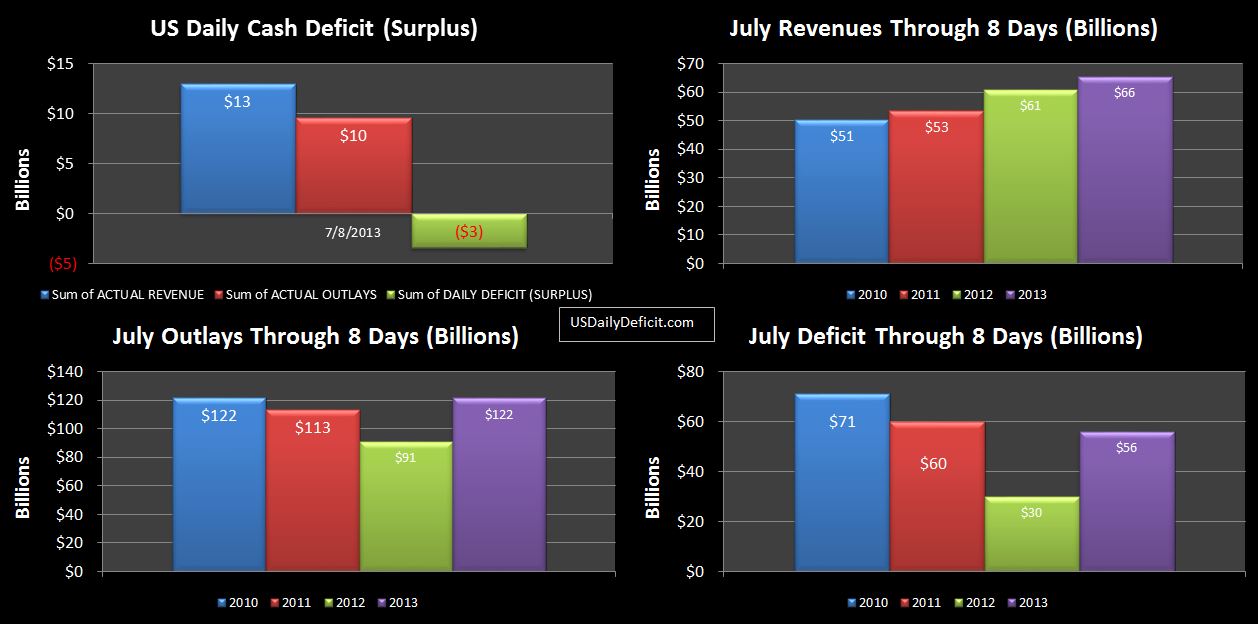

The US Daily Cash Surplus for 7/8/2013 was $3.4B on typically strong Monday cash receipts. Revenues are up YOY by 7%, but it will probably be a week or two before that firms up…. there can be a lot of variability. The rest of the month should be rather uneventful….just the large SS payments for the next 3 Wednesday’s, and some corporate tax deposits likely on the 15th. I still have my guess at around an $80B deficit to end the month, but I will revisit in a few weeks and we have enough data to make a better guess.

We haven’t looked at this in a while, but the cash balance is now $92B. If we run another $25B for the rest of the month, we enter August with ~$67B….I am projecting about a $125B deficit for that month, leaving a $58B shortfall. however, Treasury has a knack for creating imaginary money and $58B…given their previous magic tricks…I have no reason to doubt they can come up with $58B to get through August somehow. If they get through August and the first few days of September…making it to October should be a breeze since September will see heavy cash inflows as a quarter end. That makes October the do or die month for the debt ceiling. At that point, cash will be down to near nothing, and we will be staring at a couple of $100B+ deficits in October/November….I don’t think they can squeeze $200B out of “extraordinary measures”…so Right now, I’ll peg the drop dead date at October 3rd at the latest….the day about $25B of Social Security payments need to be made. Just to recap….This assumes tax revenues continue to come in about 10% over last year, and that Treasury can squeeze another 60+B or so out of extraordinary measures between now and early September.