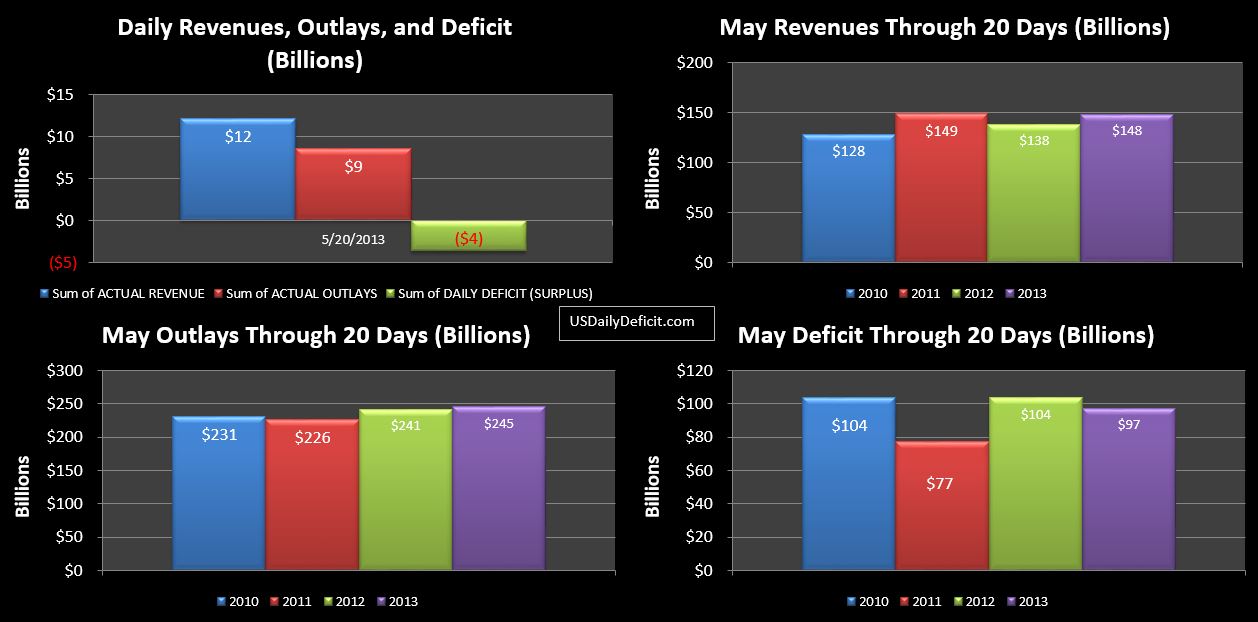

The US Cash Surplus for 5/20/2013 was $3.6B on typically strong Monday revenues, pushing the may 2013 deficit through 20 days to $97B. Net revenues are now showing a $10B improvement over 2012, but this is likely to come down a bit after the Tuesday report is released this afternoon and the months more or less synchronize again.

It does now appear that the official debt limit is locked in at $16.699T, with a cash balance of $38B. Between now, and June 3 when the first round of June social security payments goes out ($25B), I am expecting a cash deficit of $75-$90B. There was no movement yesterday, but what I expect to happen is “intragovernmental” debt, currently at $4.869T to decrease, and then for treasury to sell external debt for cash. …this is the signature of “extraordinary measures”. So…if I have this right, treasury will magically make $50B of “intragovernmental” debt just disappear over the next two weeks. If there was ever any doubt over whether or not “Intragovernmental” debt was real or just a figment of our imagination….this should pretty much clear it up.