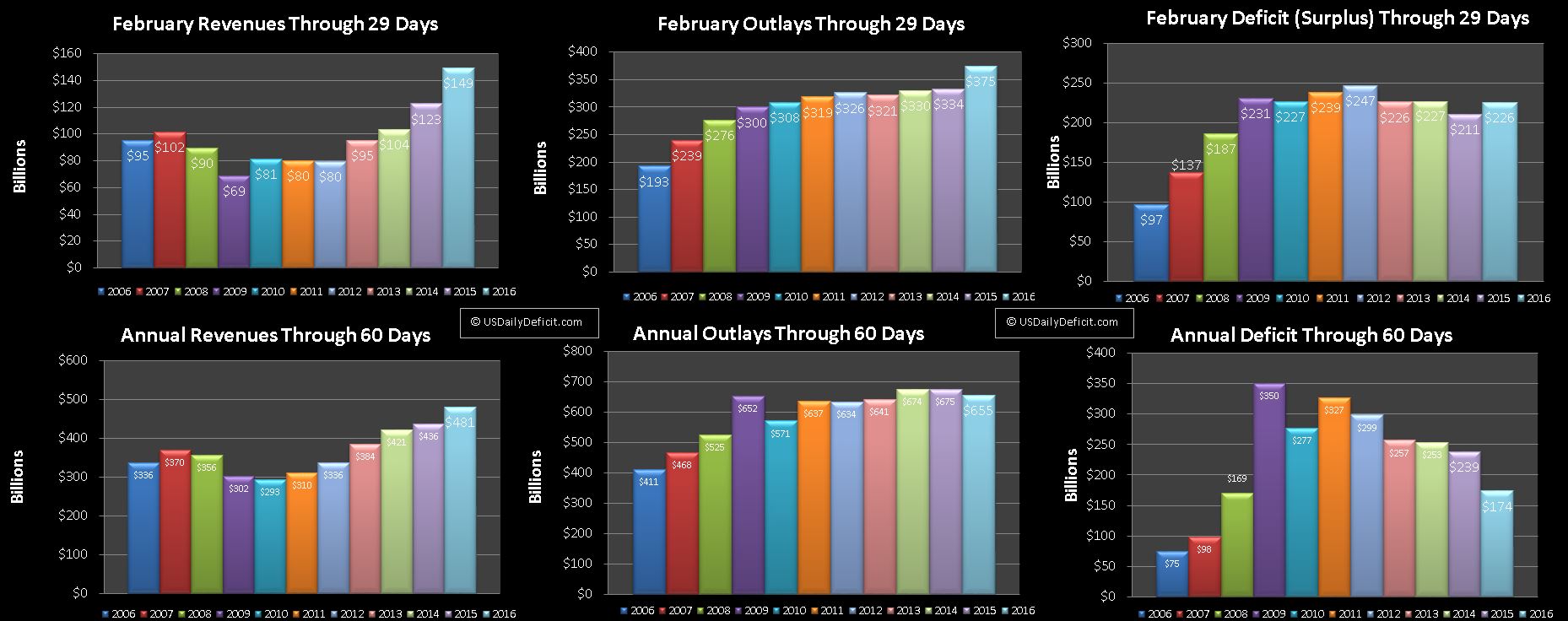

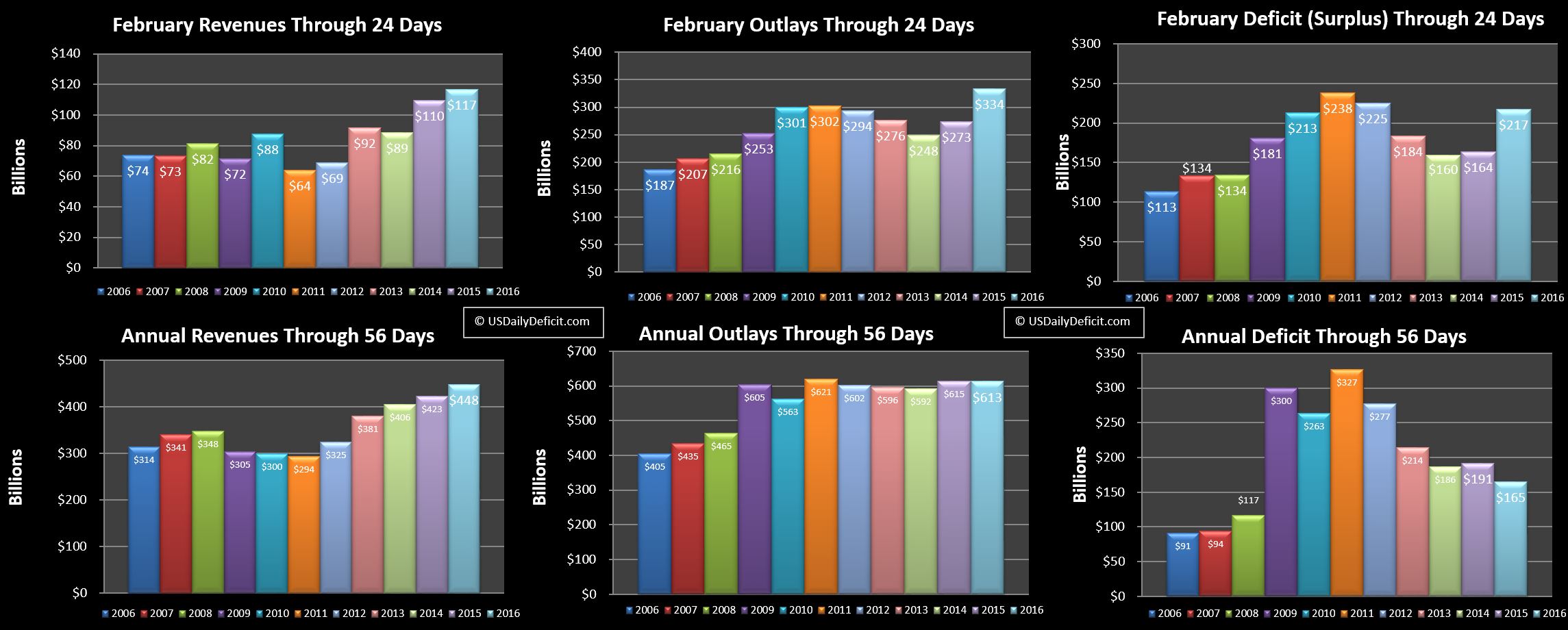

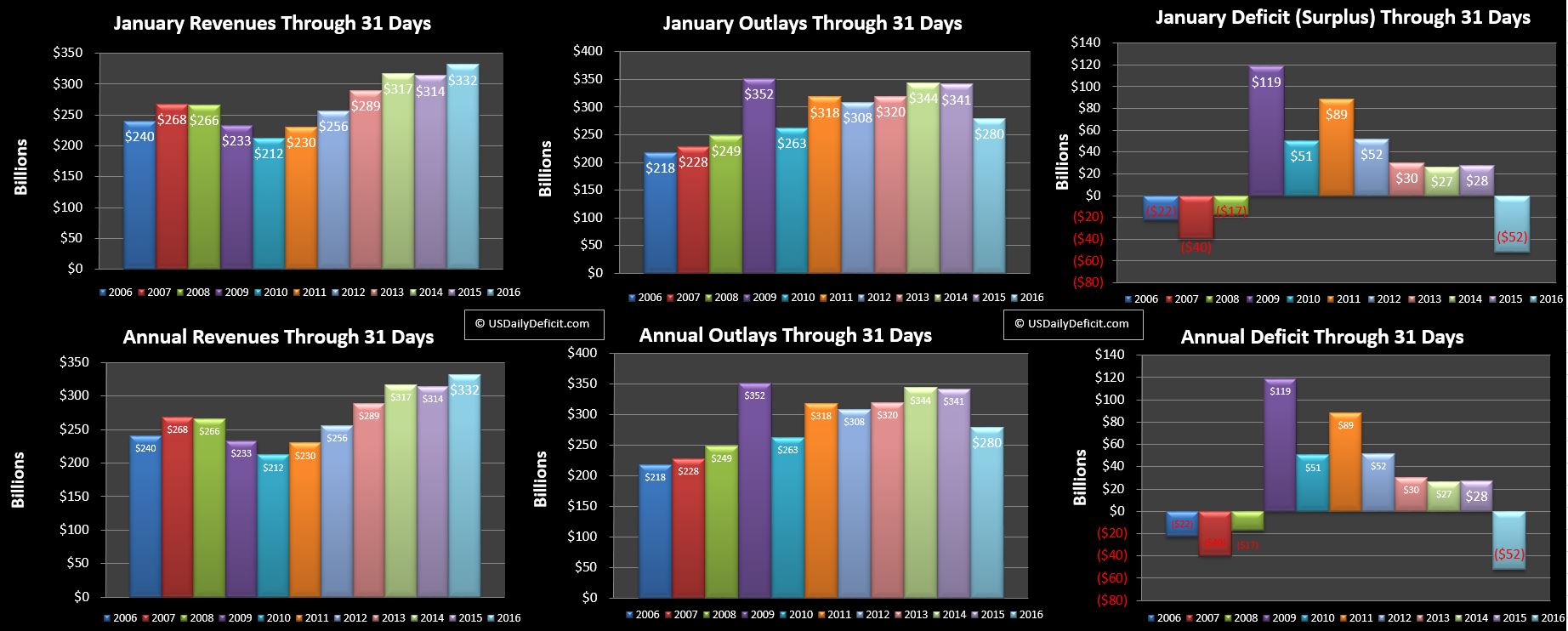

