This article over at Yahoo caught my attention…apparently Treasury is interested in increasing its cash balance in order to:

“help Washington pay its bills during a crisis”

-according to a senior “official”

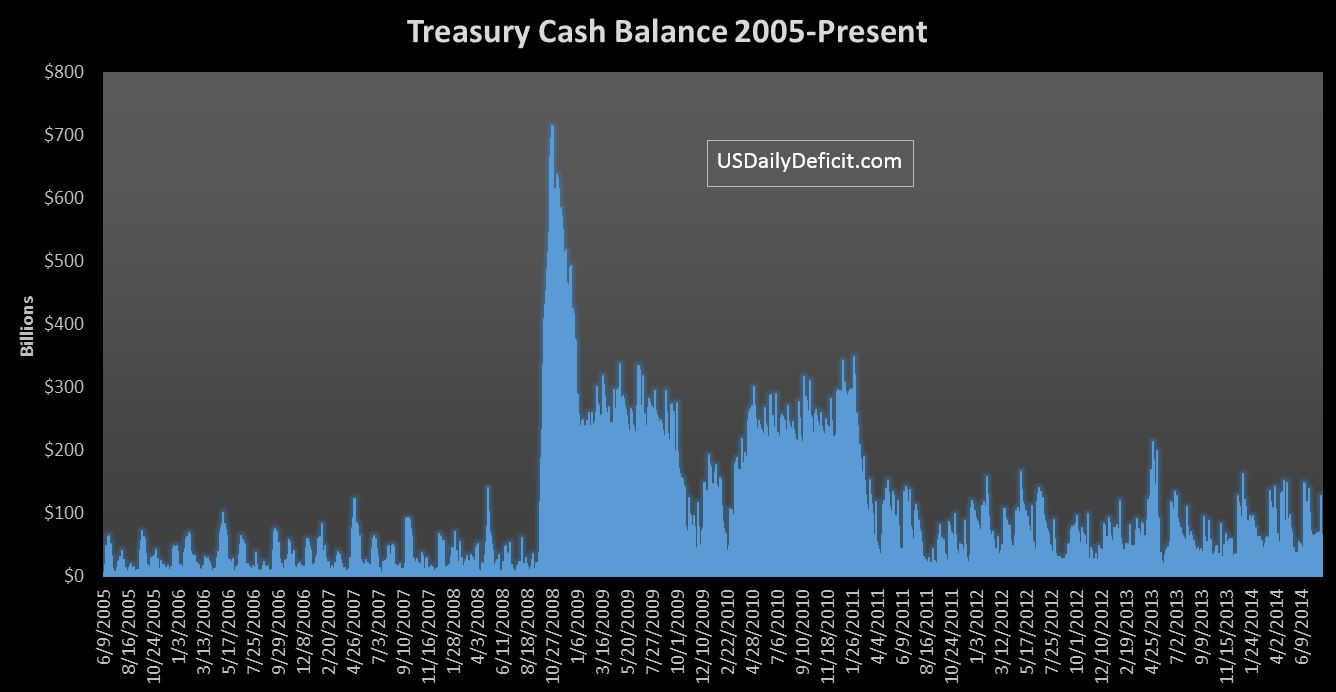

They are looking to build the cash balance up to about $500B. So what does that mean? Well…Over the last 12 months, the average cash balance was about $65B. The high was $162B and the low was $17B….so this would certainly be a departure from the status quo.

Looking back a bit further…the above chart shows daily cash balances going back to 2005. Notice anything interesting? Back in early September 2008, the balance was low as ~$10B…before spiking to over $700B by mid October….before being siphoned off by TARP and other spending. But ultimately, the balance came back down and has averages about $75B since 1/2011…though it clearly fluctuates with the day to day/monthly, and annual cycles.

Going back to $500B would be a huge departure, and I’m not sure it makes much sense. At 2% average interest..adding $500B of debt comes at a cost of $10B annually…not much in the big scheme of things….but why?? The whole thing sounds a bit shady to me, but what do I know…

Catch up (June/July 2018 Cash Deficit)