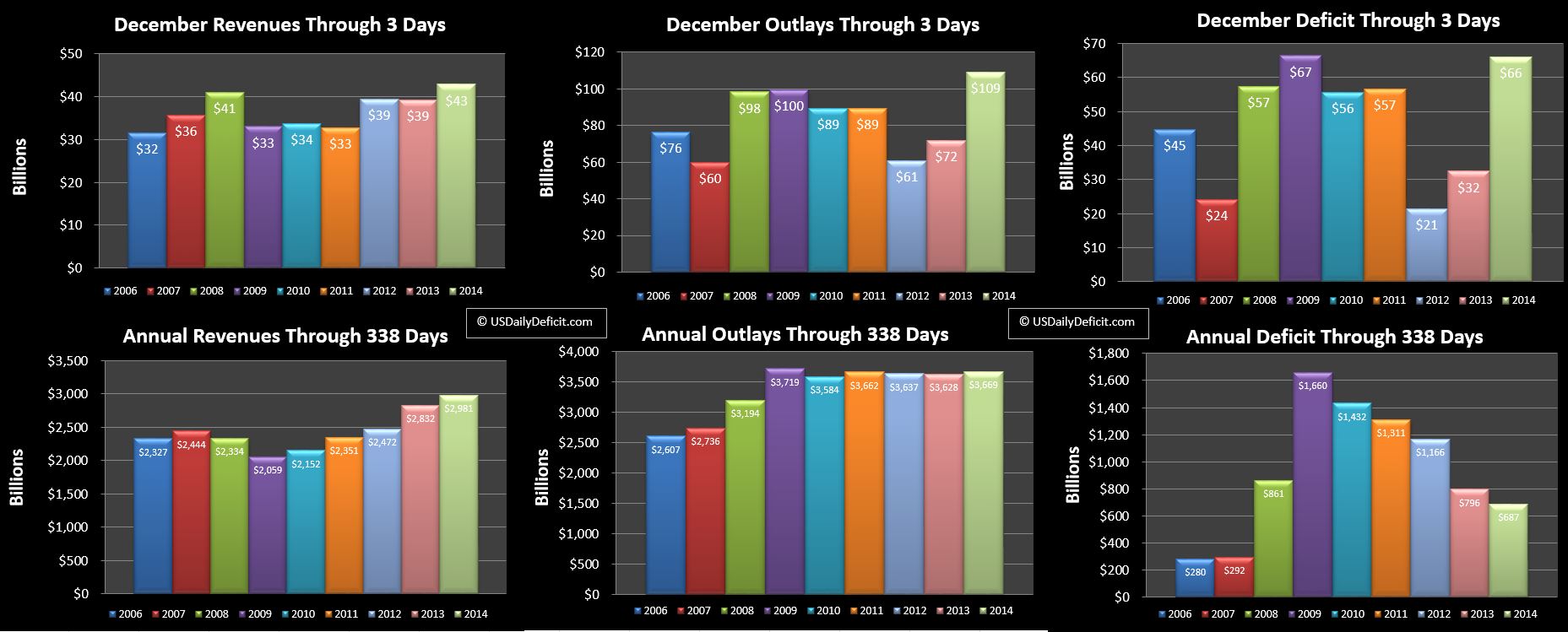

The US Daily Cash Deficit for Thursday 12/4/2014 was $6.2B bringing the December 2014 Deficit through 4 days to $66B.

As is typical, I have taken the liberty of adjusting by days of the week in an attempt to sync up 2014 and 2013 to give us a little bit more accurate picture of the YOY. This means that we are comparing December 2013 through Thursday 12/5/2014 to December 2014 through Thursday 12/4/2014. Both have 4 business days (Mon.-Thur.), so we are just about as synced up as we can get, though 2014 will get one additional business day at the end of the month which should boost YOY revenues….and outlays.

Through 4 days, December revenues look strong at $+4B…. an 10% early month lead. Outlays are up $37B, but most of that can be chalked up to timing…last December had a big slug of 12/1 outlays get pulled into November….

No real swings in the YTD…revenues have nudged up a bit to +5.3% and outlays are at +1.1%. This deep into the year, we are unlikely to see much change in those %

Looking forward to the rest of December…this is typically a good revenue month as are all quarter end months as we get some quarterly payments…corporate taxes in particular. Just for reference, November just came in at about $210B of cash revenue…..I’m expecting December to be in the $340-$360B range. April is the highest month of the year…posting $425B of cash revenues in 2014. While we have started the month with a pretty large deficit, revenues should start pouring in around the 15th and remain elevated….pushing us to a surplus by month end. I’m not feeling quite as lucky for this prediction, but after nailing November at $75B, hopefully you guys will cut me some slack because December is quite a bit trickier. I’m going to be an optimist and assume revenues come in at around +10% thanks to the extra day and the trend. However….GSE dividends are due this month and they aren’t looking so hot YOY. I saw a this article in the Washington Times that indicates the payment will be in the ballpark of $8B. This is up a bit from last quarter when they were only $5.6B, but down big from last December when they were $39B thanks to the well documented Tax Asset Silliness… That was a one time shot, which will hurt the YOY, but it’s not really a surprise. Add it all up and I’ll put my SWAG at a $30B surplus for the month compared to last Decembers $54B on timing, GSE dividends, and otherwise strong revenues.