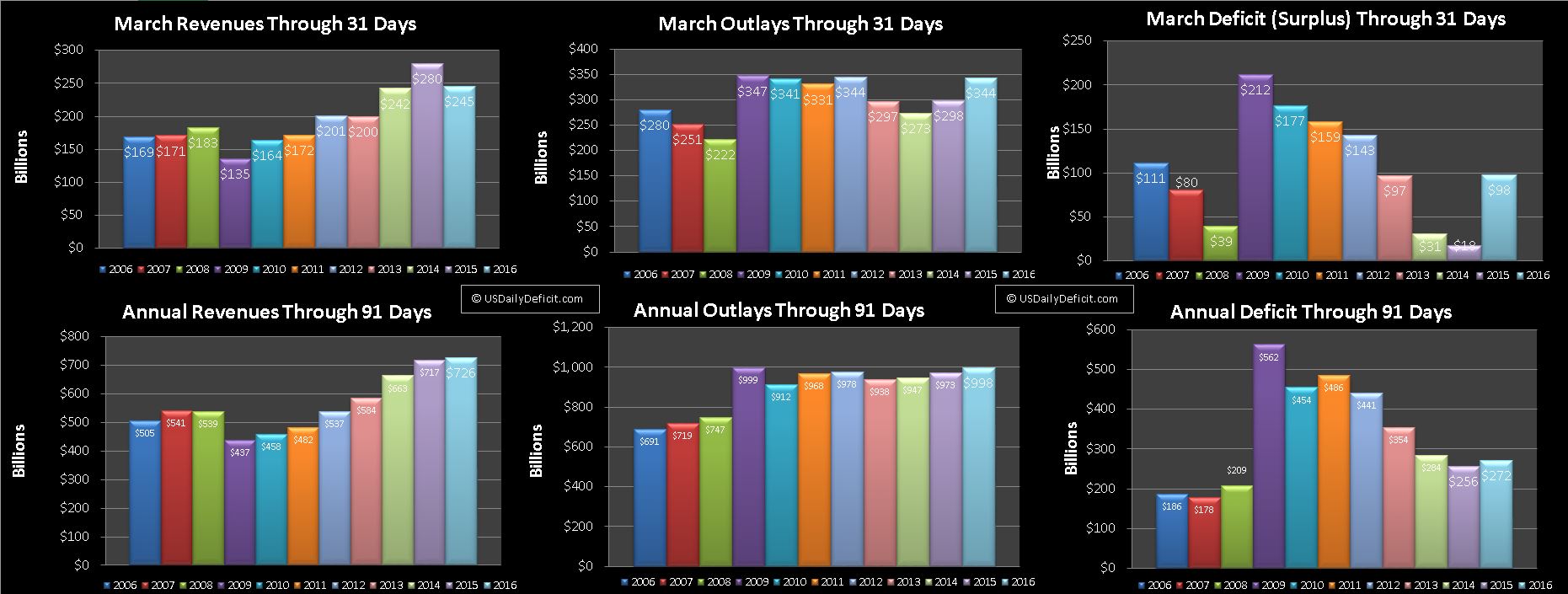

The US Cash Deficit for March came in at $98B easily topping last March’s $18B deficit and bringing the 2016 YTD deficit to $272B.

Revenue:

Revenue was down $35B from last year, which had a $35B inflow from the wireless spectrum auction. So all together flat, with some increases and decreases cancelling each other out. For the year, revenue is up a meager 1%, but the $35B spectum auction is a material piece of that disappointing increase, and looking at other revenue sources, through 3 months it looks like we may have a baseline growth of 2%-3%. April will keep it interesting…could be a big hit or miss…Seems like you never know until the end of the month though the flood of receipts should start picking up around mid month.

Outlays:

Outlays were up $46B, but most of that looks to be timing rolling off from last month. For the year, we are at +2.5% which looks ok, but I still feel like the baseline is a little higher… if we add back in some year end timing it’s closer to +5%. 4% feels about right, but we should have a better feel for it after a few more months.

Deficit:

The $98B deficit looks high, but it’s not as bad as it looks due to the timing and one time reciepts recieved last year. Still…it’s not good…through 3 months the deficit is trending higher year over year for the first time since 2011. There is still plenty of time left to keep the annual trend intact,

Summary:

All together, through 3 months, all things considered, 2016 is looking pretty flat to 2015. The good news is that revenues are increasing….if at the slowest rate we’ve seen in a while, but at least they aren’t decreasing…or worse crashing. Outlays are also trending up, and even if it is only at ~4%, when your base is about 3.5 Trillion of annual spending….4% can become a pretty big problem after just a few years. If I had to guess, 2016 will be plateau year with the annual deficit staying pretty close to 2015 before heading back up in 2017…just in time for whoever our next President is to take office. Stay tuned for April…it should be a solid surplus in the $150B-$200B ballpark absent anything crazy happening.