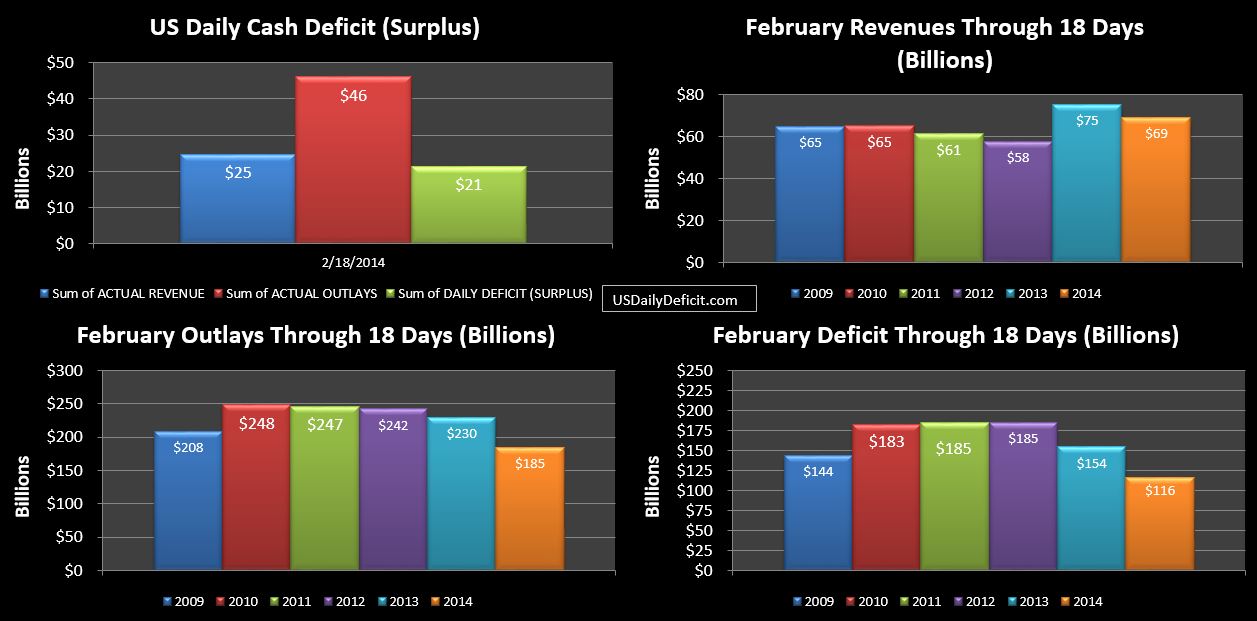

The US Daily Cash Deficit for Tuesday 2/18/2014 was $21.3B as strong revenues were overwhelmed by $35B of interest payments and continued strong tax refunds.

Taxes withheld are looking ok at this point…and will probably end up somewhere around +5-10% if the current trend continues.. However, this is being offset by tax refunds up $11B YOY and about $2B less of corporate taxes and taxes not withheld. For the month, refunds are up 17%. Now, I don’t really expect that pace to continue through April, but if it does the net reduction in revenue would be ~$40B over the 3 month period. It’s not huge, but it’s not going to help our revenue quest.

In other news, we see the lack of a debt limit reflected in the DTS now, and a roll off of about $68B of “extraordinary measures” conducted since 2/8.

Through 18 days, the cash deficit for February 2014 sits at $116B, and looks to be headed past $200B unless we see a reversal in the pace of refunds. Stay tuned.