It’s been 62 days since we officially hit the debt limit of $16.7B on 5/17/2013, and according to the latest I’ve been reading, Treasury does not expect this to become a problem until the September-November time frame. This is a bit confusing, so give me a second to explain what is going on here.

First…you need to know that hitting the debt limit is not the real problem….running out of cash is. If we hit the debt ceiling, but had $1T of cash in the bank, we could make it an entire year without having any problems. Obviously, we did not hit the debt limit with $1T of cash…we hit it with about $34B, but the point remains valid….we haven’t had any problems yet because we haven’t run out of cash.

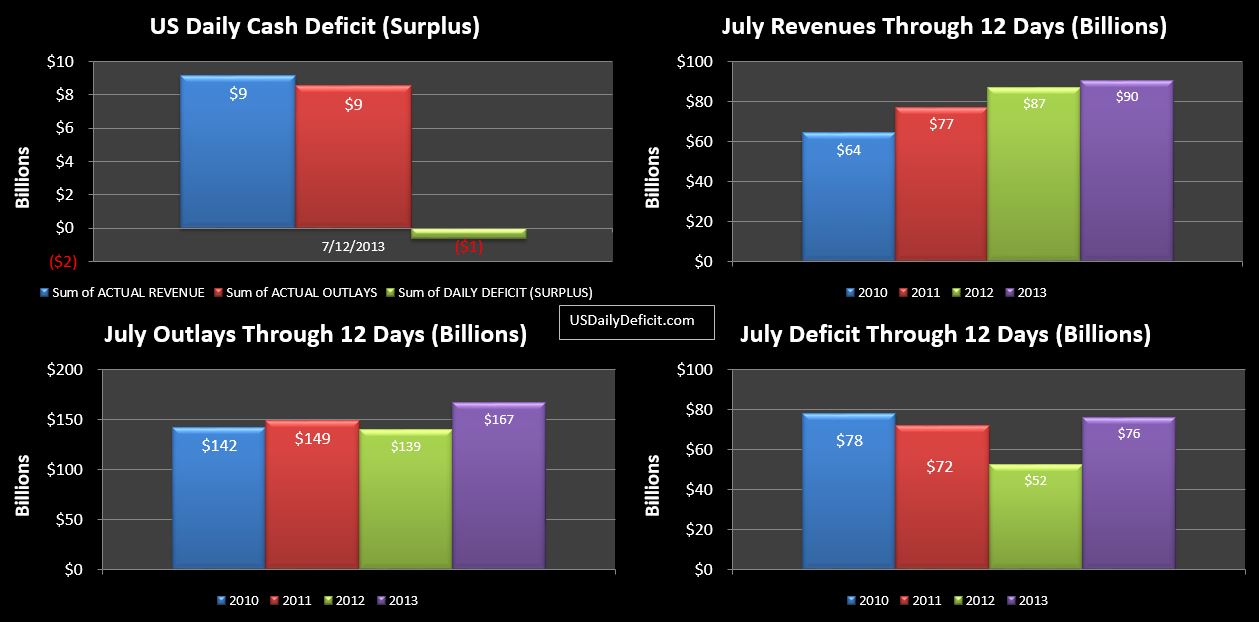

Now, assuming an annual deficit of $800B, you might expect a monthly deficit of $67B…at which pace we would have run out of cash sometime in early June. Except…it’s not that simple. You see, the month to month deficit/surplus is actually all over the place, with February usually having the highest deficit at $200b+ and April typically running a strong surplus of $100B+. The rest of the months fall somewhere in between, with quarter end months generally being better on strong quarterly tax remittances.

So the time it takes for the debt limit to be a problem depends on how much cash you have in hand at that point, and the expected deficit/surplus over the coming months. The last debt limit fight…you may recall came about in January…which is the absolute worst time to have a debt limit fight because a huge amount of tax refunds are scheduled to go out starting in February. If they don’t go out…you could have a revolution on your hands, so not surprisingly, a deal was brokered, pushing the fight out to the middle of May, which as it turns out, is just about the best time to have a debt limit fight…if you must.

The main reason is that you have the strong early month outflows behind you, and with June in front of you likely to run a surplus, you have at least a few months to work it out. This June ran a $116B cash surplus….building that $34B cash stash to $135B by June 30…thanks in part to a ~$60B payday loan to Fannie Mae. Now, July and August are not deficit friendly months…I expect about $200B over this two month period. That’s more than $135B, but…thanks to the shenanigans known as “extraordinary measures”…which essentially hides real debt off the balance sheet…it seems likely that treasury can pull the difference out of its hat… September is likely another Surplus month, but small….so making it to September gets them through to early October. I don’t see how they make it much further, but you never know.

Now honestly, the date doesn’t matter….it took us 30 years to get to this point…whether we run out of cash in August or November really doesn’t matter one bit in the big picture. I fully expect the debt limit will be raised and here is why. Even with admittedly material improvement in the deficit…from $1.6T in 2009, to $600-$700B likely for calendar 2013…$700B is still a huge number. And if they don’t raise the limit…they can’t spend it. I’m not saying it’s the right thing to do, but yanking that $700B per year out of the economy is going have immediate consequences that nobody in either party is ready to deal with.

Basically, it would mean cutting everything by about 20%. Social Security, military pay, medicare, Medicaid, food stamps ect…. If you don’t cut some…like SS and military pay….you have to cut even more from the remaining programs. $700B/60k per person gives me over 10M jobs lost directly, and who knows what the secondary and tertiary effects would be. Now…one way or another, that’s going to happen anyway (and we will be better in the long run for it), but don’t expect the debt limit to be the trigger. Both Republicans and Democrats will work together to keep the imaginary party floating as long as possible before gravity takes over and we all tumble down the cliff together.

Because of this, I am quite confident that after a lot of noise and pretend victory claimed by both sides, the debt limit will be raised. Don’t worry…Be Happy!!