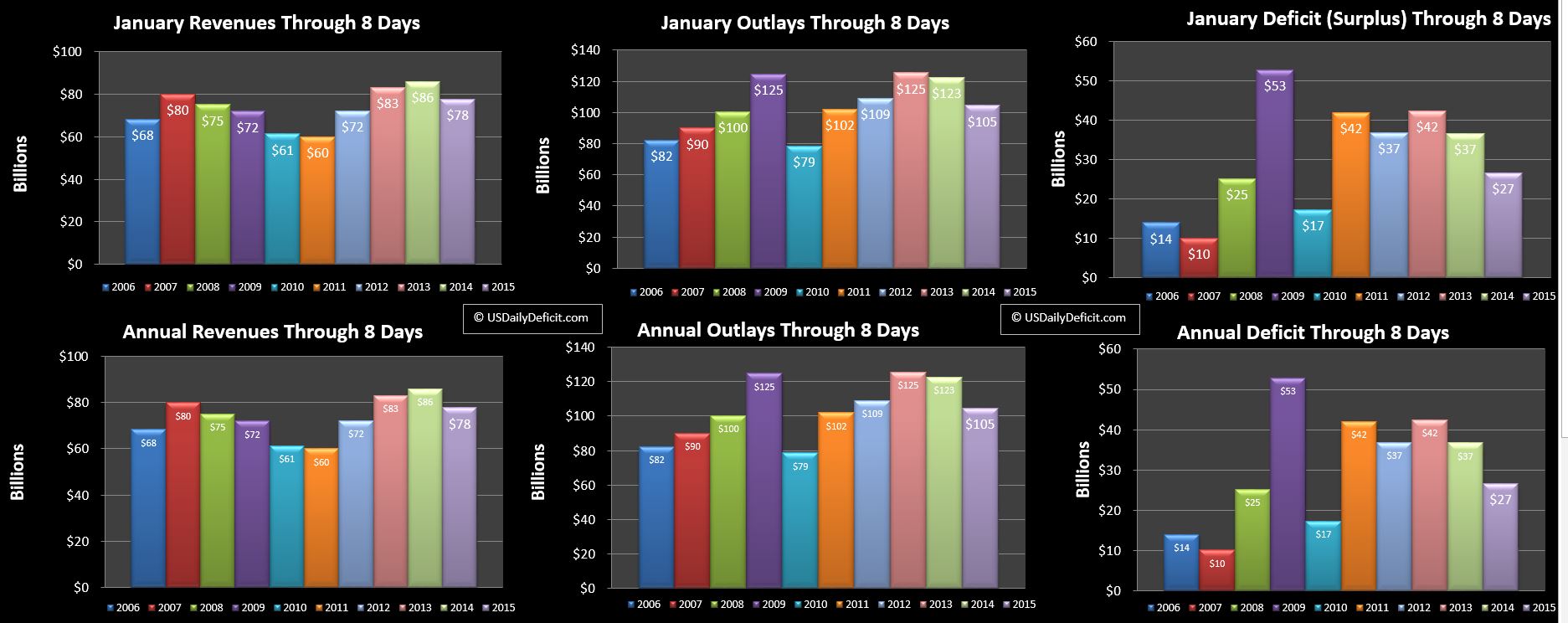

The US Daily Deficit for Thursday 1/8/2015 was $4.5B bringing the January 2015 deficit through 8 days to $27B.

As is standard practice, I have attempted to sync up the current year with the prior year based on day of the week, which drives many, but not all of the revenue and payment cycles. So the charts above compare 2015 through Thursday 1/8 to 2014 through Thursday 1/9. Because of this, 2014 has an extra business day, a difference it will retain for the rest of the month.

Revenues through 8 days stand at $78B, $8B under 2014….we can probably chalk this up to one less business day. Assuming revenue continues to grow at 5%+ into 2015, we should see this shrink over the coming week and go positive, hitting +15B to+20B by the end of the month.

