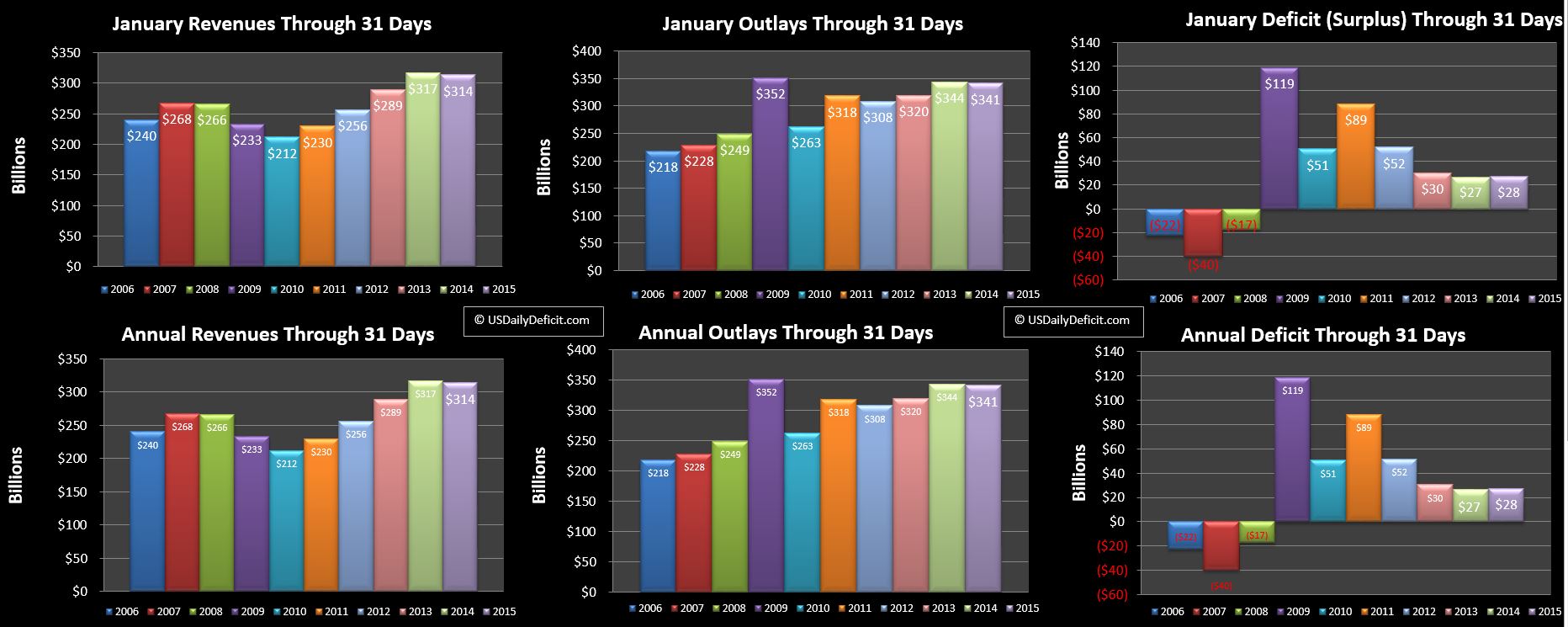

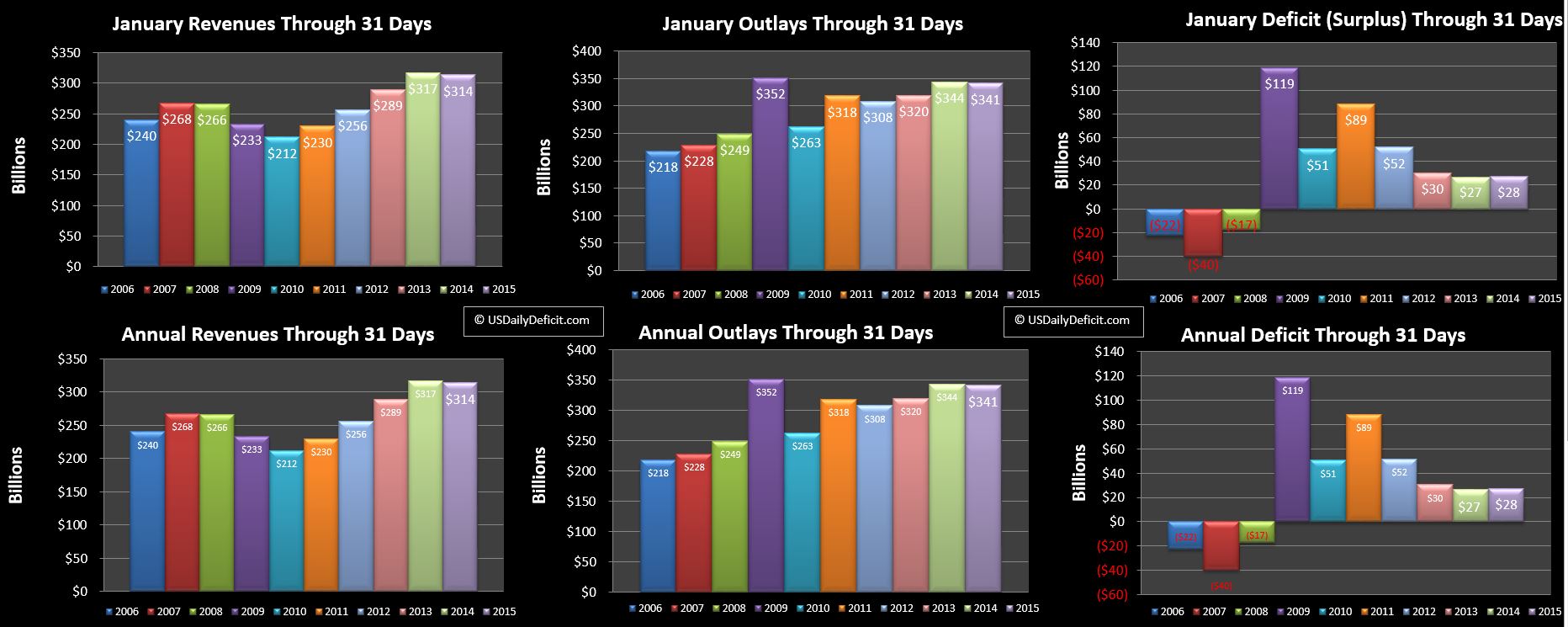

The US Daily Cash Deficit for Friday 1/30 was $47.4B, pushing the January deficit for the full month to $28B.

There were a few surprises. First off, $10.5B of refunds went out. I didn’t expect any material refunds until the first week of February, but there they are. I account for refunds as negative revenues, so the result was a big hit to January revenues. Other than this, Friday revenues were a bit lower and outlays a bit higher than I would have predicted, pushing the deficit about $18B over the range I provided just a few days ago.

Revenues:

