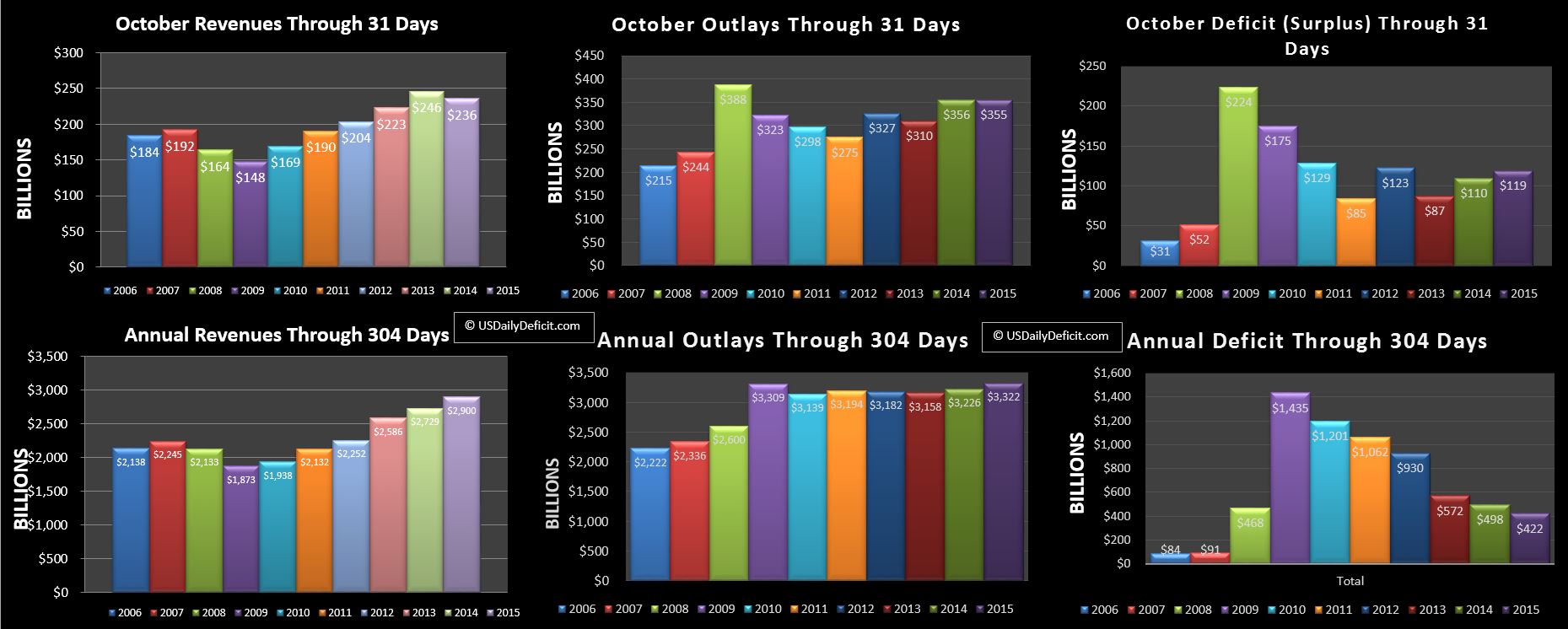

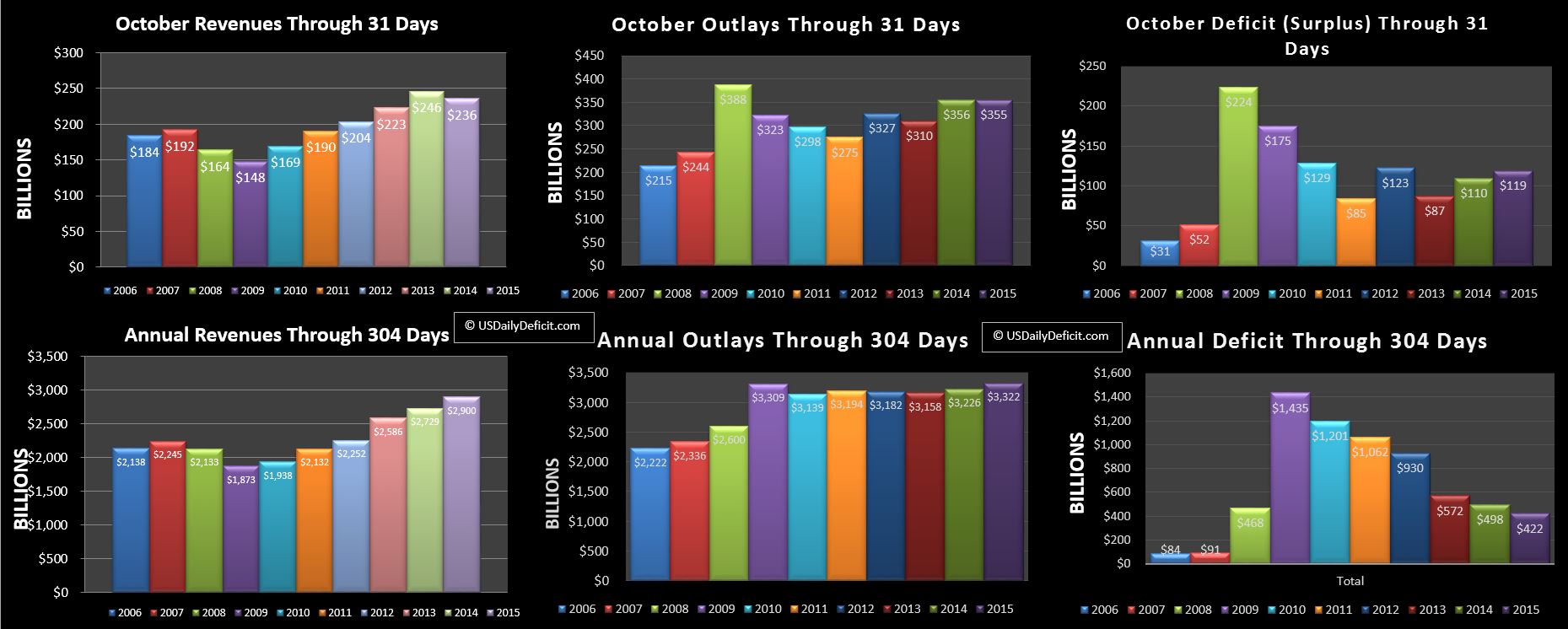

The US Cash Deficit for October 2015 ended up at $119B on $236B of net cash revenues and $355B of cash outlays topping last October’s deficit by $9B