Outlays are at $105B, $18B under 2014. This can be chalked up to the extra business day, and the timing of SS payments this month. SS payments of about $13B go out the 2-4 Wednesday of the month…in 2014, the second Wednesday was 1/8, in 2015 the second Wednesday is 1/14. These won’t sync back up until the end of the month, so just keep that $13B in the back of your mind.

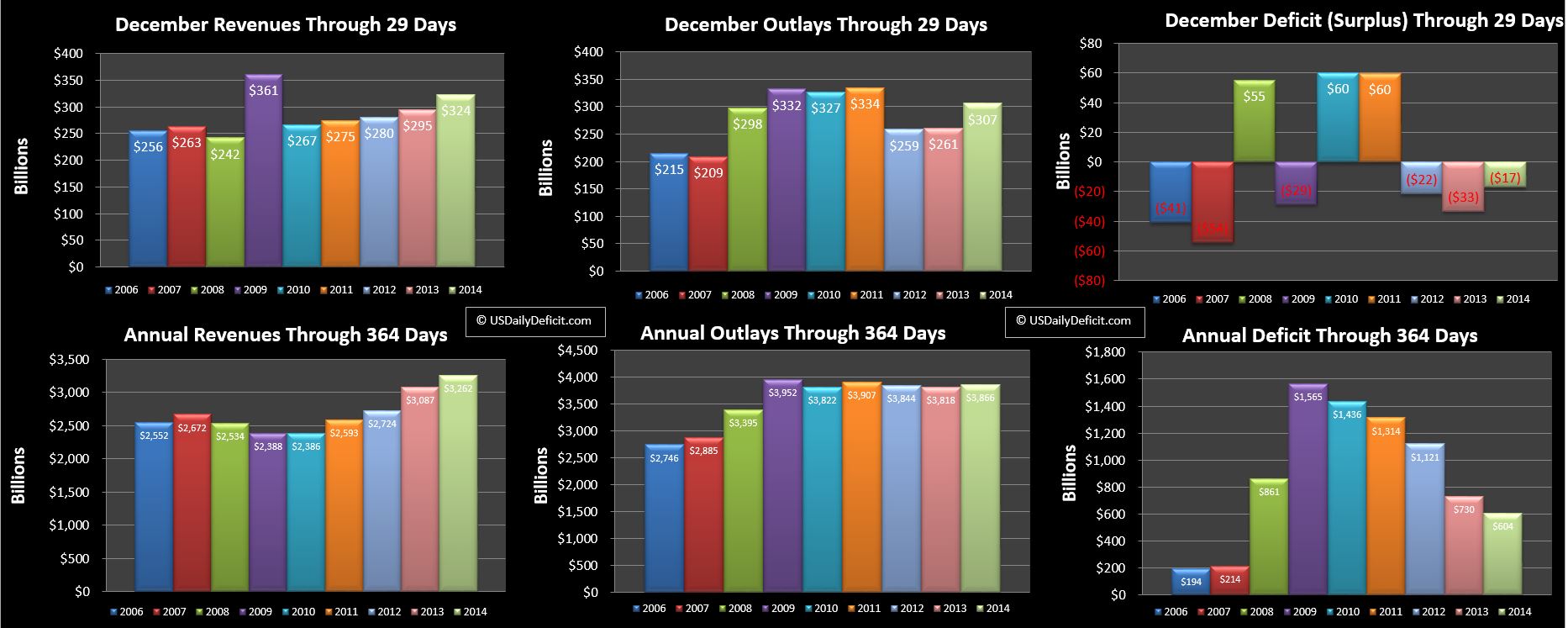

Now for my January forecast. December didn’t turn out so well….my optimistic forecast of a $35B surplus missed the actual $14B surplus by $21B. January is typically a low deficit month as tax revenues pick up while tax refunds don’t really kick off until early February. I’m going to throw my dart at a moderate $20B deficit to kick off the year. Stay tuned…