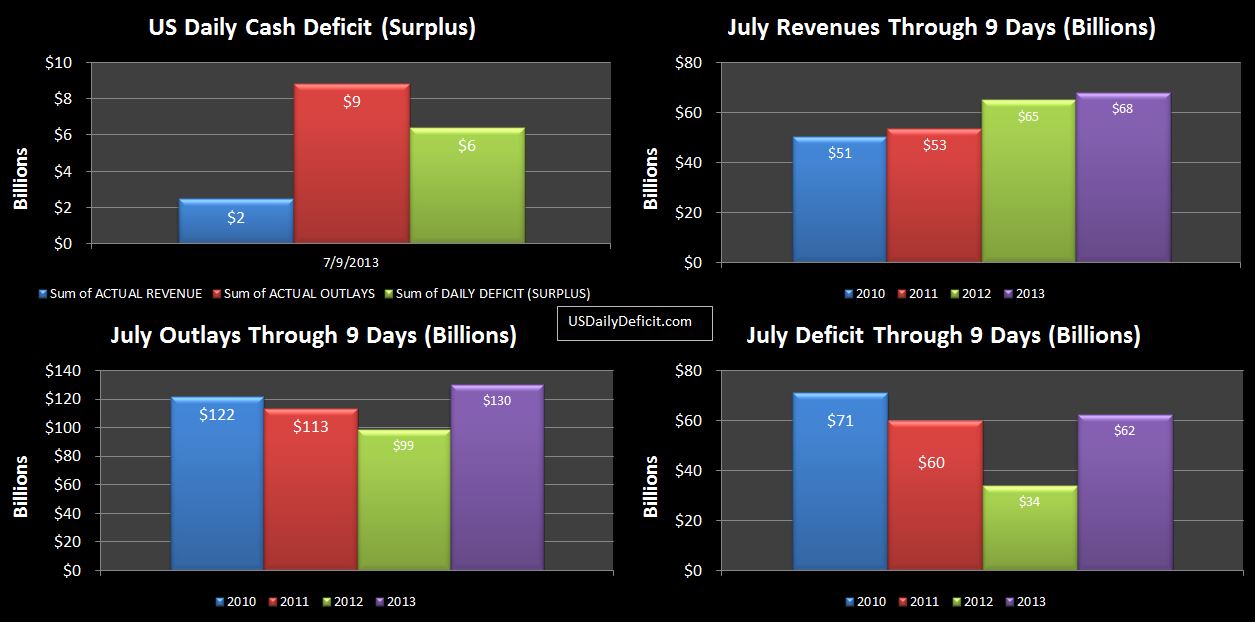

The US Daily Cash Deficit for 7/9/2013 was $6.4B bringing the July 2013 deficit through 9 days to $62B. Revenues were a bit light, even for a Tuesday, bringing down the YOY growth for the period below 5%, but it’s still early in the month, and strong finishes seem to be the pattern lately. Still…with the debt limit on the horizon….Treasury is going to need every last nickel to make it into October (and the new Fiscal year)…5% revenue growth will not get them there.

I don’t suppose it really matters in the big picture whether the default date is 10/3 or tomorrow….however, I suspect they want to get to the new FY because it will allow them to somehow shift some additional cost out of FY 2013 and into FY2014. This way….they can post a spectacular 2013 official deficit number, perhaps as low as $600B, and use this as evidence that Obama’s tax hikes and cuts are on path to fixing the deficit. Never mind the gimmicks…like the payday loan from Fannie Mae…getting a good 2013 number in the books gives Obama and the Democrats something to talk about all year long, even if it is unsustainable.