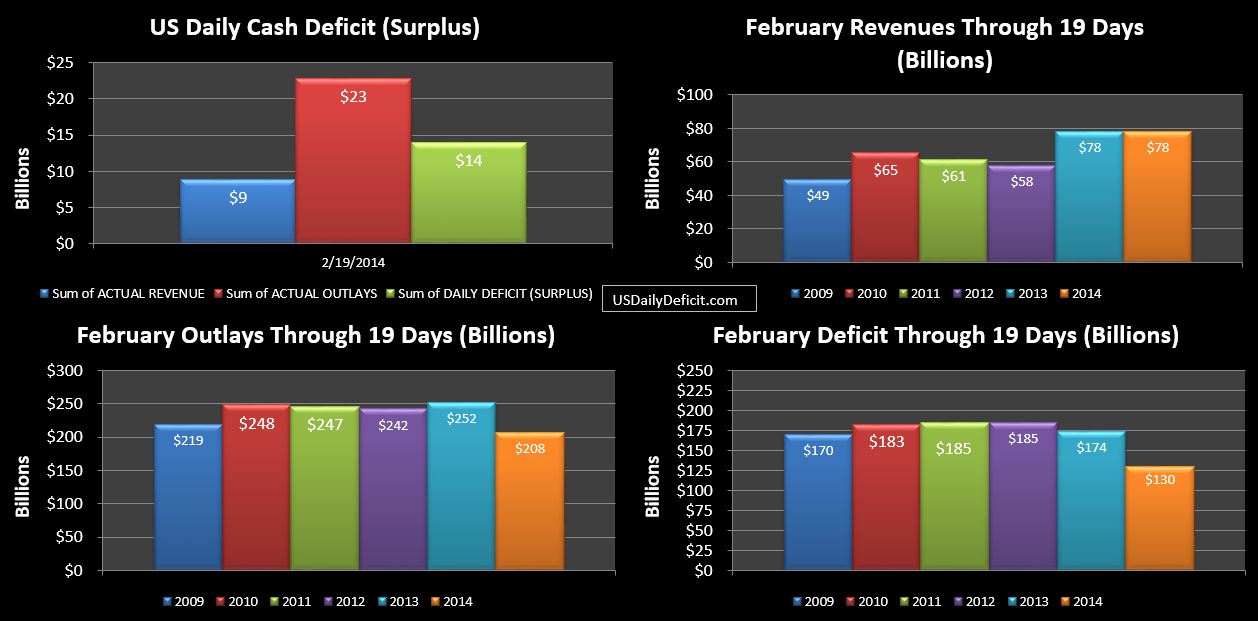

The US Daily Cash Deficit for Wednesday 2/19/2014 was $14.0B (**corrected…originally posted as $8.8B**) pushing the February 2014 deficit through 19 days to $130B with 7 business days remaining.

Refunds plummeted for the day down to $388M…from $6.8B yesterday. I guess the bottom line is that at least day to day, tax refunds have become less correlated with prior year numbers. Who knows…maybe it’s a process change, maybe it’s being driven by refund processing or even taxpayer filing patterns I can’t imagine. But whatever the reason, there is no denying that there is more randomness….and therefore less predictability.

Thanks to the drop in refunds…which offset revenues, 2014 has pulled back to even with 2013 in that category. Outlays are still way under at $-44B. However, I think we’ll come close to catching back up by the end of next week when once again outlays due Saturday 3/1 will get dragged forward a day into February. This happened last month, and accounts for about $35B of the -$44B we are currently down….the rest I suspect we will catch up with since per our sync….2013 is ahead by one business day over 2014, but that will sync back up next Friday as well. Assuming that plays out….and outlays will be more or less flat…the story becomes revenue…and refunds…