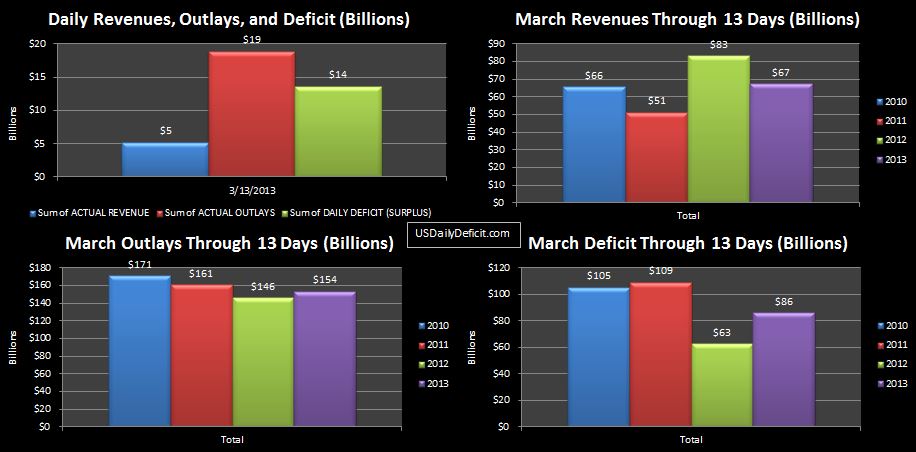

The US Cash Deficit for 3/13/2013 was $13.7B bringing the March Deficit through 13 days to $86B.

This is getting interesting…13 days in, and 2013 has a $23B higher deficit, including $16B in lower revenues? At first I thought maybe I had a data error…but no…the numbers are correct, I just overlooked one more revenue source from last year…TARP…that has fallen off a cliff. Last year, through 13 days, Tarp had pulled in about $12B of cash. 2013…only $1B. So between TARP, the GSE MBS Income, and increased tax refunds (delayed from February), that’s about $30B of negative YOY revenue variances….offset by about $14B of higher tax deposits thanks to the tax increases and higher employment. We can chalk most of the higher cost up to timing of SS payments….that will sync back up tomorrow.

I won’t say it is likely yet, but it is certainly looking possible that the 3 month streak of YOY improvement gets broken, even with some favorable cost variances at the end of the month. The variables to keep an eye on are tax refunds and tax deposits…If we continue to see improvement in tax deposits, including corporate taxes we’ll see by next week, the streak could hold on for another month. If, however, tax refunds continue to outpace last year, growing from $10B delta to $20-$30B…that’s going to be tough to overcome.