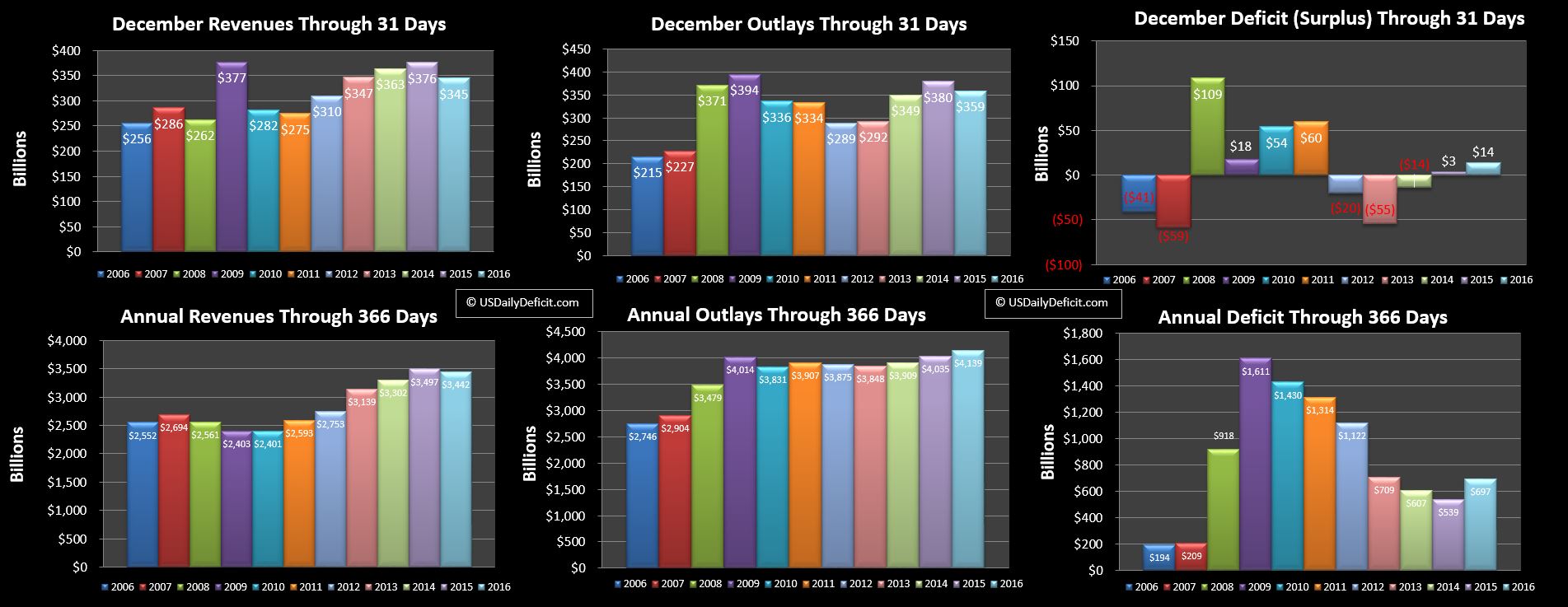

I’m posting this way late, but the 2016 cash deficit came in at $697B breaking a 6 year streak of improving deficits and topping 2015’s deficit of $539B.

Revenue:

For years now revenue has been saving the day increasing faster than expenses and slowly whittling away at the size of the deficit. That streak ended in 2016 with a $55B 1.6% year over year decline. It wasn’t all bad news though, as the base of taxes withheld from paychecks actually increased 3.7%, but was offset by decreases in corporate taxes, unwithheld taxes, and a handful of one off items that boosted 2015 but did not happen again in 2016, with the 2015 spectrum auction that provided $35B cash being the largest that comes to mind. Thinking back to 2015, this shouldn’t come as a huge surprise, as while 2016 looked ok, it was basically a really good first 4 months of the year followed by 8 months that were essentially flat….and that trend carried over into the full year for 2016.

Outlays:

Outlays were up $104B for the full year, a 2.6% gain that was pretty much in line with my 3% estimate despite some favorable timing that pulled some 2016 outlays into the end of 2015. Nothing especially exciting here, but there usually isn’t….just a slow march up and to the right. Social Security, Medicare, and Medicaid combine for 46% of the total spend at $1.889T and look like they are increasing at about ~4% a year. Also interesting, external interest was essentially flat year over year despite the public debt outstanding increasing $762B. The mechanism for that is of course that we are seeing some of the longer dated debt with higher rates be paid off, and refinanced at the current low rates. The weighted average rate looks like it is about 2%…not too shabby but keep an eye on it in 2017 if we get a few more quarter point raises it could start adding up to big bucks going forward.

Deficit:

After six years of improvement we are headed back up toward $1T despite never getting closer than $539B of a balanced budget. In all fairness, going back four years, the deficit has been far lower than I had initially expected thanks to the tax hikes and moderate economic growth. Alas, it does not appear there will be a plateau, but more than likely a race to $1T and beyond.

Forecast:

If all else were equal, I would probably make a wild guess that in 2017 revenues would be up 2% and outlays would be up 4%, pushing the deficit up to about $800B for 2017. However, the 2016 election adds a lot of uncertainty to that. First and foremost, tax cuts seem to be on the table for both companies and individuals. Unfortunately, it will likely be summer before any of those plans make their way through congress and in the meantime, the government withholding is at the same old 2016 rates. On the outlays side, there is clearly an apetite to spend on some infrastructure projects, but even a $16B wall spread over a few years isn’t enough to make a noticeable increase in spending, especially is we get some small piecemeal savings with some cuts elsewhere….I wouldn’t expect anything actually material to be cut, but I would expect lots of political theater from both sides of the aisle. For now, since details are short I will stick to the $800B deficit forecast but note that tax cuts could possibly increase that by another $100B or so depending on the timing and the actual cuts that get passed.