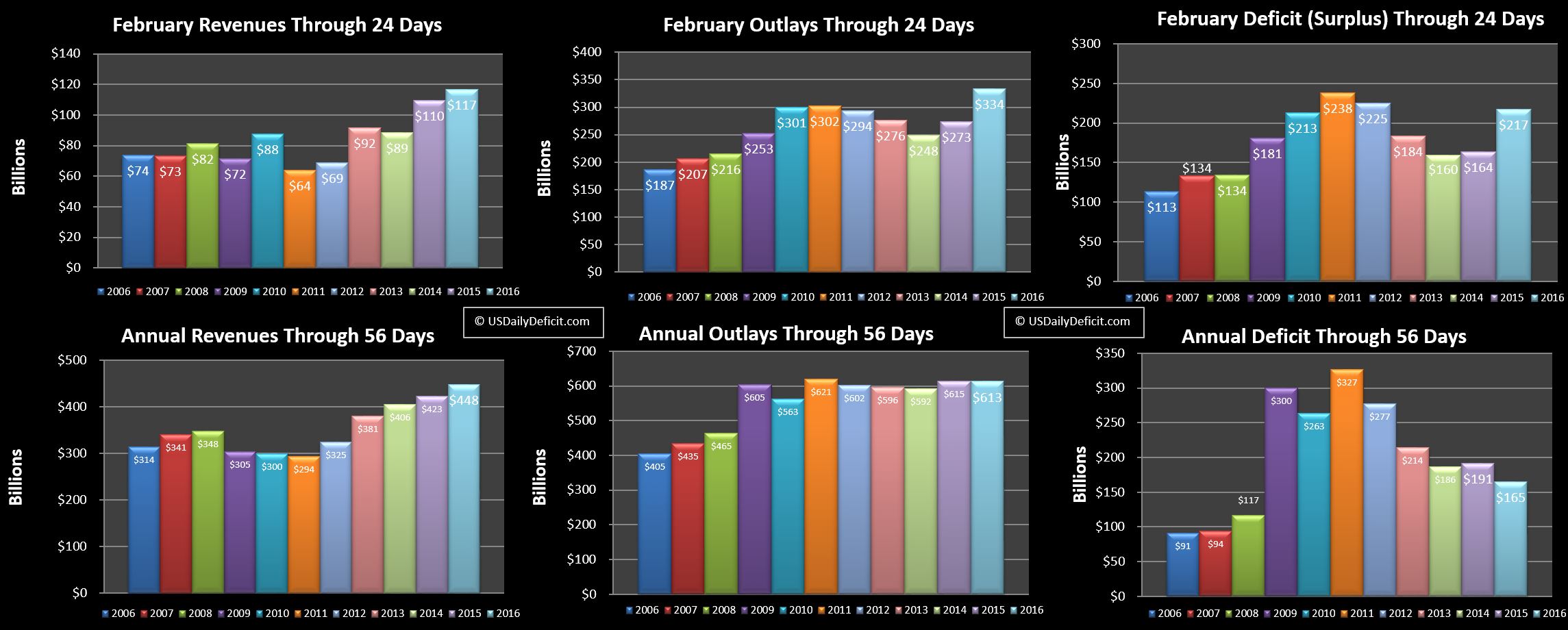

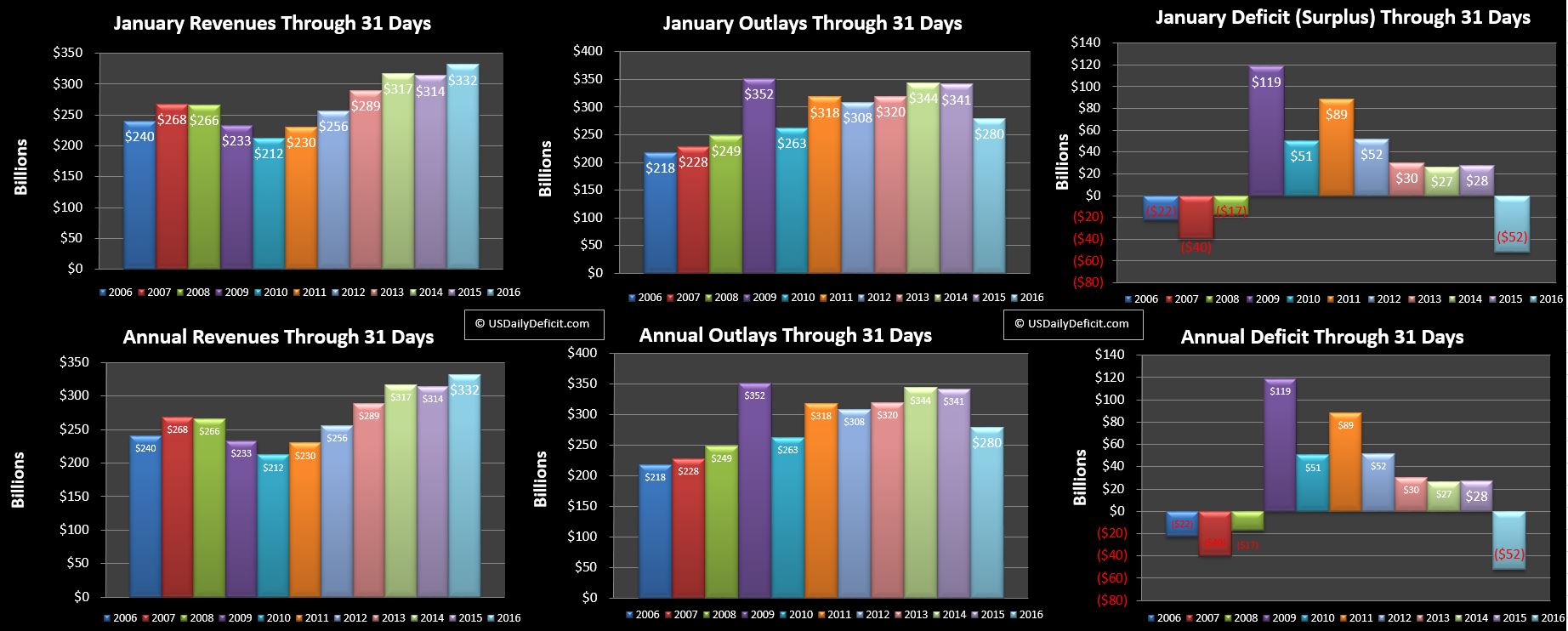

Revenue:

Cash revenue was down $10B…the first YOY miss since January when early refunds drug down net receipts under the prior year. There are two primary factors here…first was last October Justice pulled in $9.3B of cash compared to $0.7B this October. The names elude me but I believe this was some big banking fines made their way into the federal coffers. The second factor was that there was one fewer business day vs October 2015, which all else equal would generally be a ~$10B reduction. Still…even with one fewer business day, general tax receipts manages to pull more or less even with last year, which is hopefully a good sign that November…which gets the benefit of an extra business day vs 2014, may be able to exceed our +5% target. Overall, while I hate to see a YOY miss, the fundamentals still point to a baseline of +5% revenue growth. While this is far less than we have seen over the past few years, it is more or less enough to stabilize the deficit between $400-500B and keep at bay the outlay growth of ~3%. For the Year through 10 months, 2015 revenue stands at +6.3%…losing a full % in the last month alone.

