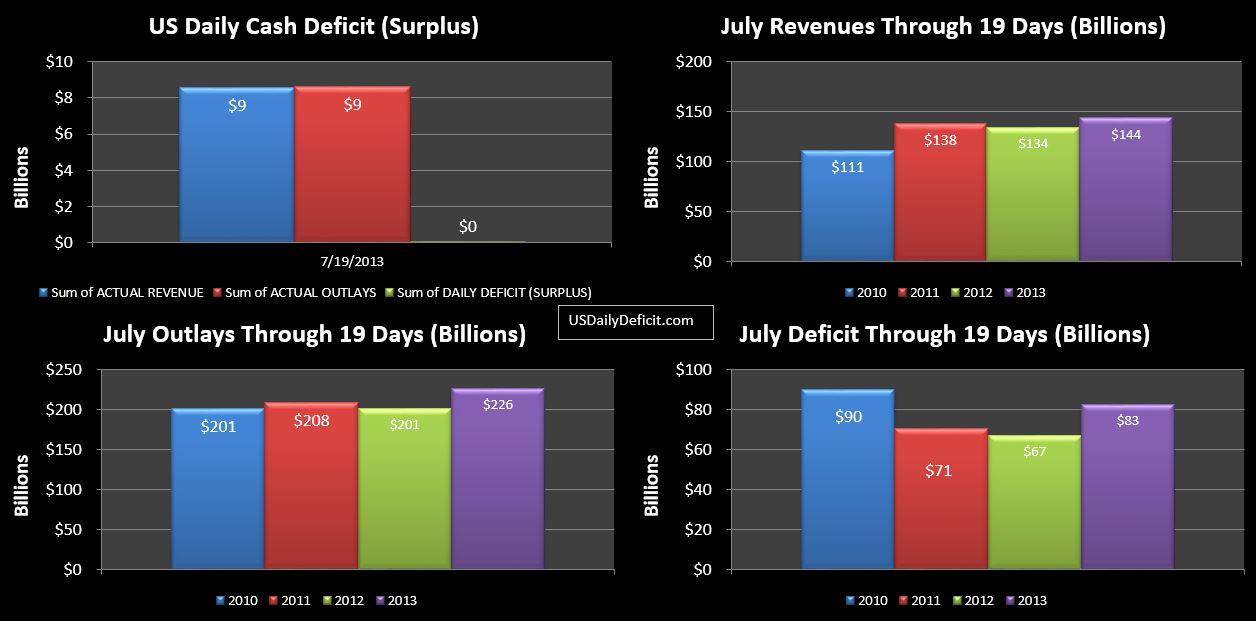

The Daily US Cash deficit for 7/19/2013 was $0.1B, leaving the cumulative July 2013 deficit at $83B, $16B over last year through 19 days. Revenue was strong, pushing the YOY up from 5.5% to nearly 7% with eight business days remaining. Just for reference, last July had about $200B of net cash revenues, so when I say we are looking for a 10% improvement….we are talking about $20B..roughly $1B per day. In a $3.8T budget, it probably doesn’t sound like much, but I’m the first to admit…string 3 or 4 years of +10% revenue together with mostly flat outlays, and it makes a huge difference to the big picture. So here we are….7 months running +10%, thanks primarily to tax increases. I’m not holding my breath….I’m more or less expecting this +10% growth to be a one year boost, but I’m willing to be pleasantly surprised (unless I have to pay the extra taxes :))

I’m not sure what to expect for the rest of the month. Historically, we should be on trend to touch $100B, but there seems to be a shift for some reason…where late month revenues are stronger than they have been historically, causing the month to look weak for the first half….then finish strong and make my projections look a little doomy. So, I’ll hold off for now, and just say that cost does look like several categories will show significant reductions, and revenue looks to be on pace to end around 10%.