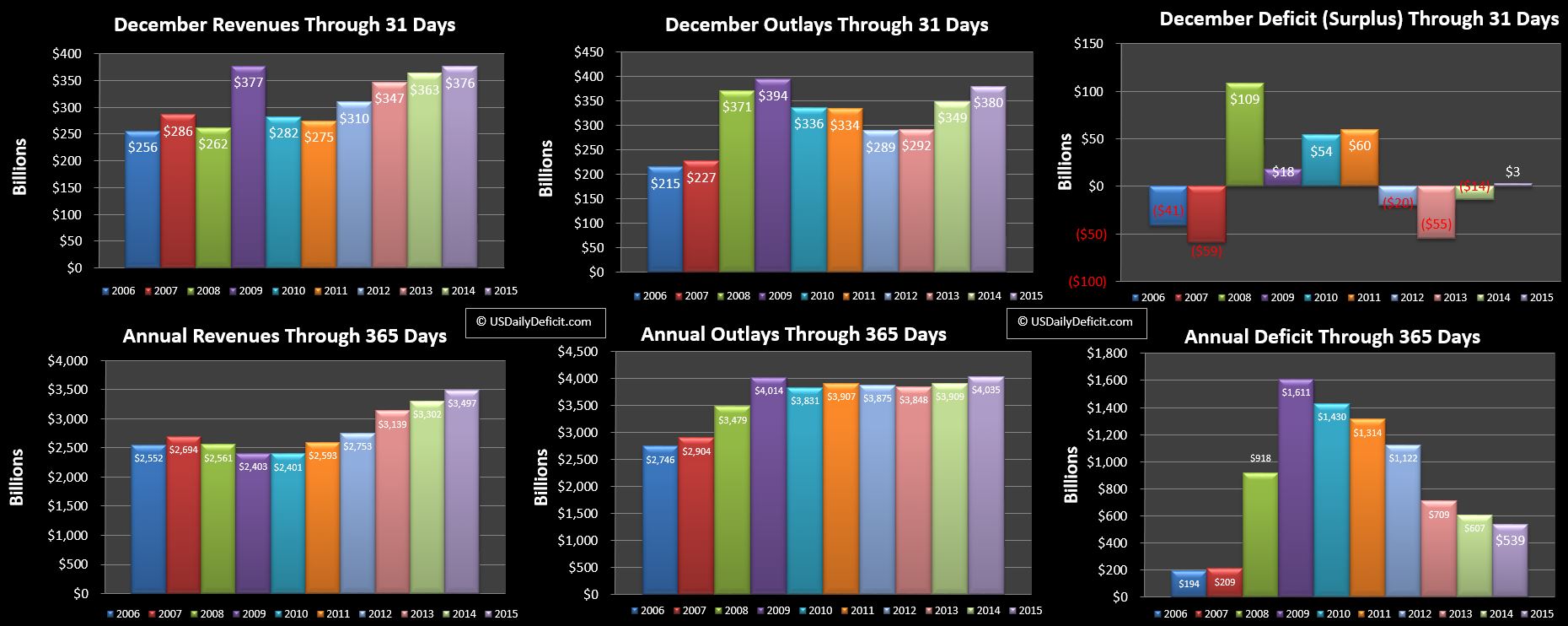

The US Daily Cash Deficit for December 2015 was $3B bringing the 2015 full year deficit to $539B.

Revenue:

Revenue was an interesting story this month ending up at a solid but unremarkable 3.6% gain. However, Looking at the details, we had withheld taxes at +2.9%, corporate taxes down 9.4%, “other” reciepts down 36.4%, and GSE dividends down 68%, all offset by our good buddies at the Federal Reserve, whose earnings went up from $9.3B last year to $29.3B this year. Historically, the Federal Reserve makes a cash payment to treasury every Wednesday in the ballpark of $1.5B-$2.0B. Months that have 4 Wednesdays will typically have $7B-$8B of revenues from the Federal Reserve, months with 5 will be closer to $9B. So I was a bit surprised Monday 12/28/2015, when I saw a $19B payment from the Federal Reserve spiking revenue. The recently released Monthly Budget review provides some insight. Apparently the FAST Act(Fixing Americas Surface Transportation) signed into law in early December has a few revenue provisions including selling oil from the strategic petroleum reserve, and it sounds like forcing the Federal Reserve to pay fewer dividends to it’s member banks and therefore submit more of their surplus to Treasury. I can’t argue with that, though I’m not yet sure what magnitude of increase we can expect going forward. An extra $20B per month would be $240B annually, which would be a nearly 7% baseline increase for 2016 vs 2015…all else equal. That sounds way too high though, my guess would be that this December $20 payment was a one time catch up or something… we’ll find out over the coming months.

Moving on, without the extra $20B from the Federal Reserve, revenues would have been down, despite having an extra business day, which is never a good sign. October was also negative, so if we see another negative in January it will probably be time to start getting a bit concerned. For the full year, 2015 Revenues landed at $3.497 Trillion, up $195B and 5.9%. Not too shabby, even though nearly all of the gains were in the first 4 months, followed by 8 months of mediocrity.

Outlays:

Outlays were up $31B and 9%, primarily on a timing event I missed in my forecasting that pulled $23.4B of SS payments due 1/3/2016 to 12/31/2015 due to the weekend. For the full year, outlays were up $126B and 3.2% vs. 2014. If we back out the timing event, we get a 2.6% YOY gain.

Deficit:

For the full year, we had a $68B improvement in the cash deficit pulling it down from $607B in 2014 to $539B to close out 2015. This marks the sixth year in a row of continuous improvement over 2009’s disastrous $1.611T cash deficit.

Summary:

The top line of a $3B deficit wasn’t terrible, but the key takeaway from December is that revenues look to be in trouble. January will give us a better idea if this is the case, and we should know for sure by the end of tax season in April. For now, I’m going to guess that for 2016, revenues and outlays will both be up ~3%, and the cash deficit will stay in the ballpark of $500B.