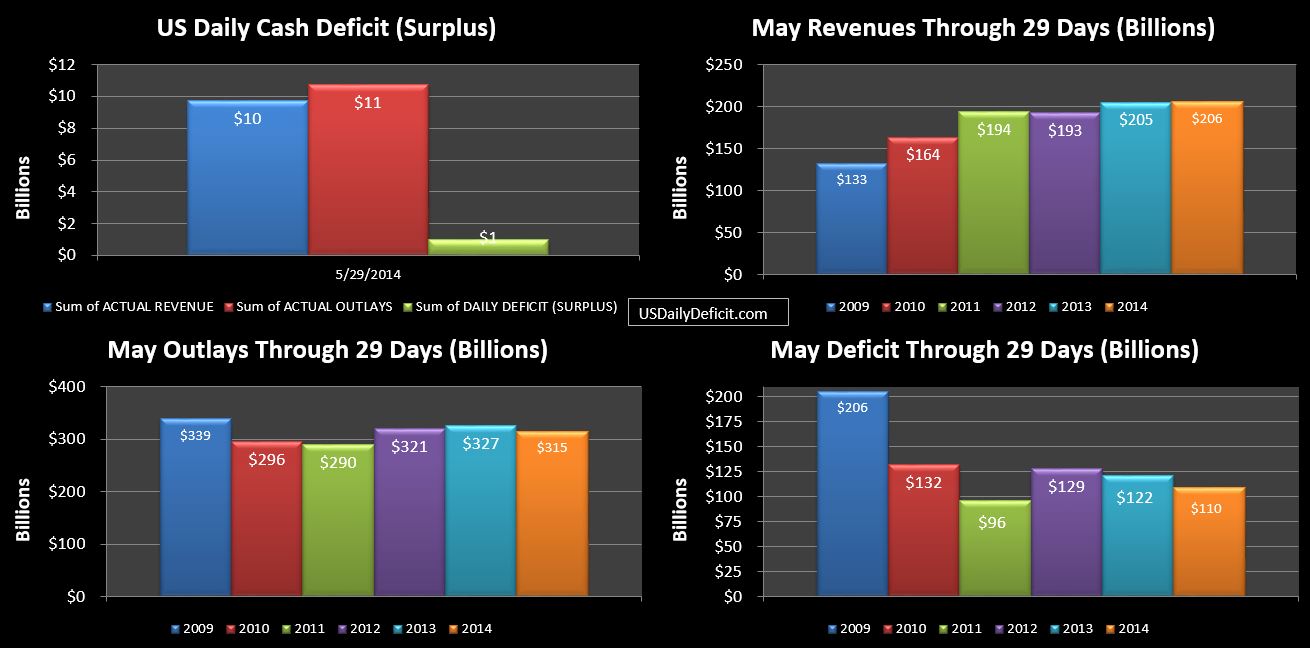

The US Daily Cash Deficit for Thursday 5/29/2014 was $1.0B bringing the May 2014 deficit to $110B with one day remaining in the month.

As expected, Revenues finally overtake 2013 and now stand at +0.3% with a $552M edge. Last days of the month are generally hard to predict….I would expect May 2014 to retain its narrow lead and build on it a bit, but you never know.

Looking only at withheld taxes, January-March 2014 was running at +8.04% over 2013, which itself was up 8.32% over 2012. With one day remaining in May, April-May 2014 is running at +1.53%….compared to 2013’s 13.23% gain in the same period over 2012. So what we have is starting to look like a real slowdown in revenue growth from the 10%+ we saw from 1/2013 to 3/2014. This is actually more or less what I expected to happen in January…after all, it makes sense that revenues grow more or less in line with GDP/population/labor force….that is 1-3% or so (absent changes in tax rates like 2013). It will take a few more months of data to confirm if this is the case, but if it is, the deficit should more or less stabilize for the time being at around $500B or so before slowly heading back up as moderate growth in outlays outpaces the low single digit revenue gains over the next few years. Of course…if there is a recession or if interest rates rise…all bets are off….it could go south in a heartbeat.