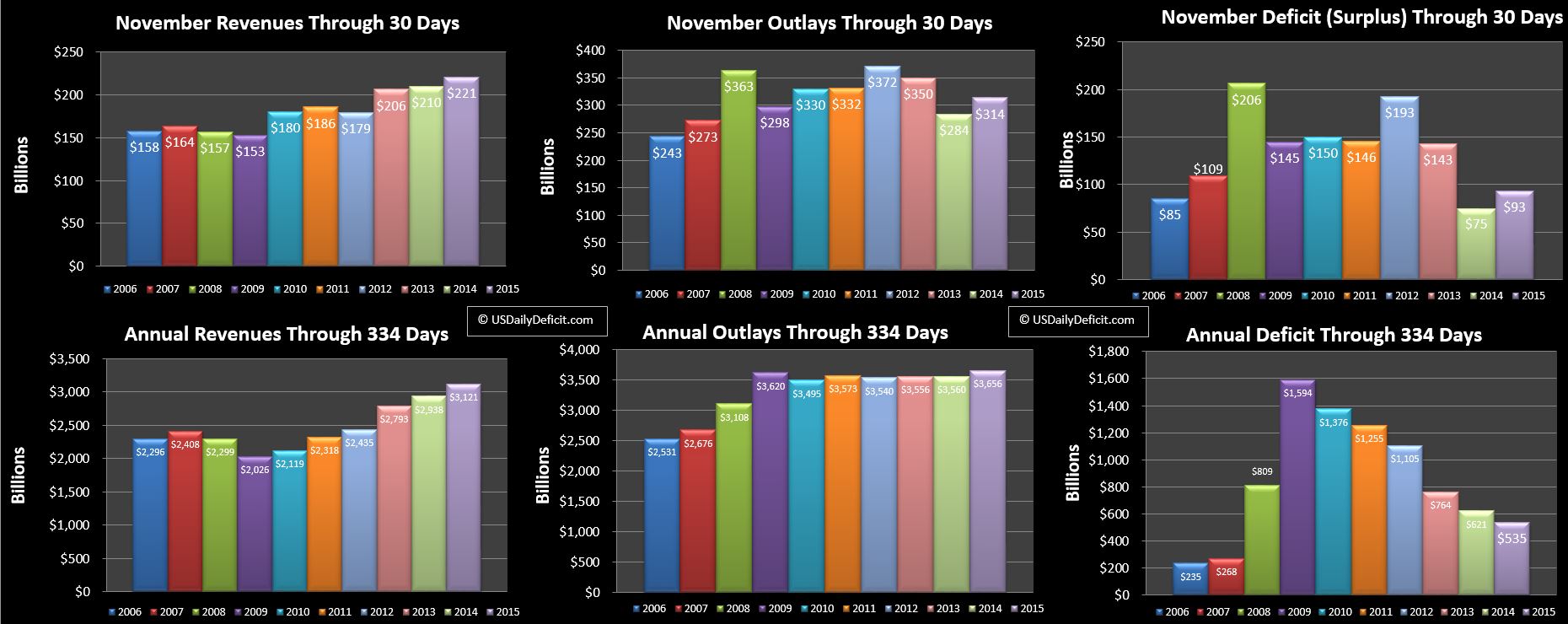

Outlays:

At first glance Outlays were flat, but once you add back in another business day and ~$6B of interest payments that slipped to November, we are a little bit above that 3% baseline discussed above. Medicare and Medicaid continue their march upward at +10%. SS is steady at +5%….it will be interesting to see what next year’s comps look like with no COLA increase this year. If nothing else it should give us a good idea what the underlying growth looks like, though I don’t expect too many seniors excited about the experiment. For the year, cash outlays are up right at +3%.

