As mentioned in the last post, a deal to increase the debt limit (technically suspend until December 8) was reached…supposedly between Trump and the Democrats, but that story seems a little silly to me, not that it matters.

So, last Friday, Treasury pulled all of the “Extraordinary Measures” (EM) IOU’s out of the coffee can and made them official, pushing the total debt outstanding up by $317B. Again, nothing shocking at all.

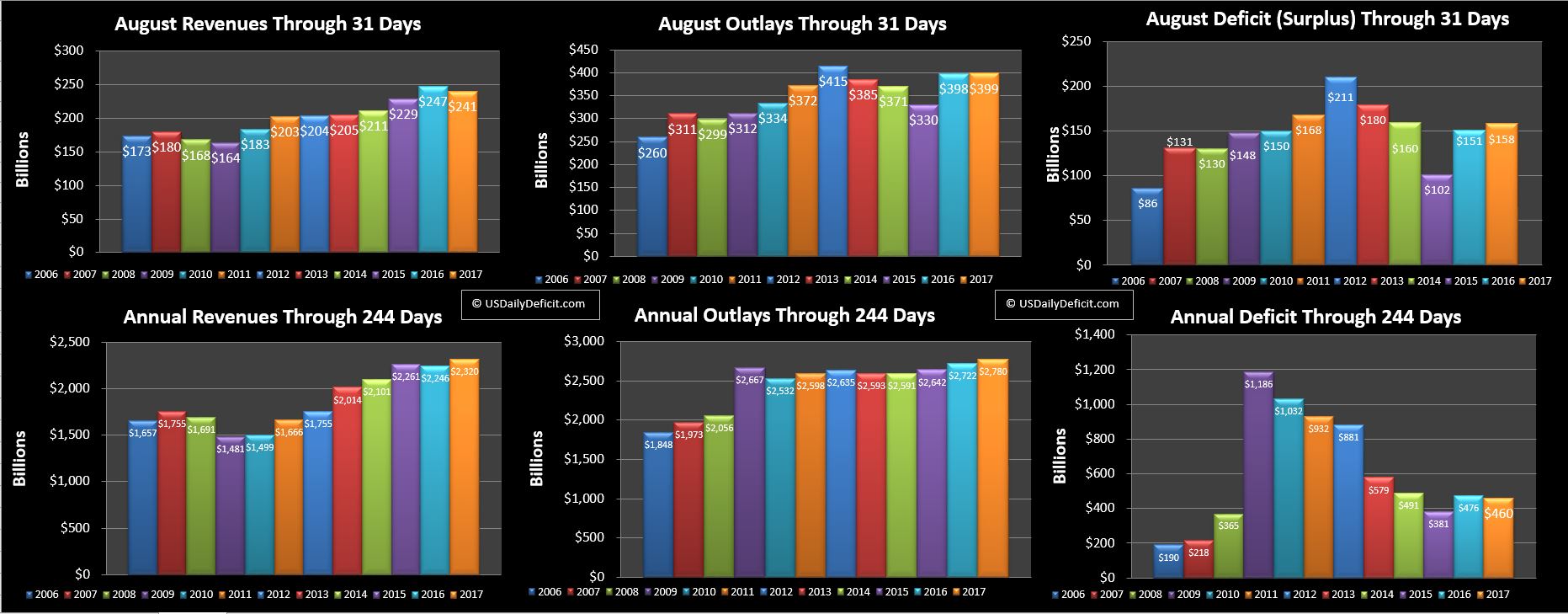

As I have complained mightily about in the past, these shenanigans nuke my simple cash deficit calculations, but I am able estimate them. Now that EM is over and the debt is once again properly accounted for, and I can now calculate it to the penny again. Over nearly six months of EM, my estimates were only off by $5.5B….or $1B per month, which was better than previous EM periods, though honestly nothing about my process has changed. What that means is that just last week I had the August YTD deficit at $460B….these revisions push it up to $465B….so no real material change….The 2017 deficit is pretty much in line with the 2016 deficit which was $476B through 8 months.

My thoughts on the debt limit….it is still just a really bad joke. I get the principle….but am still forced to see that it has failed completely so many times for so many years. And then of course…can we really even call it a debt limit if Treasury can then circumvent it using laws/rules passed by congress for six full months, and $317B? I’m in favor of scrapping the whole silly thing, but perhaps we should at least stop calling it a “debt limit”….maybe we should call it a “Red Line”…LOL (too soon??).

Here is the deal…the US government has a baseline deficit at the moment of about $600-$700B….same as last year. As it stands, this budget is “un-balancable” (probably a made up word 🙂 ), and therefore the debt is unpayable. Sure, we can roll it for a while, maybe a long while, but we can never pay it off.

In order to change the baseline above…. something drastic must change, probably on the spending side of the deficit equation. Nearly half of the annual spending can be attributed to just 3 things…Social Security, Medicare, and Medicaid at nearly $2T/Y. You simply can’t plug that $700B hole, or even make a dent in it with out materially changing these programs, and yet, not a peep. That’s why it pisses me off to hear the Republicans in particular pretend like they care about this issue….then come up with some crazy optimistic proposals about how they are going to “save” $500B….over 10 years. That’s not even worth talking about….if you care about the debt/deficit…come up with a plan to save $10T over 10 years…or don’t even bother trying.

One final thought….now that the EM cannon has been reloaded with a fresh ~$350B, don’t be surprised if the debt limit has in actuality been pushed out not just a few months, but possibly all the way out to next summer. The timing isn’t as good for Treasury this time around….last year EM went into effect just after the heavy tax refunds had gone out in February and just before the heavy tax payments of April. This probably would have got them well into October if the hurricanes Harvey/Irma hadn’t given them the cover they needed to extend it sooner. This time around, it will be much tighter. They may not make it through tax refund season without running out of cash, but if they somehow can make it to April when cash starts flowing back in they can probably make it through the summer again…I hope it doesn’t…watching this stupid game year after year is kind of a downer!!