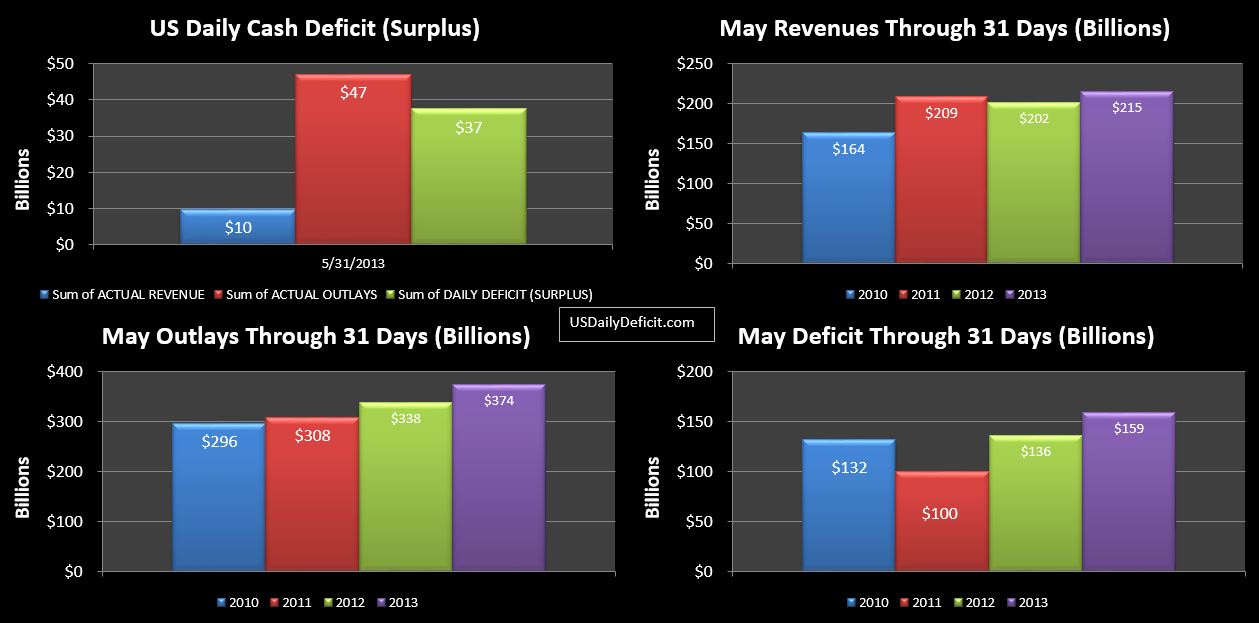

The US Daily Cash Deficit for 5/31/2013 was $37.5B, wrapping up May 2013 with a $159B deficit compared to May 2012’s $136B. However, as suspected, about $30B of June outlays were pulled into May due to 6/1 being on a weekend. Adjusting for this, May would have posted marginal, but not that impressive improvement.

Cash:

As presumed, Treasury Secretary Lew started pulling money out of his magic hat…about $31B of “extraordinary measures”, raising enough to pay the $47B of 5/31 Outlays and increase cash from $20B to $35B….which should be enough to clear the 6/3 Social Security Payments of $25B.

Revenues:

While tax deposits withheld were up nearly 13% YOY, Declines elsewhere reduced the total revenue YOY growth to 6.6%, a disappointing follow up to April’s 26.6% surge. So revenue is a mixed bag. It is a very good sign to see taxes withheld…by far the largest source of revenues continue to see solid YOY growth above 10%. On the other hand….those other sources of cash are important too, and 6.6% growth is disappointing, but it is just one month. If we are ever to fix the deficit problem, and I’m on record as doubtful….we are going to string together 5-10 years of double digit revenue growth with 5-10 years of single digit outlay growth.

I’ve been saying for a while now that May was going to be our first clean look at the 2013 tax hikes. 6.6% is well below what I expected, but as noted, the internals do show some promise. June, as a quarter end will give us our second clean look at the 2013 tax hikes….though there seems to be a good chance a $60B payment from Fannie Mae will provide the illusion of another surge. Good thing I know how to subtract:)

Outlays:

While they post as up 11%, most of this is the June cost pull foreword of about $30B. This will fall out in June as a decrease in cost. Adjusted for this, we see another month of flat cost..no real surprises. Of interest, Social Security was up from $56B last May to $61B this year, a 10% gain, and over $60B annualized. On the other side, we saw spending on defense vendors and unemployment each fall $2B. Unfortunately, sooner or later, the falling categories are going to flatline while SS is going to start accelerating the other way.

Summary:

On the surface…it was an ugly month. Deficit up, cost up, and revenue up only 6.6% vs. the 12% or so we were expecting. But when you look inside, the cost was nearly all timing, and while revenue really was down, the withheld tax deposits number was actually the best through 5 months. So onward we go to June, which should be another interesting month. We will get a chance to see if the internals of the revenue were one offs, or if a trend one way or the other is being established. I will be keeping an eye on the taxes not withheld number for this quarter close, and we will also get to see more “extraordinary measures” shenanigans, topped off by a $60B payment from Fannie Mae predicated in some rather outrageous accounting gains. This one could get crazy, but right now,I would forecast about a $15B normalized Surplus for June, but then add $30B for the cost pushed to May, and another $60B for the prospective Fannie Mae payment…so $105B surplus with revenues and Fannie Mae being the wildcards.