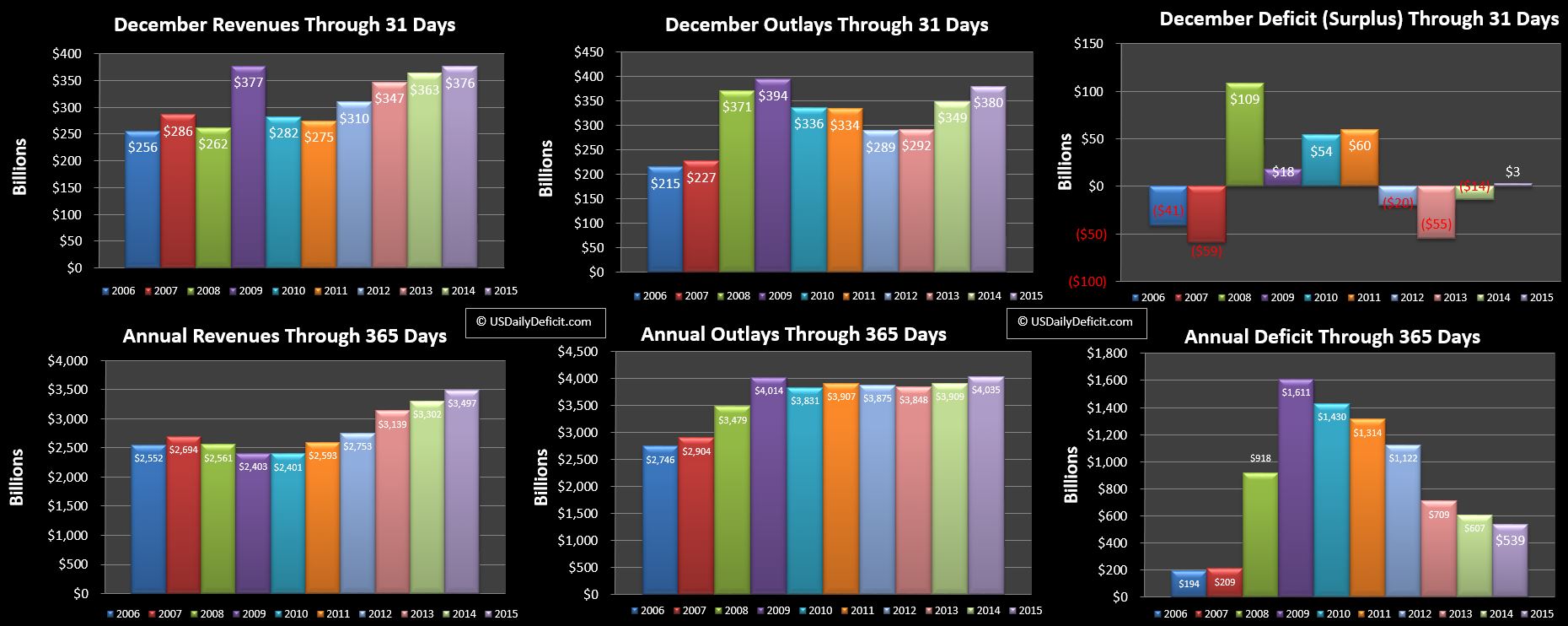

The US Cash Deficit for February 2016 came in at $226B, topping last February’s $211B deficit and wiping out the January surplus leaving 2016 through 2 months with a 174B deficit.

