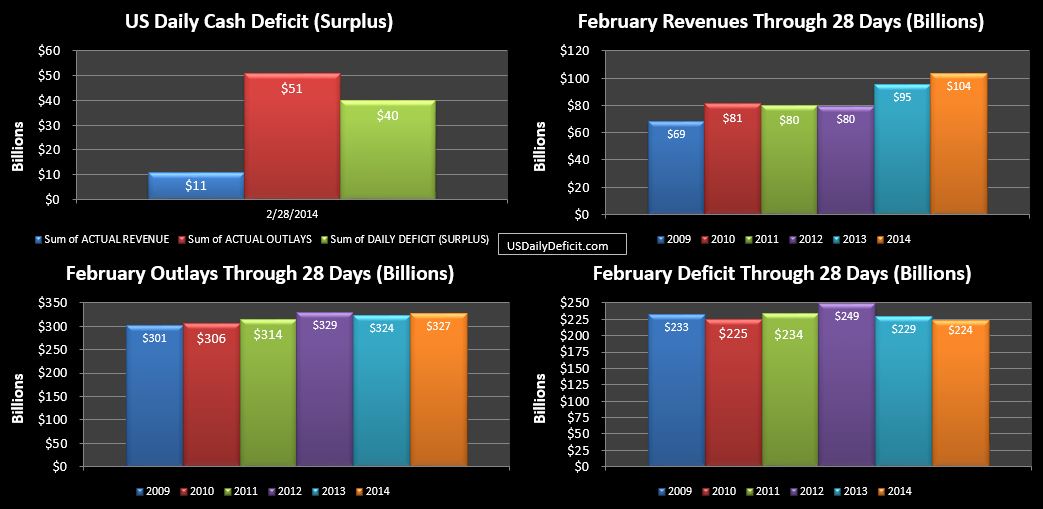

The US Daily Cash Deficit for Friday 2/28/2014 was $40.0B bringing the February 2014 Cash Deficit for the full month to $224B vs $229B last year.

It was an interesting month. Outlays were flat…up 1%. We still see declining outlays nearly across the board…except for SS, Medicare and Medicaid….where gains have…at least for this month washed out the reductions elsewhere. Due to timing, I don’t expect this to continue into March, but stay tuned for the rest of the year. Sequestration is just about a year old now, so those YOY reductions are unlikely to impress for much longer.

Revenue was even more interesting. Revenues stayed strong with withheld taxes ending up at +8%. Taxes not withheld were down 11%…but the amount was immaterial at -$652M…not sure that means anything for April or not. Deposits from the Federal Reserve more than doubled from $3.8B to $8.9B….so we have that money printing thing going for us. Offsetting this was tax refunds up $14B YOY at $128B compared to $114B last year. I don’t know if it is just timing or a bonafide 12% surge…we’ll have to wait until the end of April before we really know. And despite this…revenue(net of refunds) still ended up going from $95B last year to $104B, good for a 9% gain. Numerically I suppose that’s not quite as impressive as January’s ~10% climb from $289B to $317B, but a gain is a gain… we’ll take it.

Put it all together, and we have another strong month in the books with revenue clocking in just under +10% and outlays more or less flat. If we keep up this pace we could very well shave another $200B+ off the deficit this year getting us into the $400-$500B range. I’m skeptical….but I’ve been wrong before.