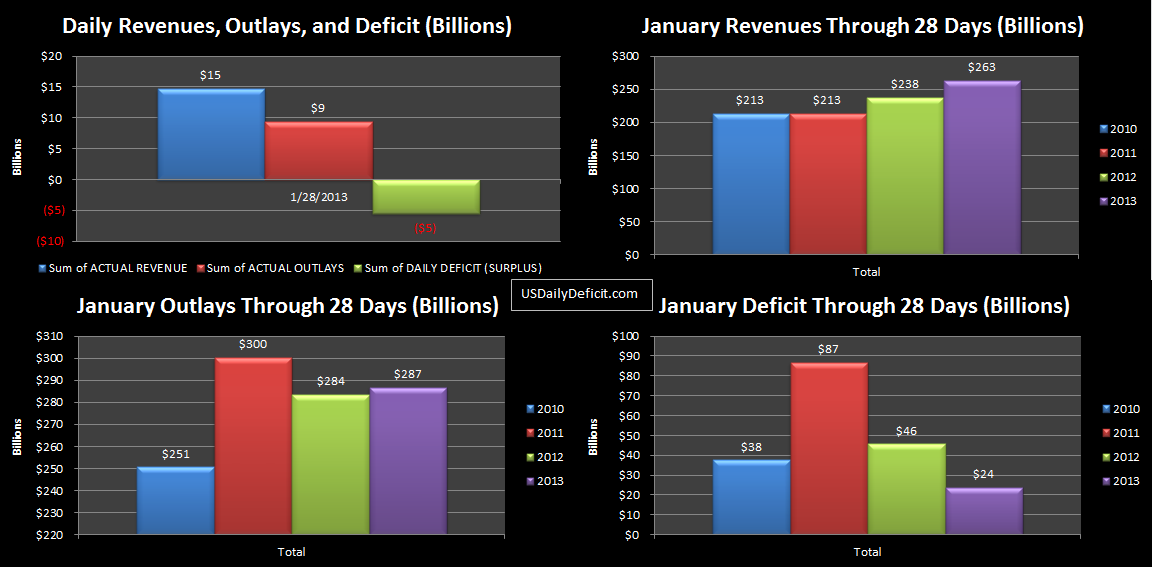

The US Daily Surplus for 1/28/2013 was $5.5B on strong revenues…pretty typical for a Monday. Cash in hand was $75B, and the debt limit is still unchanged. The House has already passed the bill, but the Senate still needs to approve it and Obama needs to sign it. This is expected tomorrow, or at least by week end. I don’t know how long it will take Treasury to unwind their “extrordinary” measures, but I will be keeping an eye in the change in debt once they do. Expect a spike in the $100B range. The last time there was a debt limit battle, debt outstanding spiked $238B the next day as Treasury brought their off balance sheet shenanigans back into the fold. I don’t expect that much…the battle of 2011 went on for a lot longer than this battle…if we can even call it that.

With 3 business days left, Revenues are up a solid 10% over last year and likely to increase a bit more. I expected a ballpark of $20B increase due to tax hikes and the trend. Add some delay to refunds (which we count as “negative” revenues) and possibly some filers pulling some income into 2012 for the lower tax rates, and there is nothing all that surprising about this “improvement”…if we dare call getting taxed more an improvement.

Cost is currently fairly even, but will likely end up $10-15B over last year. We’ll have the finals Friday, but $25B looks like a pretty safe bet for the monthly deficit. I said early on that deficit wise, January was going to be a snoozer, but never fear…February is almost here. Feb 2012 posted a $249B deficit…about a quarter of the yearly total packed into 29 exciting days!!. I have no reason to expect anything different from Feb 2013.