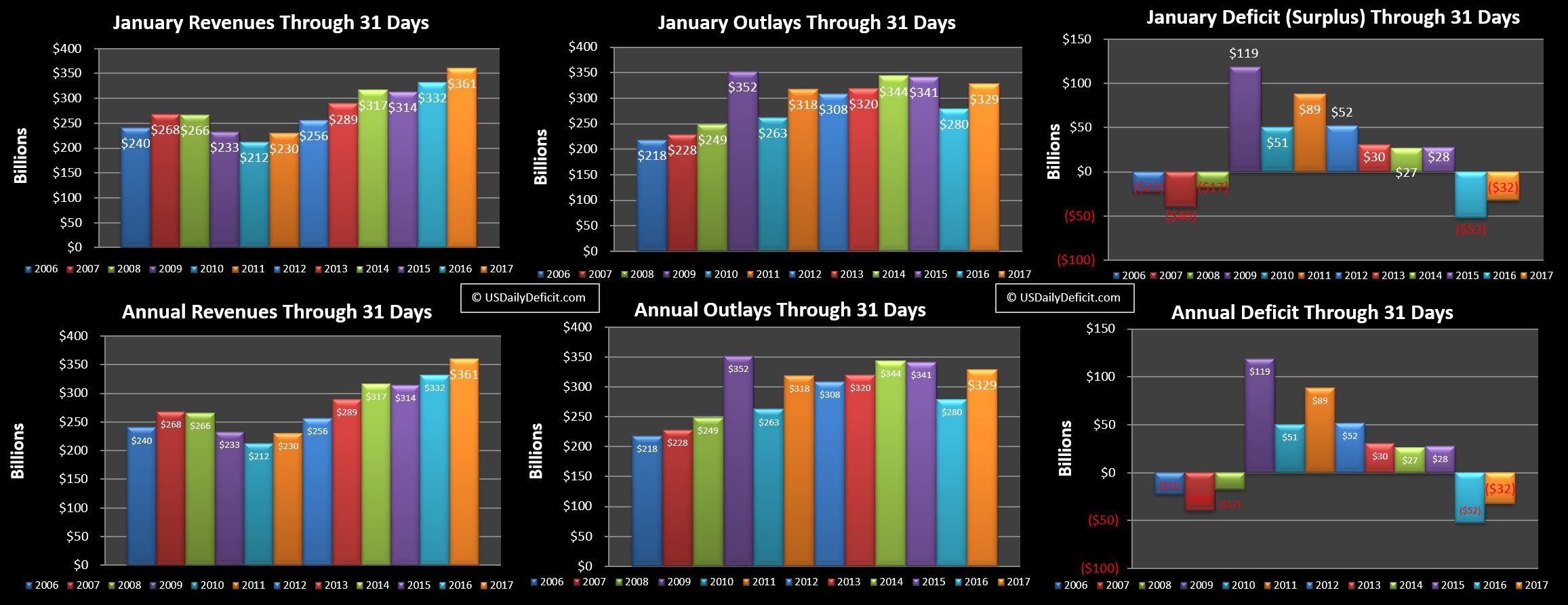

The US Cash Surplus for January 2017 came in at $32B as strong revenues were offset by a large increase in spending driven primarily by timing.

Revenue:

Revenues were up $29B, good for a 9% year over year increase which is a pretty good beat compared to my initial estimate of a +2% YOY revenue gain for the year. That’s a good thing no matter how you slice it, but…..January 2017 did have an extra business day, and the timing of those days was favorable as well. Don’t write it off yet, but my guess is that January’s gain will be February’s loss, and the YTD will settle down a bit, but we’ll have to wait and see. Complicating that forecast, of course is the February ritual of tax refunds, which should start gushing out of federal coffers in a week or two. As we have discussed in the past, I account for tax refunds as negative revenue, so any big diversion from last February’s $134B of refunds will show up in revenue for better or worse.

Outlays:

Outlays were up $49B and 18%, offsetting the positive revenue news, but most of that can also be explained by timing. As with revenue, the extra business day also means an extra day of expenses, but also, in January 2016 a lot of cost was pulled forward into December-2015 due to the timing of the weekend and New Year’s holiday leaving January 2016 short on outlays. That pattern didn’t repeat in 2017, so it isn’t really a surprise that we have a large increase in expenses. Assuming timing was $35B, we aren’t so far away from my estimate of +4% on the year, but we should have a better idea after a few more months of actuals and a clearer picture of what kind of legislation will get pushed through in 2017.

Surplus:

It’s always a good thing to start the year with a surplus, even if it isn’t likely to last long. Last January kicked off 2016 with a $52B cash surplus, so we are a little off the pace already but we certainly have an interesting year before us. My initial forecast for 2017 is a full year $800B cash deficit assuming revenues grow at 2% and outlays grow at 4%. This estimate does not take into account any new tax cuts or spending, which could easily add $100B+ to the deficit depending on the details and the timing.

Forecast:

February always runs a huge deficit thanks to tax refunds and 2017 will be no different. Last February the deficit came in at $225B, and for 2017 I am guessing it will come in a little higher at $240B, with the biggest variable being the timing of tax refunds. Going forward I am going to try and stay on top of this a little better than I did in 2016, so check back every few weeks and make sure to follow me on Seeking Alpha here.