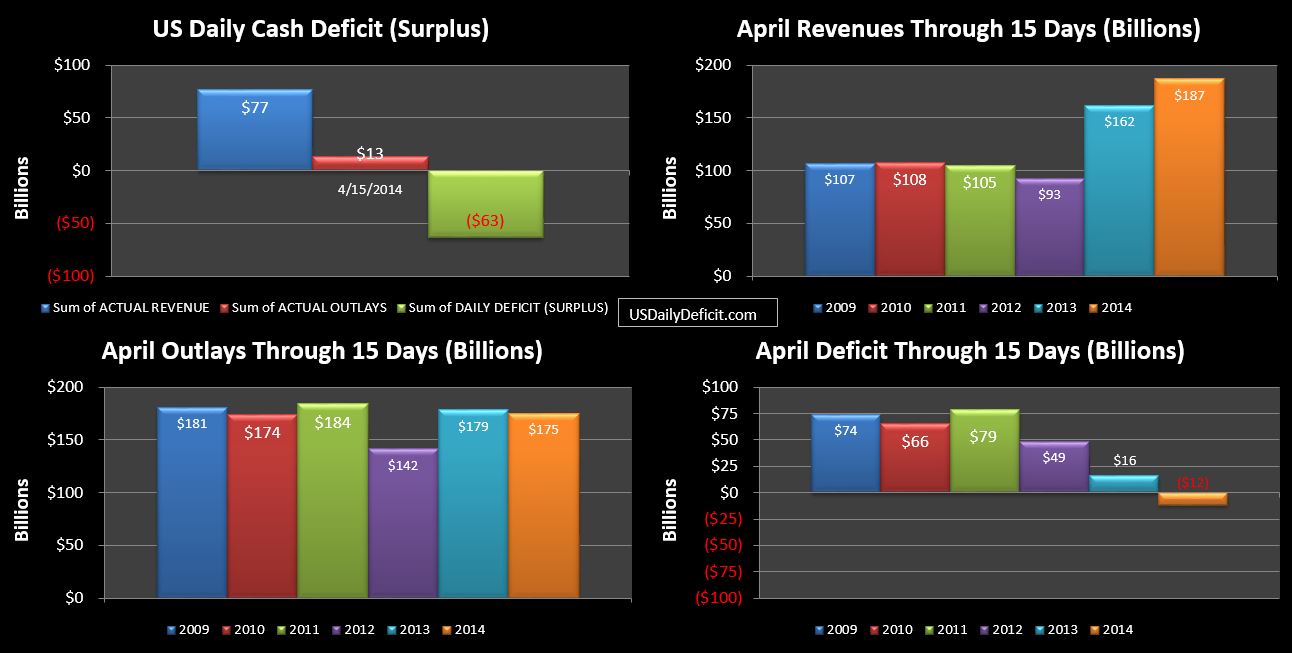

The US Daily Cash Surplus for Tax Day, Tuesday 4/15/2014 was a very healthy $63.5B, wiping out the monthly deficit and bringing us to a $12B surplus at the halfway point.

For comparison, 4/15/2013 had a $48.9B surplus. Corporate taxes, the biggest haul of the day came in at $32.9B compared to $32.3B last year….so basically flat. Curiously, taxes not withheld came in at $19.2B compared to just $4.7B last year. Is this a sign of another blowout April, or just a timing issue? My gut says timing, but I flipped back all the way to 2008…the last time 4/15 was on a Tuesday, and see no precedent for such a large spike.

Typically, those who owe large tax bills write checks and drop them in the mail around 11:59PM 4/15…thus getting a 4/15 postal stamp and adding at least a few days before the check actually clears their account. Last year, 4/16 brought in $23B of taxes not withheld, and they continued to pour in at elevated levels for the rest of the month.

So tomorrow….if we see 24B+, we can probably assume it was not just a one off timing event. If, however we see it fall and the two days average out the same as last year, it was likely timing.

All together, we have to look at the day as a positive, with a small question mark to be resolved tomorrow. Through half a month, we have solid 5%+ gains across most of our major revenue categories with the exceptions being taxes not withheld at +65%…see note above, and withheld taxes down 4%, representing a $3.6B decrease. This is curious, but not necessarily alarming…yet. Outlays are mostly flat. There is still a lot of month left, but so far, so good.