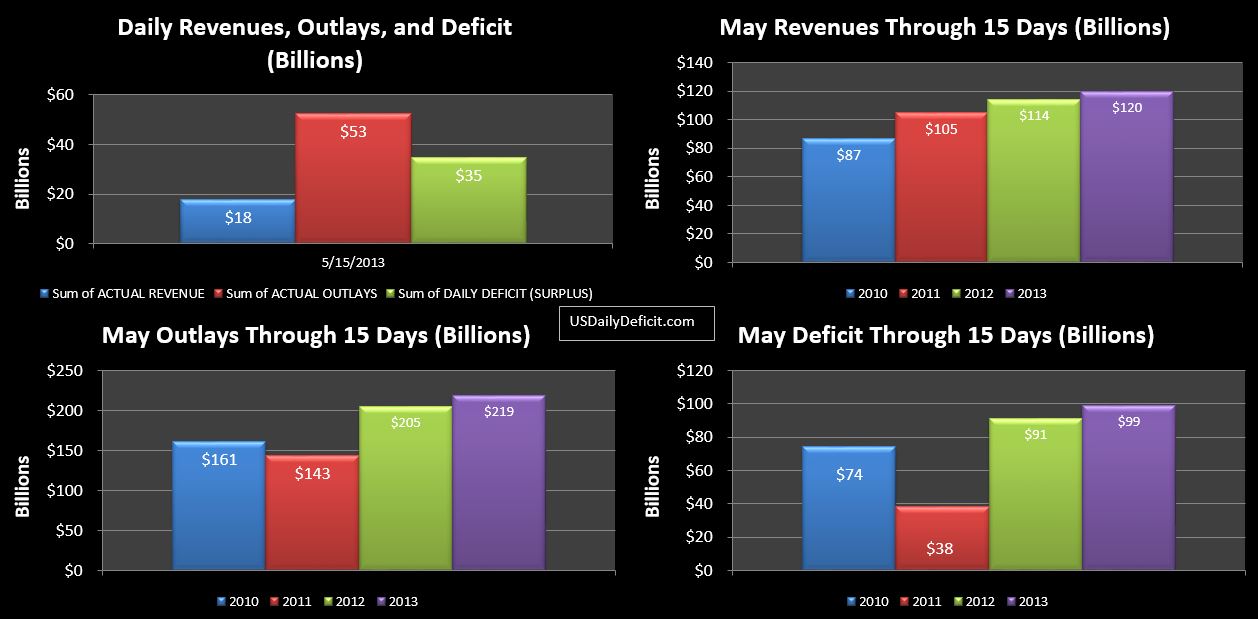

The US Cash Deficit for 5/15/2013 was $34.7B bringing the May 2013 deficit through 15 days to $99B.

As expected, a large interest payment went out for $30.4B…about $1B more than last years payment on the same day. So not earthshaking, but a small nudge in the direction we would expect given the ~$1T increase in debt since last year. Also of note, corporate taxes of $5.8B were received today…a shade lower than last year, but month to date is up 6%, though that’s only $0.4B, so immaterial in the big picture.

We are back to having timing differences, so comparing revenues and outlays isn’t especially useful, but more or less everything is in sync…no material moves up or down. Cash fell an additional $22B, bringing the balance to $69B with 2 more days before the debt limit kicks back in. This is a complete 180 from the path it looked like they would take just a few weeks ago where it looked like they were going to load up on cash and debt in anticipation of the 5/19 debt limit expiration. Hmmm…. I give up. I don’t see how they make it to October if they start with under $100B of cash, but you never know.