Revenue:

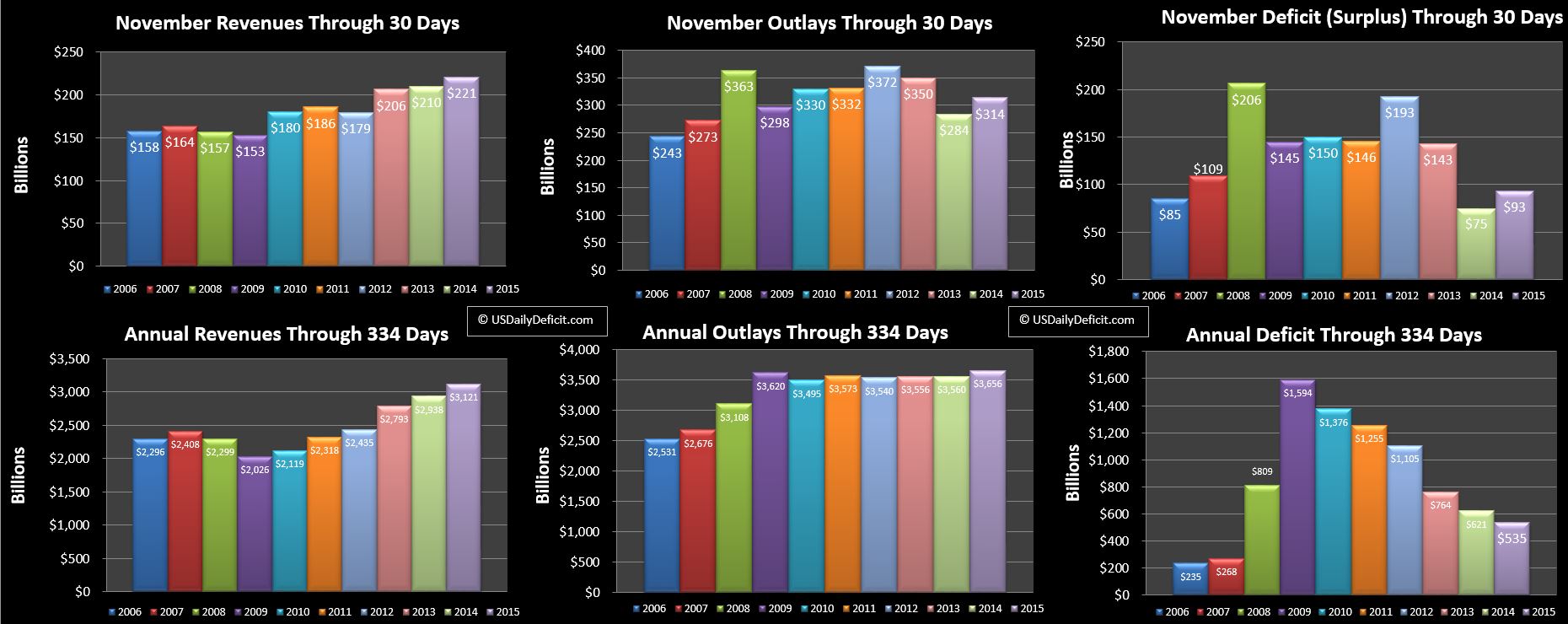

Revenues were up$26B, good for +21% YOY vs 2015….not bad, but for the most part we can thank leap year and February tax refunds. I treat refunds as negative revenue rather than an outlay, so the $125B of refunds that went out to individuals in February pulled down total revenues to $149B, while an average month is closer to $300B. Leap year gave 2016 an extra day vs 2016, and Monday 2/29/2016 did not dissapoint, with a solid $23B of extra revenue. Refunds were more or less in line with last year, but having the small revenue base made the +21% possible. With only 2 months. this also pulled the YTD up to +10%. So yes…the numbers look good, but there is a good chance it is all timing and one offs….and that the reality is we are still in the ballpark of +3%….we should have a much better idea by the end of April.

Outlays:

For the month, outlays were up$40B but that is primarily just last month’s timing rolling off. For the year, we are still under 2015, but that is due to the January 2016 payments that went out in December 2015, permanently pushing 2015 outlays up and 2016 down by ~$30B-$40B. We look to be burning through that benefit at a rate consistent with my estimate of ~+3% growth for the year, but it will take a few more months for that trend to solidify(if it exists).

Deficit:

Thanks to timing and leap year, the deficit is $65B under where it was last year through 2 months. Even though it doesn’t look particularly solid at this point, improvement is improvement…we’ll gladly take it….just don’t get your hopes up yet.

Summary:

Through 2 months, the headline numbers look pretty good, but I am a bit worried about revenues…specifically federal tax deposits which are the largest consistent revenue source in the budget. Through 2/28…they were up just 0.2% for the year compared to +4% last year. Thanks to a big leap day, the year is at +6%, but I’m not sure it will last long. If baseline revenue growth is only 0.2%….it could mean trouble is brewing.

Looking forward, refund season marches on, so we will probably have a March deficit in excess of $60B before hitting April, which will likely have a surplus in the $150-$200B range.