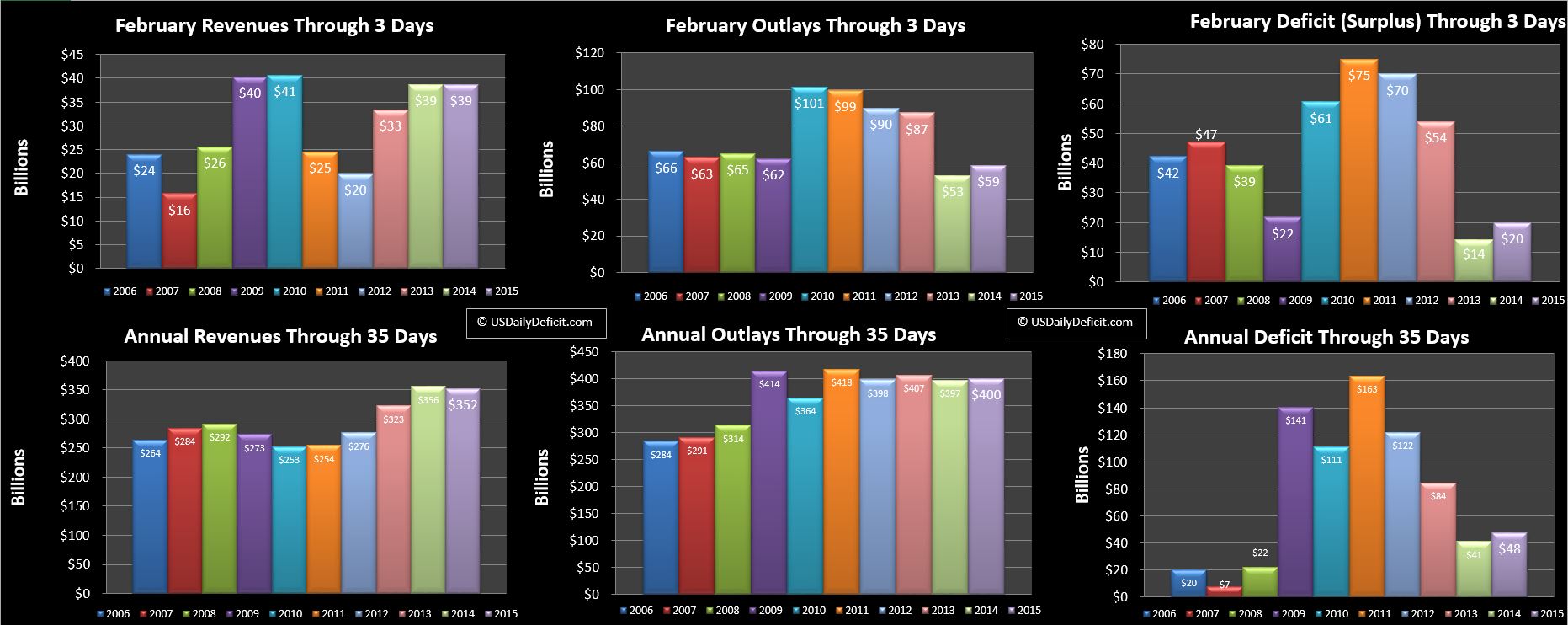

After looking like they were honing in on a solid +3% gain, Friday’s tax refunds pull revenue back under last year for a 1% loss instead. Adding refunds back in gets us to a 2% YOY gain. Withheld taxes were up 2.4%, taxes not withheld were up 7%, while corporate taxes were down 2%. Individual Tax refunds went from $1B last year to $11B. Altogether, it was an ok, but not impressive month for revenues. It will be interesting to watch refunds in February….was Friday’s $10.5B of refunds an indicator of a larger than expected refund season, or just a timing event? I believe that the refund season was delayed a week or so last year due to the late congressional wrangling delaying forms or something… In any case, last February had $128B of refunds. I keep reading that refunds will likely be lower as millions have their Obamacare penalties taken out of their refund, and others who underestimated their income for the Obamacare subsidies will see the difference taken out of their refunds as well. This coupled with the timing event we just saw adds a lot of uncertainty to February. I honestly haven’t a clue, but I’ll peg it at $105B on timing and an overall decrease in refunds.

Outlays:

Outlays end down $3B, helped out by ~$5B or so of interest payments that were bumped to February 2. Also helping was my -$7B adjustment for unamortized discounts and premiums. Generally, this number is positive as debt is sold at a discount…for example a $100 bond sold for $99. Rather than attempting to track and amortize hundreds of issues, i would just book the $1 as essentially an outlay in the period incurred, while the accountants would instead recognize it as interest over the life of the debt. Over time it all zeroes out. In any case, while these are generally positive…and thus increase outlays, this month we have a -$7.3B…essentially an offset to outlays. Negatives are not unprecedented….they would indicate that on average more debt was sold at a premium for whatever reason last month. In that case, we get $101 cash, for a $100 bond. For more information on this, read here….or you could just trust me on this one 🙂 In 2014, this averaged about +$4B per month….it will be interesting to see if that trend changes. If you add those two items back in and you get to a 2-3% YOY growth rate in outlays, which could indicate after 5 years of stability, outlays are about to start growing again. Looking to the categories, we see small reductions in defense vendor spending… most categories fairly flat, maybe down a little and the SS, Medicare and Medicaid up +14B together.

