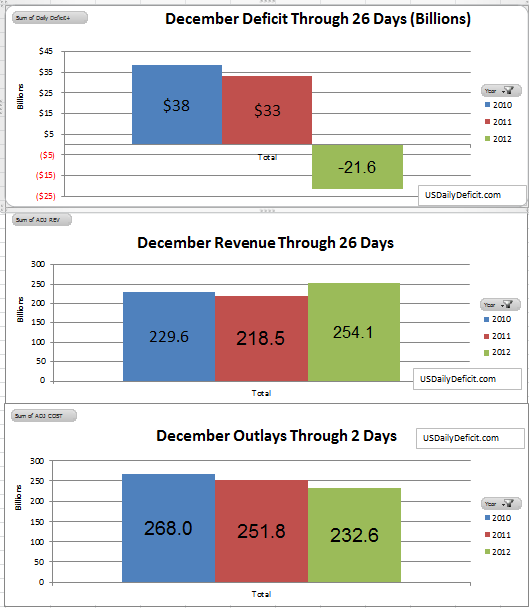

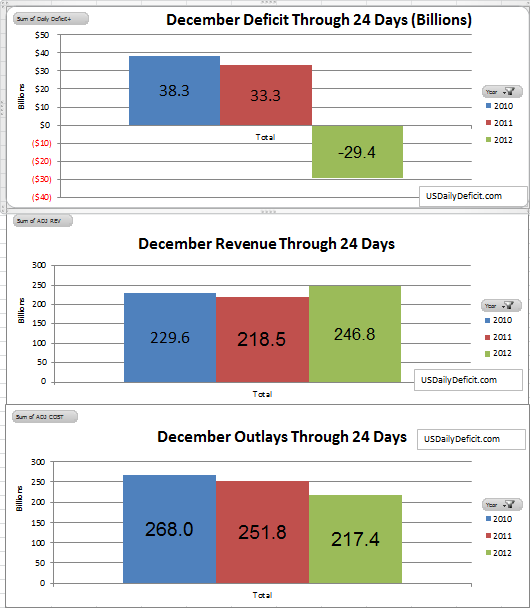

The US Daily surplus for 12/24/2012 was $12.1B pushing the surplus for the month to 29.4B. With four business days remaining, it is a very real possibility that we could end December with a surplus for the first time since 2007. I’ll go ahead and take one on the chin and further revise my estimate down to 0, +/- $10B for the month of December. As it stands, revenue is up $28B and outlays are down $34B for a $62B improvement over last year through 24 days. While the outlay improvement is primarily a timing issue, there is no explaining away the revenue improvement…let’s see if it sticks in January.

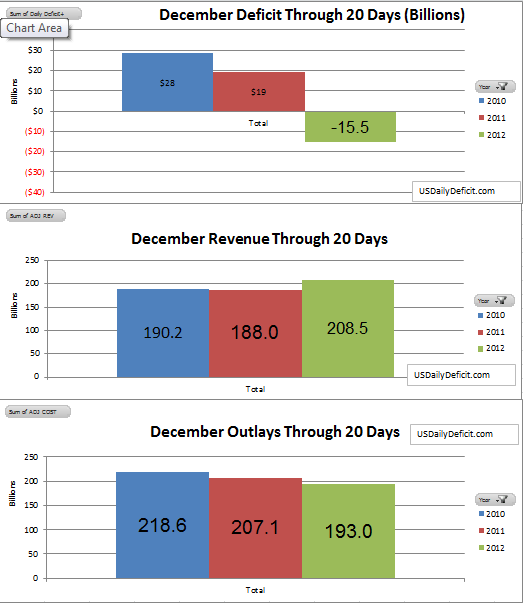

The US Daily Deficit for 12/20/2012 was $4.3B bringing the December Surplus through 20 days to $16B and dwindling fast. Revenue continues to build it’s lead on last year, now up to $20B and while behind due to timing, outlays are catching up to last year despite giving 2011 a $30B head start. Stay tuned… if I have a chance I’m hoping to complete a 2012 deficit preview for next Wednesday. Other than that, posting will be light. Enjoy the holidays!!

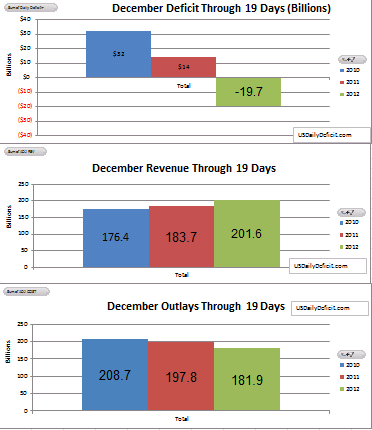

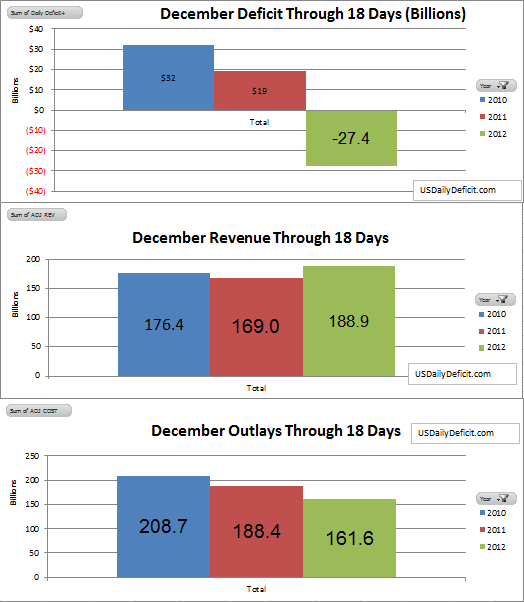

The US Daily Deficit for 12/19/2012 was $7.6B bringing the monthly surplus down to $20B. Through 19 days, revenue is running $18B over last year and unadjusted cost is $16B under last year.