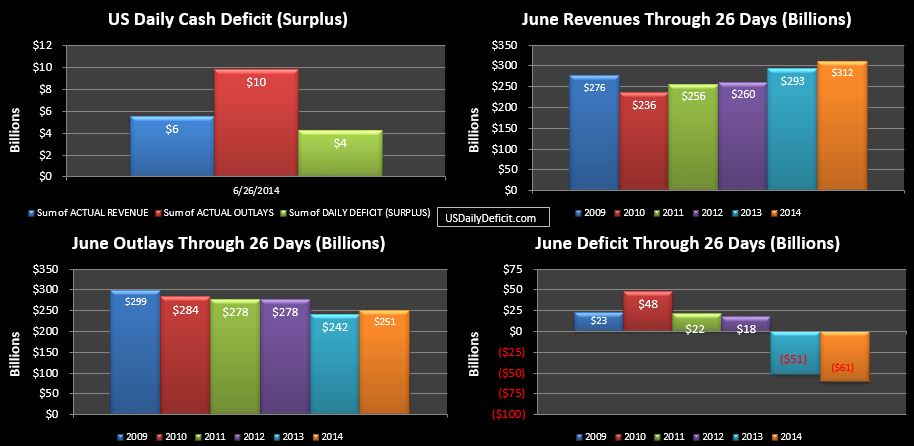

The US Daily Cash Deficit for Thursday 6/26/2014 was $4.3B bringing the June 2014 surplus to $61B with 2 business days remaining.

We’ve enjoyed an almost perfectly synced up 2013 vs. 2014 for just about the whole month, but with GSE dividends incoming, and an extra business day for 2014, we are about to see some major divergences over the next 2 days….meaning that the above chart… comparing 6/1/2013-6/27/2013 against 6/1/2014-6/26/2014 is pretty much the closest YOY comparison we are going to get.

Revenues are up $18B so far good for a 6% YOY gain. Our base….taxes withheld from paychecks is solid at +5% so far…not the +10% we saw all last year, but a big improvement over the +1% we saw between April and May. If I were Obama…I’d take +5% all day long. Taxes not withheld are up $6B for an impressive 12% gain. Corporate taxes are also up $6B…good for a 10% gain. I won’t know for sure until the month ends, but I’m guessing that there are some “Other” revenue streams down pulling down the average.

On the outlay side, they are sitting at +$9B, a 4% gain, though $6B of this is due to May interest payments slipping into June. Still….a gain….largely driven by SS, Medicare, and Medicaid which combined look like ~+$12B…with Medicaid being the largest gain….more on that when we get the finals.

The surplus…now at $61B, will likely grow from here as GSE dividends are received Monday, probably pushing us into the ballpark of $80B. We’ll know by Tuesday afternoon where this all ends up, but for now…June looks to be an ok month with the main plus being that the extremely disappointing revenue gains we saw over April and May did not hit a 3 month streak. Outlays look to end up….perhaps marking the beginning of a trend, but it will be many moons before we can confirm that.