Well…though it was delayed by a few weeks thanks to the shutdown, Treasury has released the September deficit numbers….capping off fiscal 2013 with a reported 75B (September)surplus. This brings the full year reported deficit to $680B…$38B higher than the $642B they forecasted back in May.

I reported the Cash Deficit for the FY earlier this month, coming in at $774B…$94B higher. So…WTH!!! When I began this CBO vs CBO piece…I unfortunately started with a bad assumption….that the Cash Deficit I was calculating would more or less tie to whatever the annual reported deficit was. I based this on two data points, FY 2011 and FY 2012. FY 2011 had a $7B difference out of a $1.304T deficit and FY 2012 had a $3B difference out of $1.092T. I figured that was close enough for government work.

Unfortunately…it turns out that these two data points for 9/2012 and 9/2013 are actually an anomaly. Historically, there appears to be a $50-$100B difference on average, though it peaked out in 9/2009 at a $402B difference. Since that was bailout mania year, I have to suspect that somehow they are/were excluding some bailout related things, but not others. Who the hell knows how/what they decided, but I think this just goes to further discredit whatever numbers they decide to publish. They are junk…to be discarded completely.

Now…this kind of defeats the purpose of the CBO vs CBO competition….if they can just make up numbers, it’s kind of a silly game right??

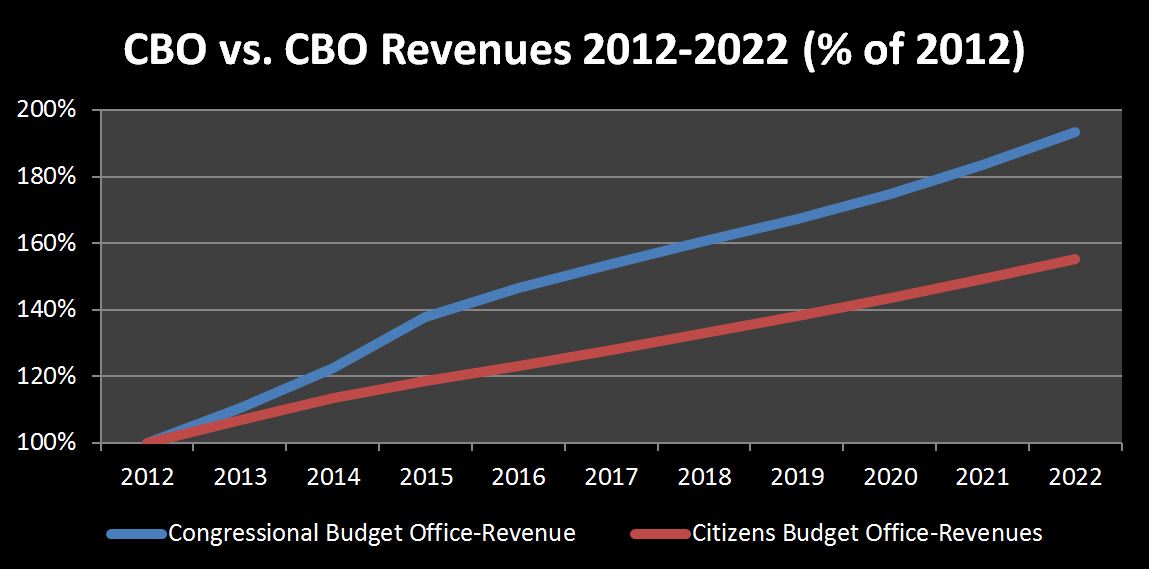

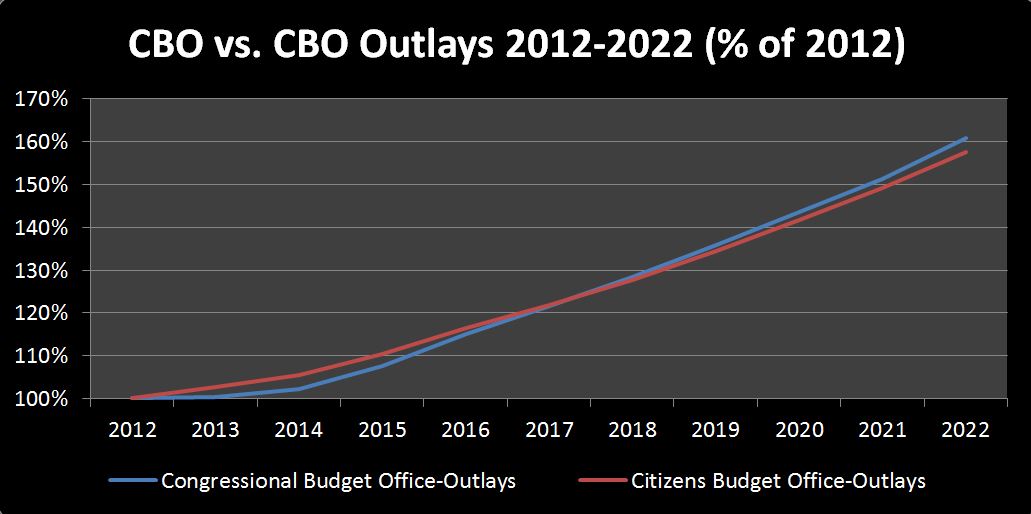

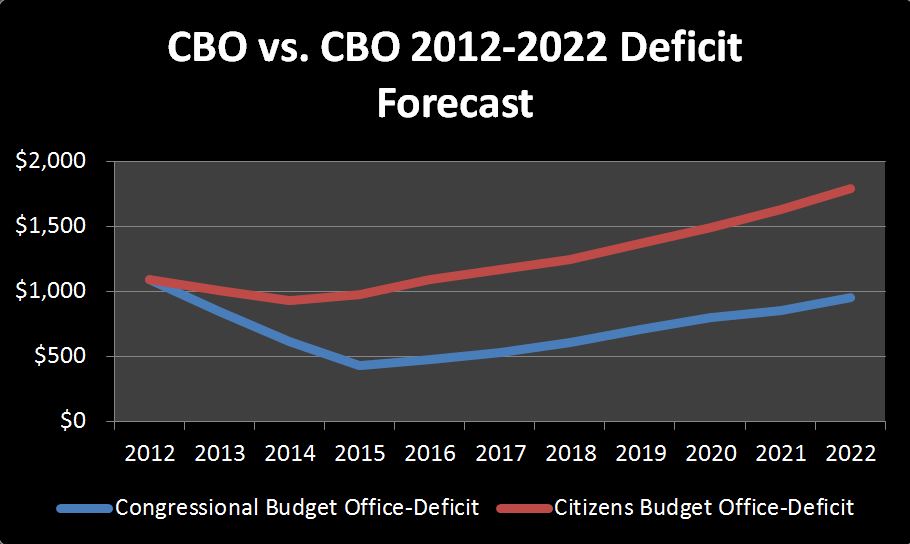

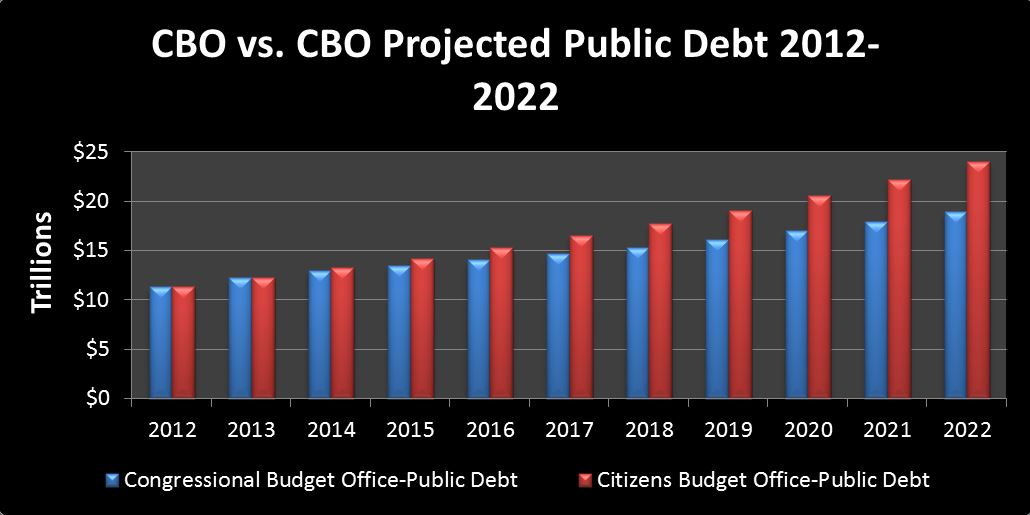

