I read Bernanke’s bond losses: $151 billion plus over at money.com with great interest. It has a sensational title, but ultimately comes clean with a solid conclusion…these are just paper losses. It’s a good article…just make sure you read it all the way through:)

So…for a primer, here is how it all works. First, the Fed, using it’s magic wand, creates new/fake money. Then, they go out into the market, and use that money to purchase bonds… $1.9T of treasuries and $1.1T of mortgage bonds according to the article. This is more or less “quantitative easing”

So say I’m a saver, and I just purchased a shiny new $100 30 year treasury bond with a 2% yield. I paid $100, and am really looking forward to getting my $1 check in the mail every six months. Then I get a call from Uncle Ben (Bernanke). “Say….if you want to sell me that bond…I’d be happy to buy it for $101”. So I say ok….take my $1 gain, and replace it with another newly issued bond…this time at 1.99%. Rinse Repeat a few million times. Now…of course Ben’s not really going to call me up with a $1 treat….but his banking buddies…you bet!!

So now Ben has managed to take his imaginary money and push it into the real economy…lowering rates, making his banking buddies rich…maybe even creating a job or two for the Bugatti plant.

Every six months, Treasury cuts him a check for $1…he pays his staff, and sends the rest right back to the federal coffers….where they book it as revenue under “Federal Reserve Earnings”

Got that? Federal reserve creates imaginary money and uses it to finance the federal government (after running it through a third party),. Then, the federal government sends the Fed their interest due….and the Fed turns right around and sends it back as revenue. Hooray for government accounting!!

So, lets just cut through the crap….what is really happening is the Fed is printing money and using it to finance the deficit and lower the interest rates paid by the government. The end.

Moving on….What has happened recently is that interest rates have risen on the fear that the Fed will not only stop the money printing, but also start selling the $1.9T they have accumulated. The problem, of course, is…who has $1.9T to lend to Uncle Sam?? Not me…not for that deadbeat, and surely not at 2%!!

So now Ben has my old $100 30 year bond paying $2 per year. but nobody is willing to pay him the $101 he paid, or even $100, or $98 because I can buy a brand new one paying say $3 of interest per year….for $100. In order to get the same 3% yield I could get with a new bond….all I am willing to pay for the old bond is $67….good for a $34 loss if Ben wants to sell it back to me. Obviously, I more or less made up the numbers for simplicity and to make a point, but these mechanics are how the authors of the story came up with the $151B paper loss. I’m sure their math is right, but as the article mentions, these are paper only losses, and the Fed doesn’t have to actually recognize them until they sell their $101 bond for $67. They could hold them all to maturity and never book a loss. Now, I have a lot of problems with this entire program, but not with this.

Say I agree to loan a friend $100 at 5%. A week later, interest rates have doubled to 10%. While one could argue that had I waited a week I would have got a better rate and made more money….I shouldn’t have to write down the value of an asset just because I kinda sorta maybe missed out on a higher rate. If rates drop, I shouldn’t write up the value either. I understand the arguments for….just the very idea of constantly marking assets up and down based on market whims kinda grinds at my accounting core….which yearns for stability. If my company purchases a work truck for 40k….and a shortage of trucks creates a surge in the market value of trucks….doubling it to $80k….I don’t write the value up and recognize a $40k gain….I recognize the gain or loss only if I actually sell the vehicle.