Deficit:

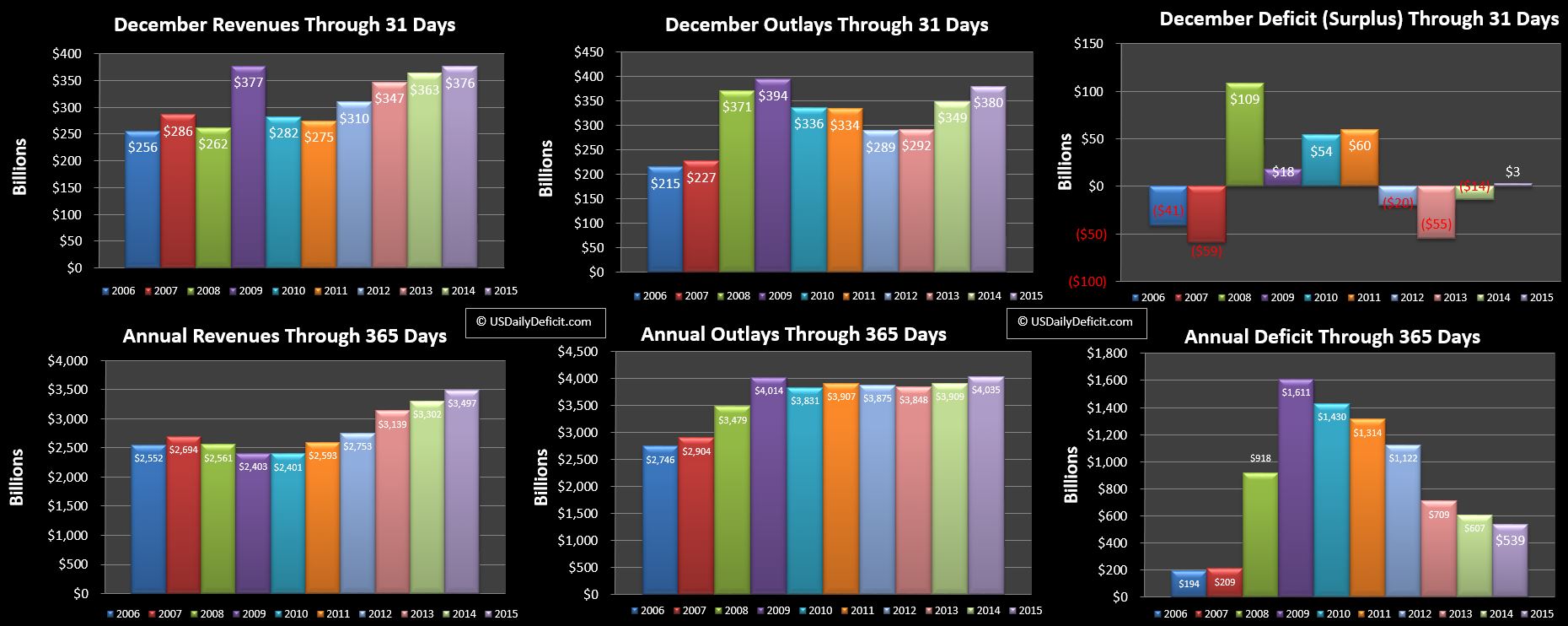

At $119B, the deficit increased $9B over last Octovers $110B deficit on flat outlays and lower revenue. For the year, the deficit sits at $422B, a $76B YOY improvement over 2014. I am expecting another moderate deficit in November, let’s just call it $75B, followed by a $50B surplus in December which would land the full year at just under $450B.

Default Day:

As expected, Default day was averted by a ~2 year deal signed by President Obama just a few hours ago. Details are sparse, but I would assume another debt limit suspension. Supposedly there is an additional $80B of spending…I assume per year split between the military and social programs. In the big scheme of things, $7B a month is pretty much a rounding error, but at 2%….added to our baseline of +3%, we are getting pretty close to that tipping point where deficits could start rising again after 6 years of improvement unless revenue can keep pace. For me, the ending of Extrordinary Measures(EM) is a great thing because EM essentially clouds the cash deficit picture by pretending that debt just disappears. It hasn’t happened yet, but probably in the next day or two, they will bring all that debt back onto the balance sheet and we will get to see how much the debt increases. Last time around, we saw an increase in debt outstanding of $328B. I’m really not sure what to expect this time around. I thought EM would last until February, not November, so I would tend to guess a little lower this time, but it could be just a different mix between public debt and intragovernmental holdings that threw off my math. In any case…once we get the numbers, I will have to go back and restate the cash deficit going back to March when this silly game started. I don’t expect a material diversion, but I won’t know for sure until I get it all reconciled.

Summary:

The top line was bad, but overall the month was not as terrible as first glance. If we start stringing together a few YOY negative revenue numbers I’d start to worry, but for now this just looks like an anomaly….I hope 🙂 For now, the deficit appears to be stabilizing with growth in revenues and outlays more or less cancelling each other out. Clearly that’s not a good thing, but we’ve definitely seen worse.