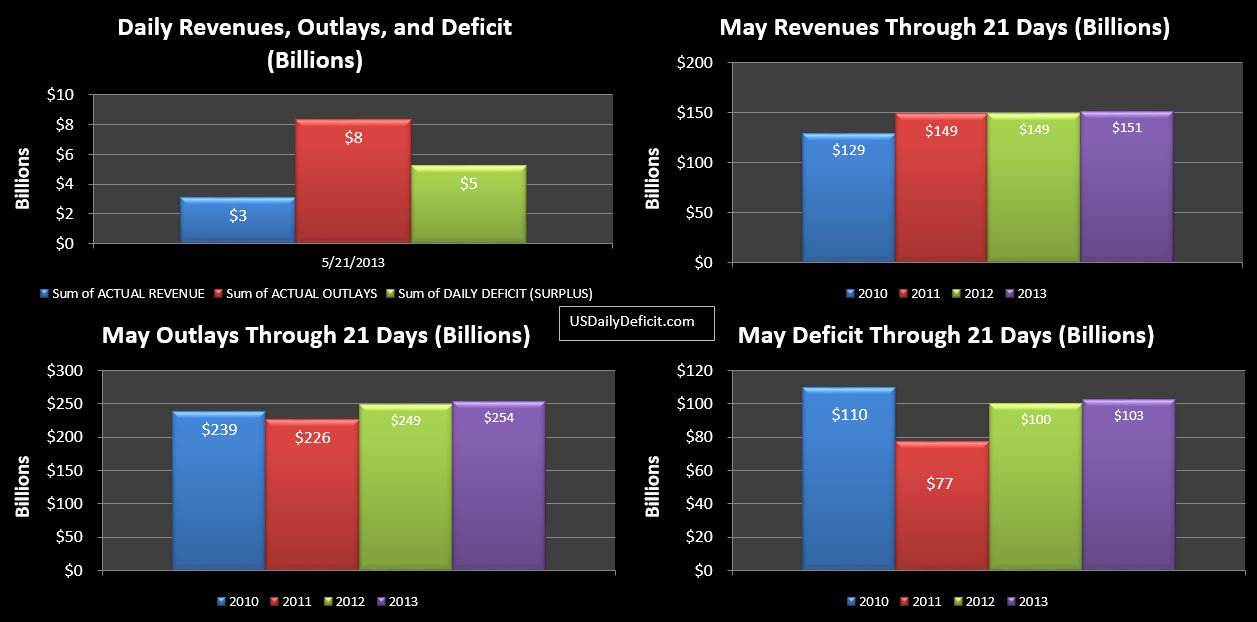

The US Cash Deficit for 5/21/2013 was $5.2B bringing the May 2013 deficit through 21 days to $103B. Once again, 2012 and 2013 are more or less aligned, with each having 15 business days M-F. Just as last week…nothing very impressive here. Revenue up 1%, cost up 2%. All this is a far cry from what we saw last month with revenues spiking 26%. We do see tax deposits withheld up 10%, consistent with what we have been seeing all year, but this has been offset by decreases elsewhere, notably unemployment deposits from the states, federal reserve earning, and TARP. With 7 business days remaining, May is looking like a rather unimpressive follow up to a spectacular April.

On the Debt limit, cash was down $6B to $31B. No sign of “extraordinary measures” yet…just a dwindling cash balance and a lot of payments due by May 31.