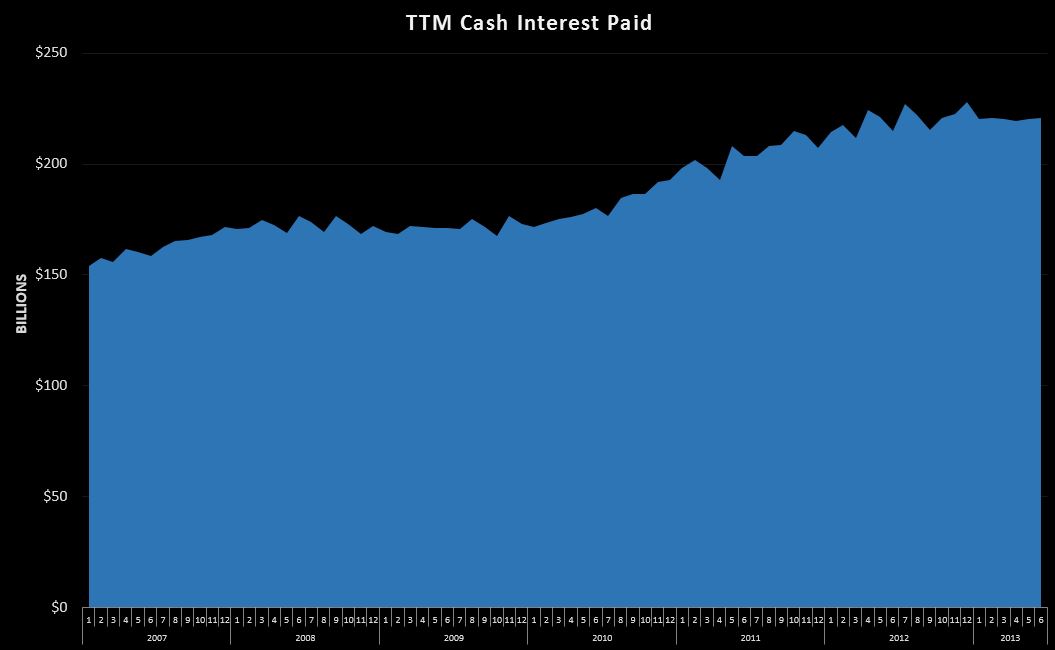

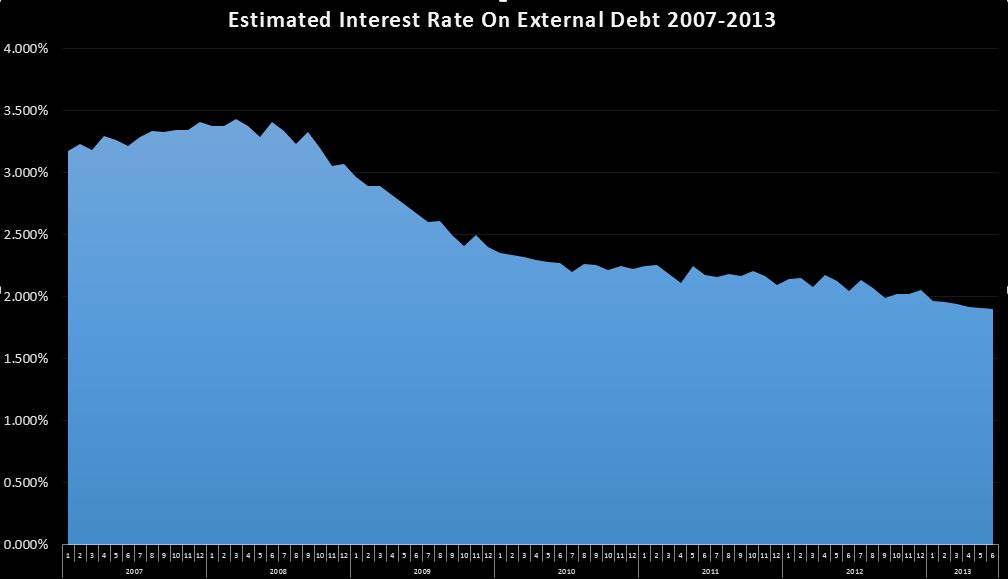

Moving on again…I know this is getting long. How does all this affect the deficit. First, QE enables the deficit…making the money available in the first place, at a lower (manipulated)interest rate, and even lower rate still once you net out the interest paid to the fed and remitted back….and that’s the part I want to finish on. Looking Back to 2007, the fed was contributing about $30B per year to federal coffers. This spiked all the way to an $87B per year rate by mid 2011, but has since slid down a bit to about $78B… as revenue, this is a direct reduction in the deficit…if it went away tomorrow, our annual deficit over the next 12 months would be $78B higher.

This, it seems to me, is the risk to the cash deficit. First…If these losses are recognized…even if over many years, one would think that this would result in a further decrease to these payments. Say they dropped $50B….that’s a new $50B hole….in perpetuity. Second…even if there were no losses…should the Fed ever start selling these and winding down their $3T portfolio…that would slow the payments anyway…probably back down to the $30B or so we saw back in 2007….and that is ignoring any losses they incurred along the way.

In my own forecast, I have this revenue continuing indefinitely, growing at a 3% pace. from 2014 on. I have it there because I do not believe at this time that the fed can ever unwind it’s $3T portfolio of imaginary money without blowing up the entire economy….in fact it will probably continue to grow, since there is nobody else with the ability to absorb the $12T or so of additional debt the US will need to issue over the next 10 years (assuming we make it that far). So…while I acknowledge the “revenue” associated with these cash payments from the Fed now appear to be in Jeopardy, I am not quite convinced the Fed can or will ever actually start unloading it’s $3T portfolio. That said…I’ll keep watching because you never know when something crazy might happen.