January Summary:

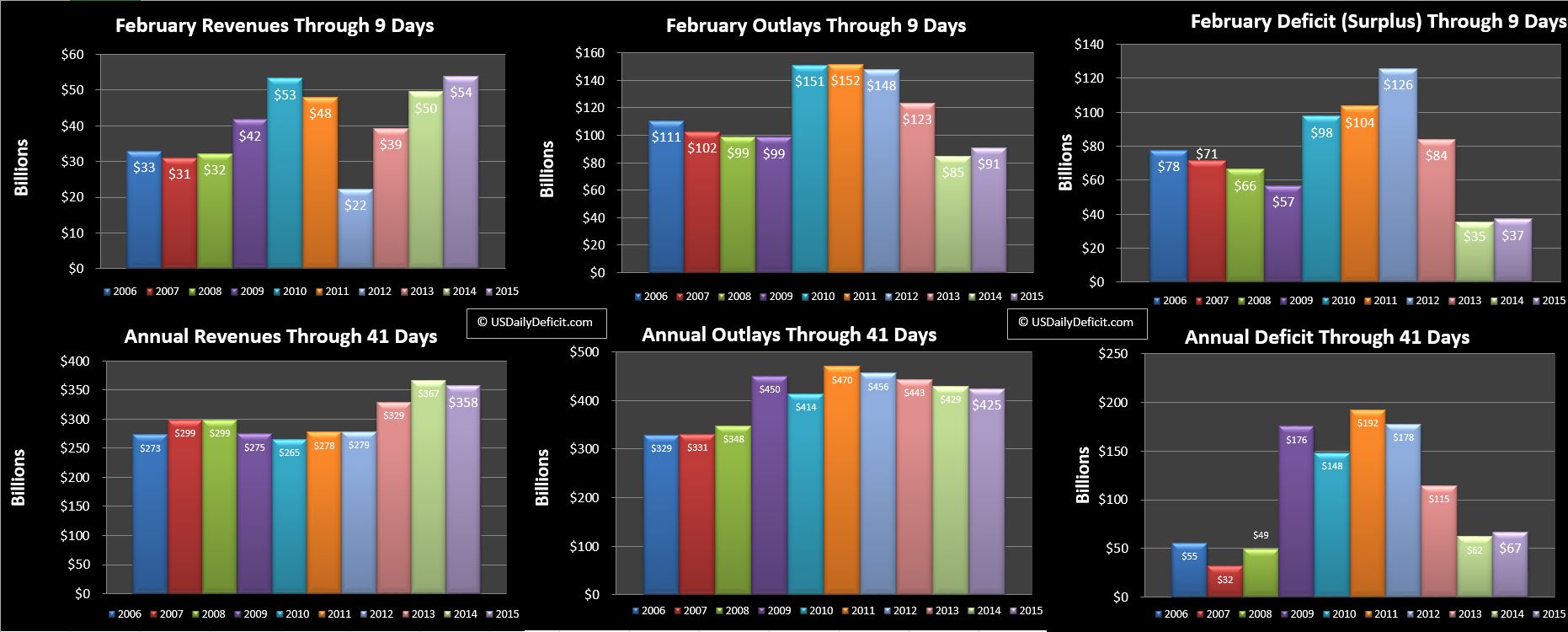

Add it all up and adjust for timing, and January basically looks like revenue +2-3% and outlays +2-3%, which is a pretty solid recipe for another $600B deficit in 2015. But…the year is young and February through April are notoriously unpredictable.

February Forecast:

Before I attempt to predict the “notoriously unpredictable”, let’s take a look at January’s forecast. My early forecast was for a ~$20B deficit, we ended up at $28B, for a $8B miss, a little bit better than my average miss of $11B. However, the internals were not as pretty. It turns out that my revenue forecast was about $15B high, offset by my outlay forecast which missed by $8B the other way. Usually that’s how it goes….I aim for the middle, and hope all the randomness and surprises net out. Sometimes it does, sometimes it doesn’t.

For February, I’m going to forecast a $210B deficit, which includes backing my revenue growth back a few %, as well as backing down expected refunds for timing and Obamacare as discussed above. So stay tuned….the next few months should be fairly interesting…well…you know 🙂