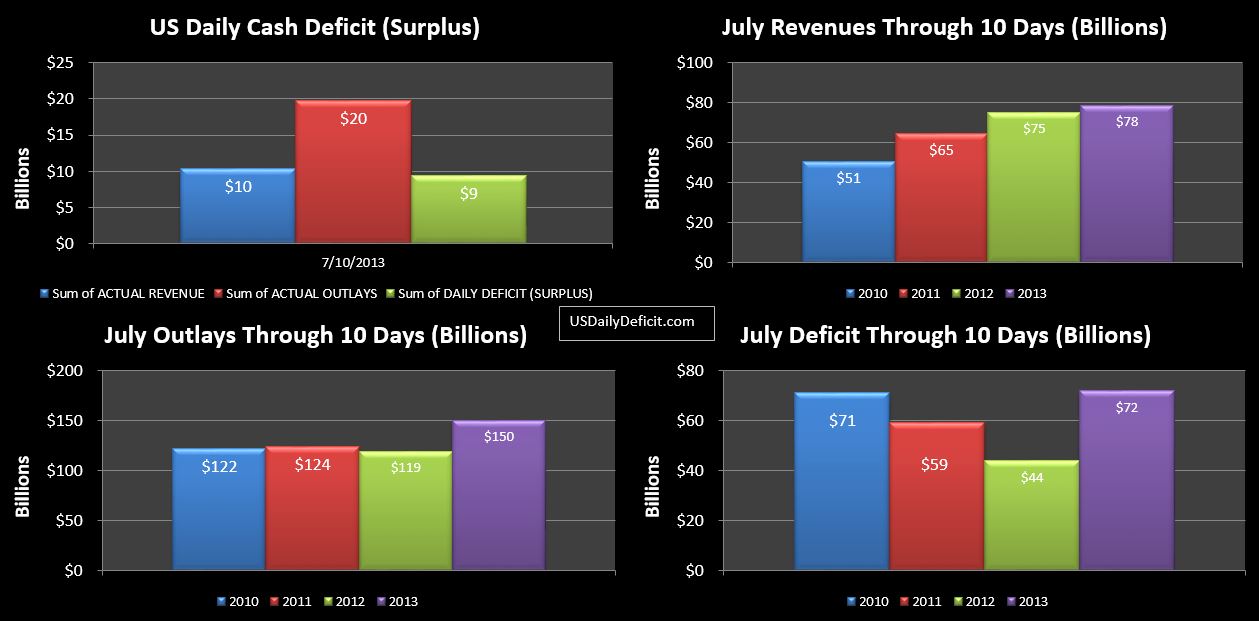

The US Daily Cash Deficit for 7/10/2013 was $9.5B pushing the June deficit through 10 days to $72B. With 1/3 of the month gone…revenues are up a meager 4%. This will be helped some by an extra day vs 7/2012…perhaps as much as a $10B (or 5%) bump, but August should give that right back. Outlays…adjusted for timing look more or less in line with last year, perhaps a few billion lower.

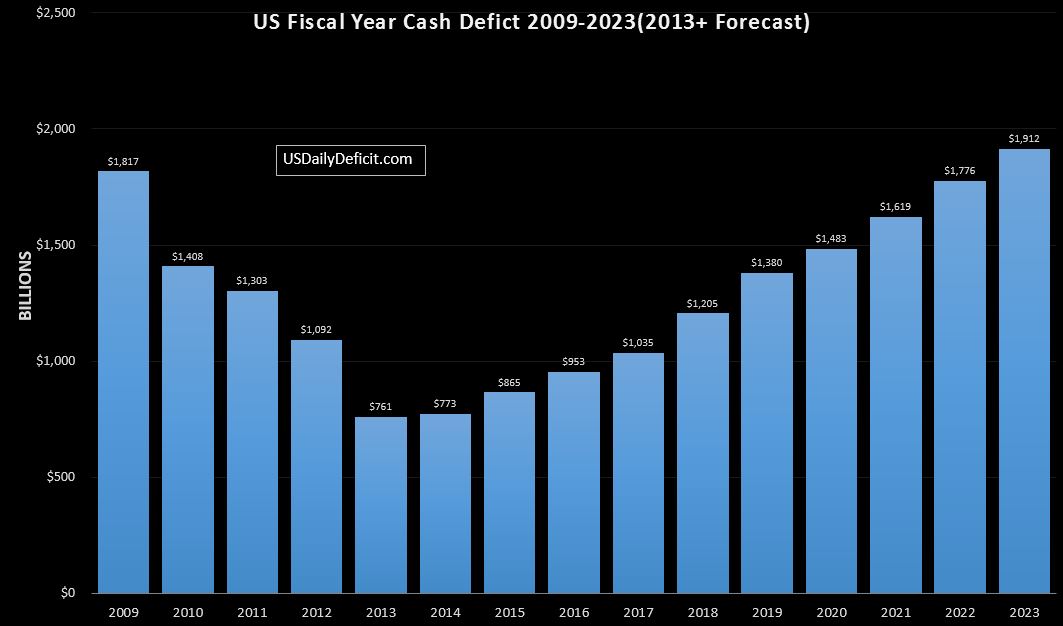

Over at money.com Jeanne Sahadi has a front page article that is trending U.S. books $117 billion surplus in June. It’s not a terrible article, but the ignorance displayed in the comments section is a bit frightening. Everybody thinks we are saved….We aren’t. No doubt, 2013 is going to be a material improvement, but it is still going to be a $700-$800B deficit. So yeah…it’s great that we aren’t blowing through $1.6T per year anymore like we were not that long ago…. but $800B per year…with $17T accumulated…no matter how you look at it…that’s a huge hole, and we’re still digging at a ferocious pace.

Above is the latest output from the model I use. We can see clear and steady improvement from 2009 forward as revenues picked up and cost was more or less held constant. There is no rocket science in the model. After spiking 12% or more in 2013 on tax hikes, I assume most revenues will grow at 5% in 2014 and 4% from there on…more or less in line with historical patterns. On the cost side, I assume 2% or so annual growth from 2014 on for most outlays, with a few notable exceptions. Social Security grows at 6-7%, and interest grows along with debt outstanding, but it held at about a 1.8% effective rate…extraordinarily low. For Medicare, Medicaid, and the Affordable Care Act, I use the CBO’s numbers. Using these fairly simple, and I believe realistic assumptions, I show we bottom out in 2013/2014 on increased revenues, before heading back up as spending increases on Social Security, Interest, and Healthcare outpace and run away from the modest annual revenue gains. Note…this all assumes no recesions, crashes, wars ect… although historically, it seems quite unlikely we will go another decade with out some kind of economic disturbances. I guess what I am saying is tis may end up being a conservative forecast unless the CBO is correct, and we manage to string together a few more years of 10%+ revenue gains. We all know anything is possible, but historically, it seems quite unlikely. Guess we’ll have to wait and see.