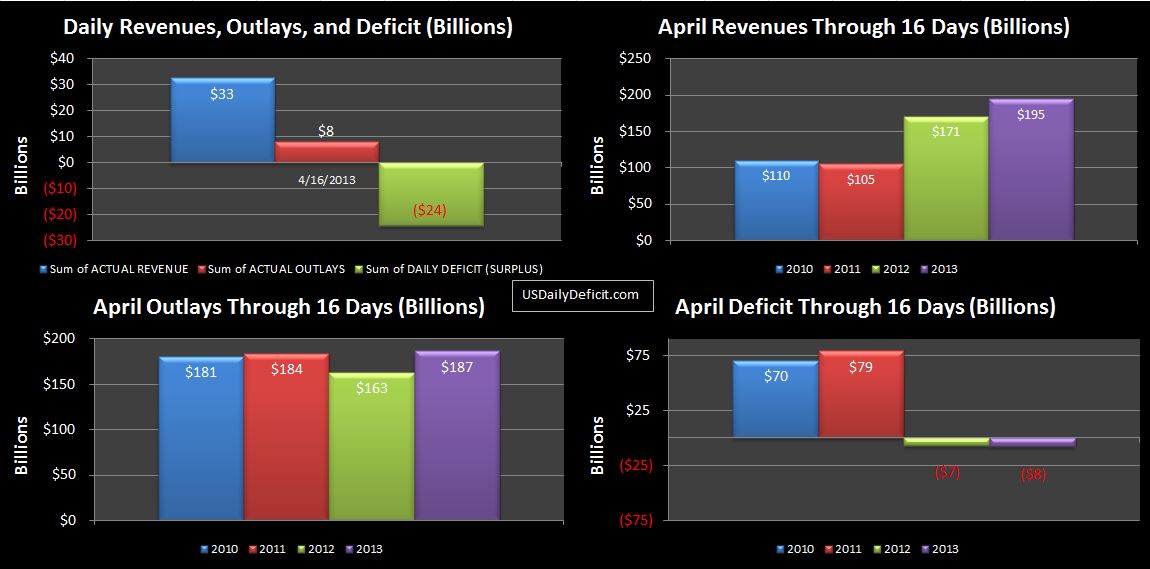

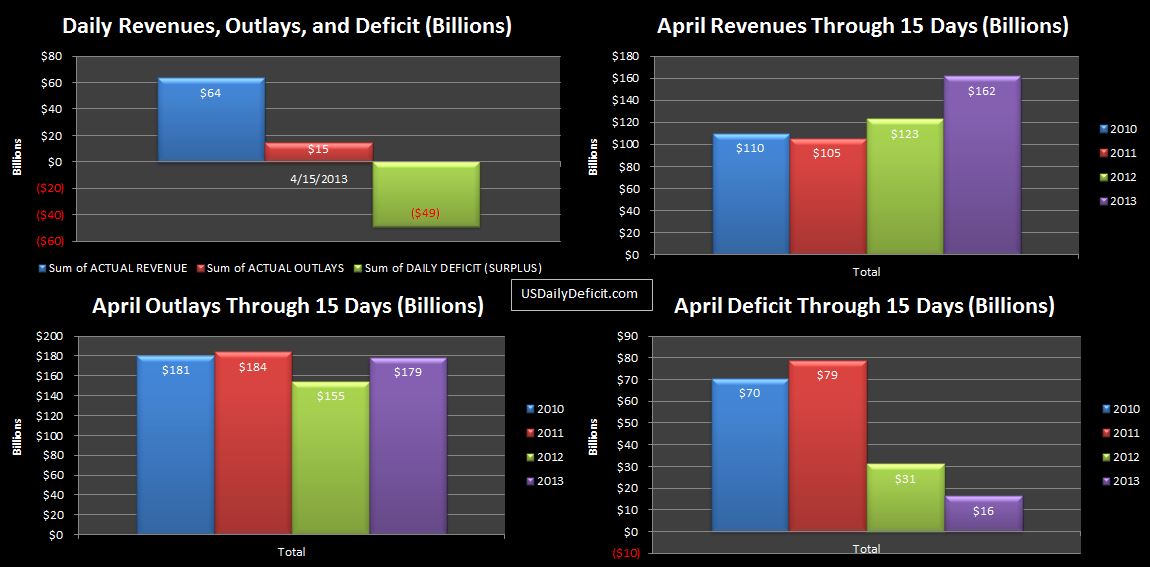

The US Daily Cash Surplus for 4/15/2013 was $48.9B… a huge day by any measure, and a $32B improvement over 4/16 day 2012 which rang up an $17B surplus. Needless to say, $48.9B far exceeded my expectations…I double checked twice to make sure I had it right. A little googling sheds some light…tax day last year was actually 4/17, due to the 15th being on a Sunday and Emancipation Day on the 16th. (Now I remember!!) The two day surplus for the 16th and 17th last year was $56B…It does seem likely that 2013 will exceed that, but because of this timing issue, we are probably going to have to wait a few extra days for the dust to settle. Bottom line, it appears to be a very good start to this phase of the Tax season (deficit wise…not so much for taxpayers)…let’s sit tight and see how it finishes. We should continue to see healthy tax revenues for the next few weeks before we fall off the wagon again in May.

