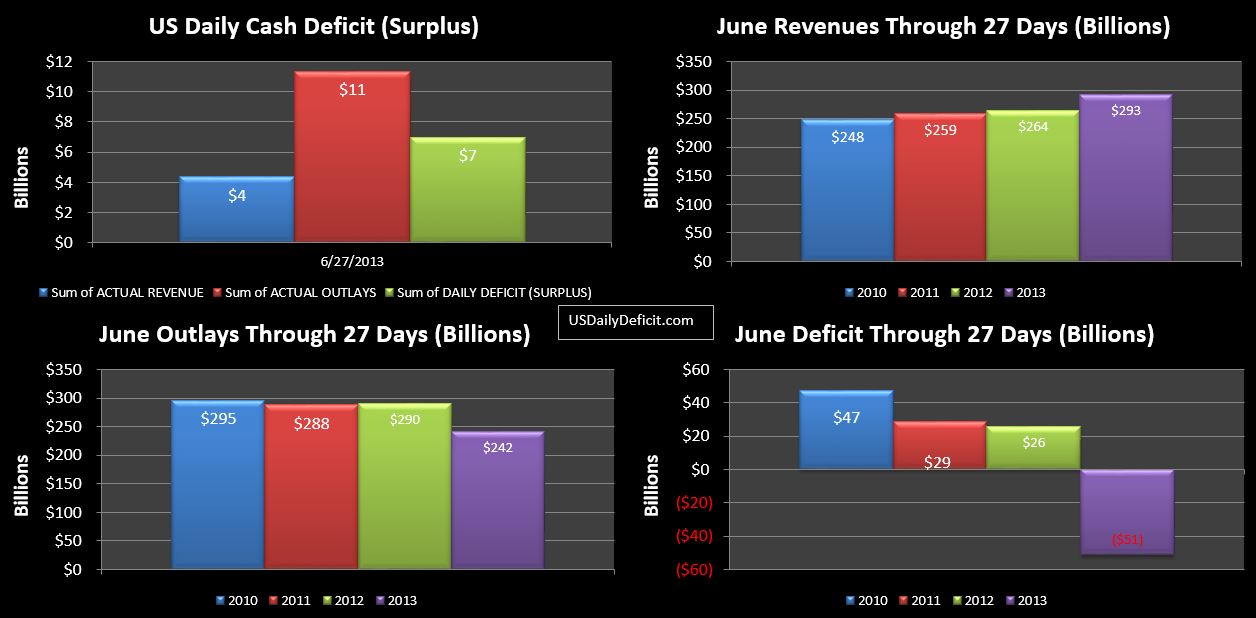

The US Daily Cash Deficit for 6/27/2013 was $7.0B dropping the June 2013 Surplus down to $51B with 1 day left.

Tomorrow is going to be polluted with the extra 2012 payments and the Fannie Mae Funny Money in 2013, so this may be the cleanest shot we get at the fundamentals. So from this year’s 51B surplus, I would just subtract the $35B timing benefit to get down to $16B Surplus, a $42B improvement over last year. Not bad at all really. The real question is….what are we going to see next January. In theory, given constant rates, revenues should roughly grow in line with GDP and population growth…so maybe a few percent. If we are posting sub 5% YOY growth next year, lookout!!