Well….Even if we can’t directly compare the Citizens Budget Office vs the Congressional Budget Office…we can at least look at the forecasts of each and compare it to actuals.

So first up….the Congressional Budget Office. At the time I published the initial CBO vs CBO write up, they were forecasting an 845B deficit, subsequently lowered in May to $642B. Actuals came in at $680B…so not that shabby. The initial forecast was high by $165B…and the later forecast ended up being $38B low.

Now…for the Citizens Budget Office…that would be me. My initial forecast was a 1.006T cash deficit revised down to $800B in May. Actuals ended up at $774B, so my initial forecast was $232B high and my second attempt was $26B high. Now…a $26B miss from 5 months out….not too shabby if you ask me.

The initial miss, however, can be broken down into a few categories. Of the $232B miss, 85B was due to sequestration…I assumed incorrectly that it wouldn’t happen. Second, I did not forecast the $60B Fannie Mae Payday Loan. The rest was primarily and underestimate of revenues. I did expect higher revenues due to the tax hike (primarily on workers) but month after month they came in higher than expected in my initial forecast. That’s a good thing…unless you pay taxes I suppose.

So in conclusion, I will grudgingly give round 1 to the pros at the Congressional Budget Office. I’m not sure if they just got lucky, or if they really are better than me. But all is not lost. In the initial forecast, I framed this not as a single year competition, but as a 10 year long challenge. So…I’m working up my year two projections and should have them out in a few weeks. Round 2 coming up….may the best organization win.