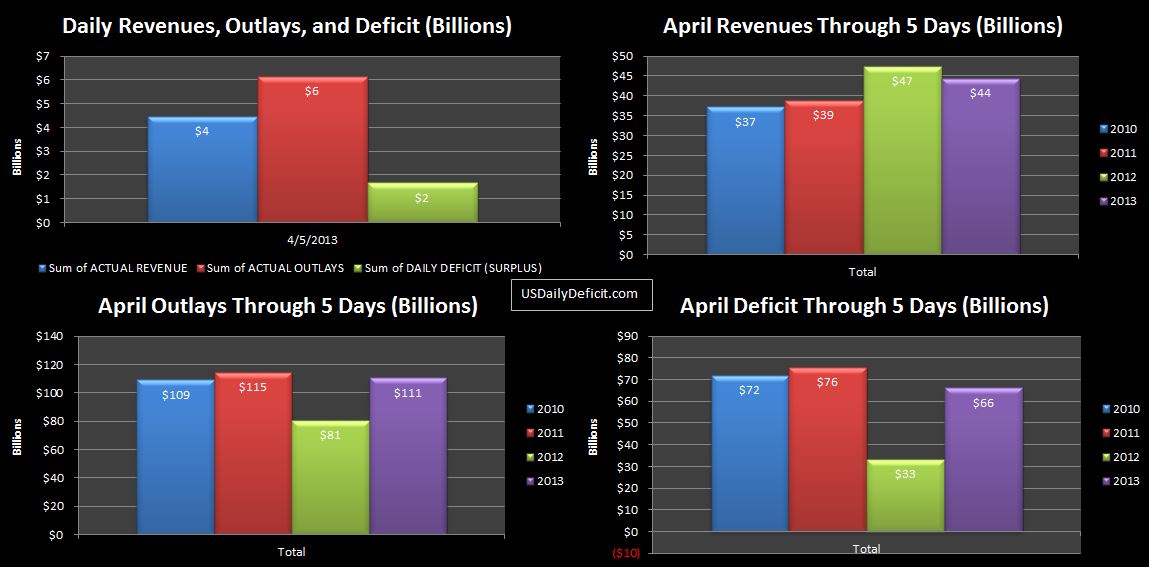

The US daily Cash Deficit for 4/5/2013 was $1.7B bringing the total April Deficit through a week to $66B.

Today’s charts give us a glance at 2013/2012 that is more or less aligned…each has 5 business days, and a full Monday-Friday sequence (I included 4/6/2012). Notice anything? Yep…revenues are down. It’s just one week, and there is plenty of action left, but it’s not what I had expected….which was for 2013 revenues to be over 2012 by $5-7B by now. Instead, tax deposits withheld are only up 2% while total net revenue is actually down. It may be nothing…just a timing quirk, but I will definitely keep an eye on it. If 4/15 goes big one way or another, we may not even notice, but it will be interesting if revenues are still down (or even) through this Friday 4/12. Cost is where expected, and the deficit still has a $33B hole to dig out of….stay tuned.

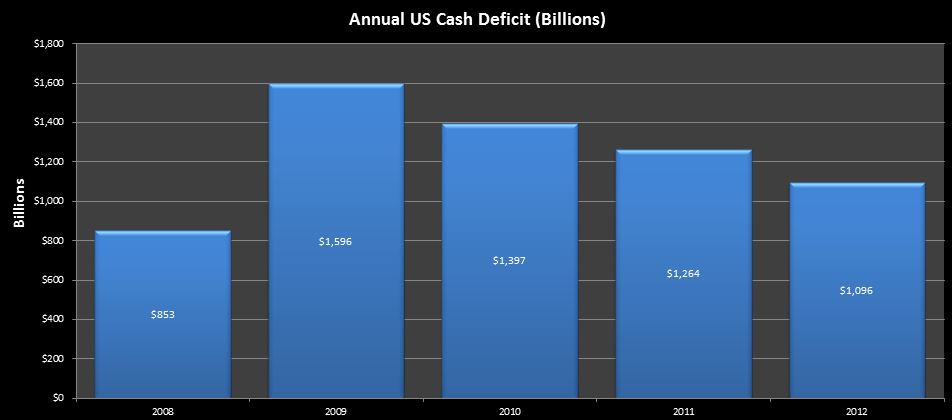

I read with great interest Obama: ‘The Truth Is, Our Deficits Are Already Shrinking’. One of the main reasons I do this is to provide some proper accounting for the historical record. So…He is right. The deficit is shrinking…no doubt about it, but it’s not exactly something new.

