For 11/13/2012 the US government ran a surplus of $1.0B on revenue of $12.8B and 11.8B of expense. Don’t expect this to carry into tomorrow though. Social Security benefits go out the second, third, and fourth Wednesday’s of the month, so tomorrow’s report will likely have us at a $10-$15B daily deficit for 11/14. Quick math…that’s almost $50 per person in the United States….$250 for a family of 5. Yikes!! Maybe I should eat in tonight 🙂

Just a note, the DTS are typically released the following business day at 4PM EST. The deficit for last Friday, 11/9 was $4.8B on revenue of $5.3B and spending of $10.0B. Yes..these are rounded. Here’s how the month is looking through 9 days:

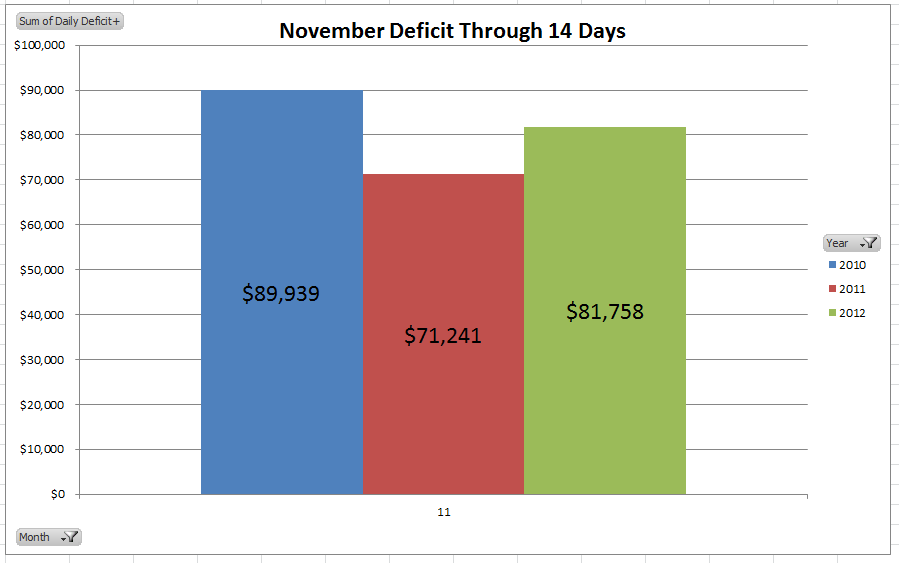

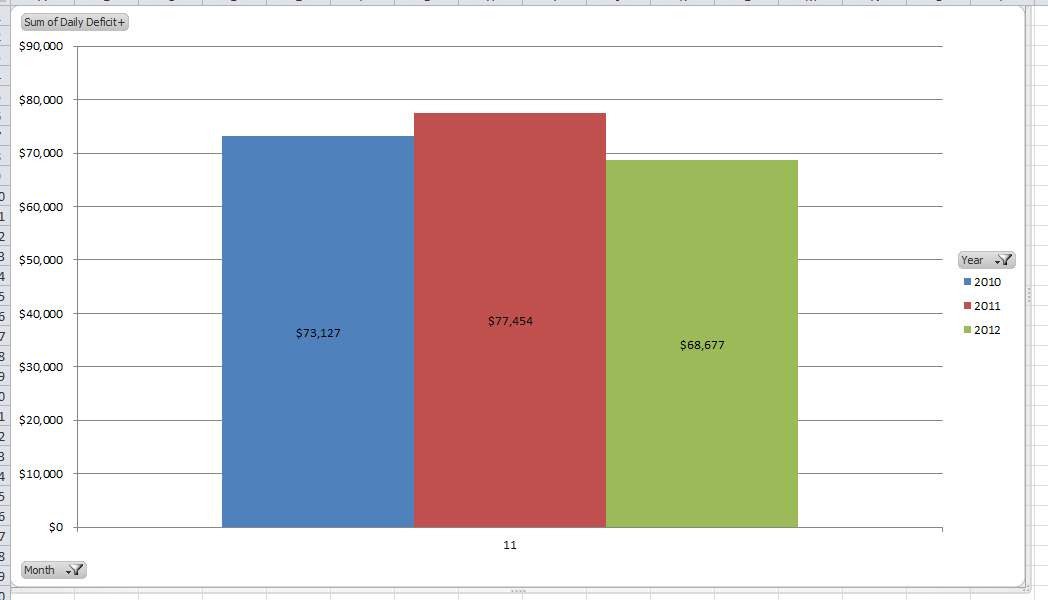

Through 9 days, the November deficit is $68.7B, an $8.8B improvement over 2011. Don’t get too excited yet. Revenue and cost are highly variable, and fluctuate depending on the day of the week and payment schedules.

With the government closed today for the holiday, we’ll have to wait until tomorrow to get the DTS from last Friday.

When we talk deficit here at the Daily Deficit….we are talking about cash. Simply…cash in less cash out. If I take in $5B in taxes, and spend $10B…my daily deficit was $5B. We make two notable adjustments to the DTS totals. We start with total cash in, then we subtract cash in from issuing debt. This makes sense. Issuing $100B in new bonds increases cash, and debt by $100B. It has no effect on the deficit…it’s a pure balance sheet transaction. We do the same on the other side of the equation by removing cash outflows used to pay down debt, or pay off expiring bonds. This gets us down to revenue in from taxes and other sources, less cash out from expenditures. We then make one final adjustment. The DTS shows tax refunds on the expenditure side. As an accountant, that makes me cringe a little bit. I believe that tax refunds should be accounted for as a reduction in revenue, not an expense, so we take daily tax refunds and reduce cost by that amount, as well as revenue. If we don’t do this, we would essentially overstate revenue and cost by about $400B per year.

So, lets take a look at 11/8 and pencil out a quick example. Per the DTS:

Total Deposits ($131.251B) – Debt Issues ($127.671B) – Tax Refunds ($0.131B) = $3.449B of Revenue

Total Withdrawals ($110.529B) – Debt Redemptions ($110.529B) – Tax Refunds ($0.131B) = $9.169B od Cost

Then, we do the math…$3.449B – 9.169B = $-5.720B

So our daily deficit is $5.72B. Yikes!! How much money did you lose 11/8?