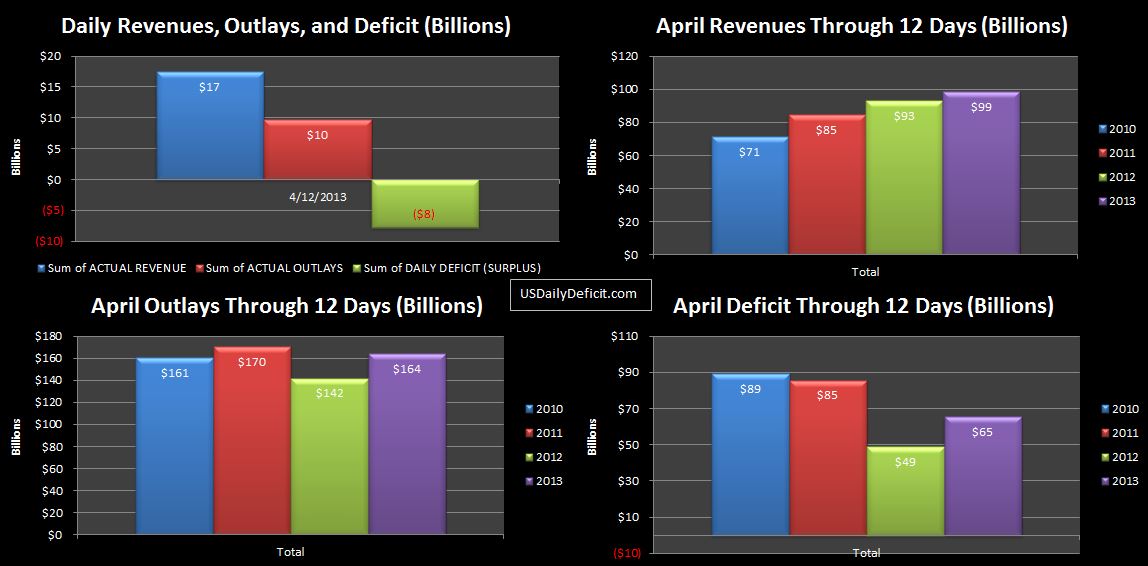

The US Daily Cash Surplus for 4/12/2013 was a not so shabby $7.7B. Still no major divergences from 2012…if it’s gonna happen we should see it this week. (15-19th). Using last year as a guide, we could see a weekly surplus in the $70B range, completely wiping out the current April deficit of $65B through 12 days.

CNN MONEY reports

“Up until now, Social Security has been a windfall for many retirees: They collected far more in benefits than they shelled out in taxes.

That’s changing. Many of those retiring will have paid more into the coveted entitlement program than they will get back.”

and

“The imbalance will get more pronounced for future generations of retirees. Couples now in their early 40s will have forked over $808,000 in Social Security taxes by the time they retire, but get back only $703,000 in benefits.”