After topping out in 2009, we have seen slow but steady improvement down $500B to $1.096T in 2012 from $1.596T in 2009. And 2013, helped by the elimination of the payroll tax cut, and maybe to a small degree the tax hikes on the wealthy, is likely to continue this positive trend.

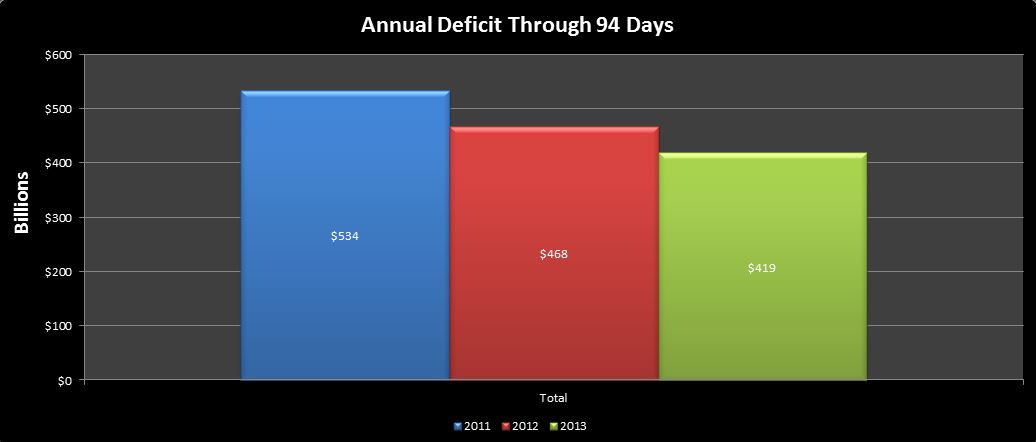

Through April 4th…94 days into 2013, the deficit, at $419B is $49B under where it was last year through 94 days. So does anyone see the problem here?… Maybe that we are working on our 5th consecutive $1T+ deficit, and our debt will soon blow through $17T…on it’s way to $20T and beyond. So, let’s use a football analogy. If in Year 1, your team loses 70-0…that’s pretty bad, kind of like our 2009 deficit. The next year, if you only lose 63-0, sure, maybe it’s an improvement, but you still got stomped. So here we are…5 years later. Maybe we lose 42-0, maybe we lose 35-0…does it really matter? Now fortunately, football seasons are not cumulative….everybody starts 0-0, no matter how bad they were last year. Deficits aren’t like that…and our $17T debt is one heck of a testament to that.

Now…. the economists and the politicians, as I’ve discussed before, are atrocious accountants. They will spout all kinds of ridiculous justifications about pointless ratios like debt to GDP, and rave about how low interest rates are….so it is ok to take on debt now… Don’t you believe any of them. Where we are now is like a household with 50k of income closing in on $300k of credit card debt. There is nothing to show(or secure) for this debt…no cars, no house (no dams, bridges to nowhere, or fleets of electric cars.) Just mountains of unsecured debt on a 0% special….expiring sometime soon. The answer for our household is obvious…declare bankruptcy, and those foolish enough to lend them the 300k in the first place, get to suffer the consequences for their foolish decisions. The US story will end the same. We are simply too far gone and our political system too broken. The game is already over, we just haven’t admitted it yet.

So, while President Obama is right…the debt deficit has been coming down, we are still losing 35-0. Worse, while we are likely to have another year or two of improvement, with 10k boomers retiring every single day, the exponential growth of Social Security, Medicare, and the other entitlement programs will soon overwhealm the entire budget. In CBO vs CBO I forecasted that by 2022, the annual deficit will have grown to $1.788T. Our Debt….external only will have doubled to $24T…not including our Intragovernmental Debt… The only good thing about a Trillion dollar deficit, is that at least it’s not 2 Trillion.

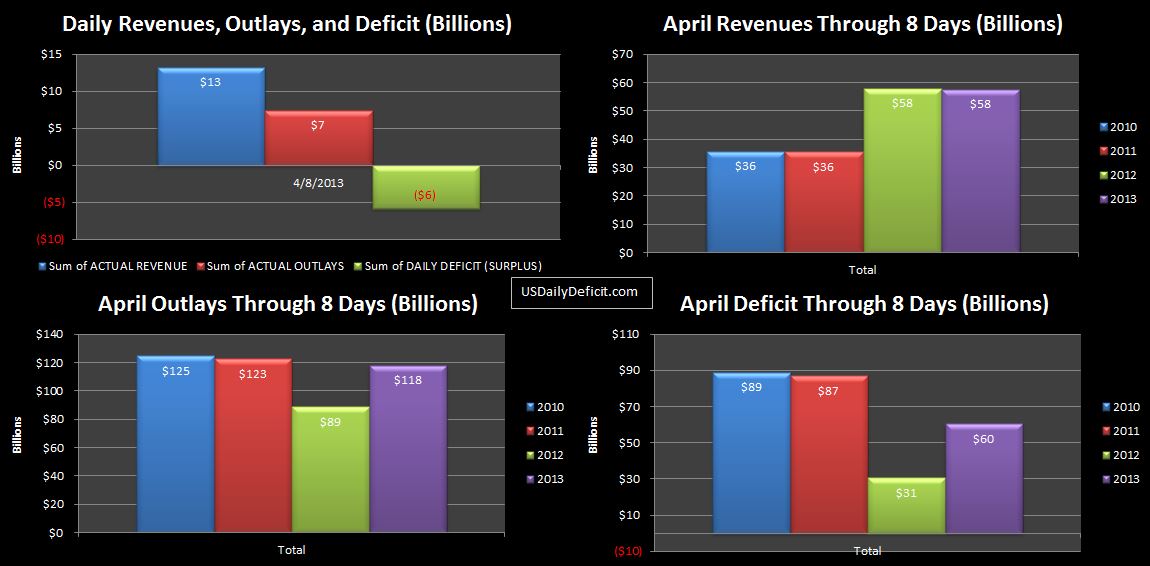

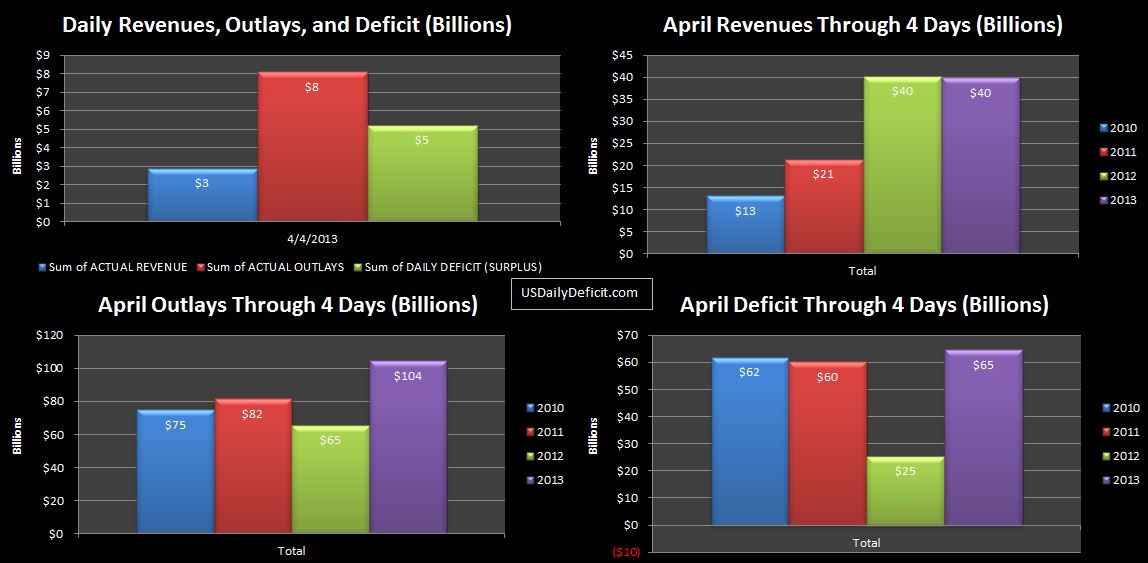

The US Daily Cash Deficit for 4/4/2013 was $5.2B bringing the monthly total through 4 days to $65B. Revenues are flat and outlays are up…primarily due to timing issues discussed in prior posts. Enjoy the weekend!!