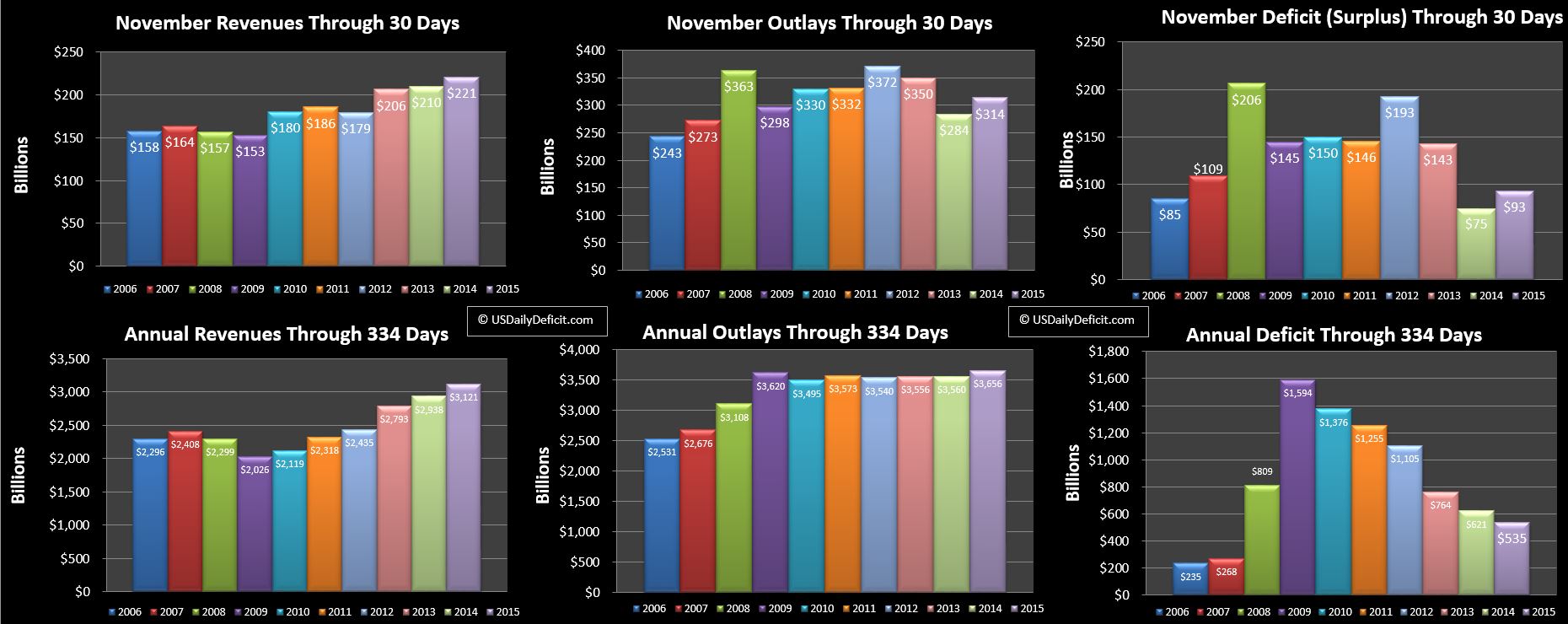

The US Cash Deficit for November 2015 ended up at $93B for the month on $221B of revenues and $314B of outlays. This, plus a ~+20B adjustment of YTD deficit due to true up the end of “Extraordinary Measures” (EM) brings the 2015 deficit to $535B through 11 months. This adjustment is due to the fact that during “EM” I am unable to back into amortized interest until Treasury uncooks their books….in this case for 7 months at ~$3B per month.

Revenue:

Cash revenue was up $11B, or 5%…not bad, but about what we would expect from an extra business day. Federal tax deposits were up 8.2%…which is a solid number….included in that corporate taxes were up nearly 14%. This is consistent with a base line of ~5% and an extra business day. For the year, revenues are up 6.1%…down a little from last month’s 6.3% rate. All together, a solid revenue month, but not solid enough for me to shake a suspicion that baseline revenue growth is slipping below our 5% target which is what we need to offset the growth in outlays and keep the deficit flat around the ~$500B per year mark.

Outlays:

Cash Outlays were up big at first glance….$+30B and 10%. However, the extra business day and timing of interest explains most of that, with our expected increases in SS, Medicare, and Medicaid being offset to some degree by decreases in “Other”….whatever that is. All in, we are still around +3% on outlays for the year…with only one month to go I wouldn’t expect much movement from here even if there are some December surprises.

Deficit:

The November deficit at $93B topped last year by $18B as an increase in revenue was not enough to offset timing of interest payments and an additional business day. For the year, we are now sitting at $535B vs $621B last November and poised to end up under $500B for the year once December’s likely $50B surplus flushes through.

Default Day:

As expected….there was no default… the debt limit was suspended in early November ending 7 months of EM, and pushing the next showdown out to March 15, 2017….likely followed by another 7+ months of “EM” shenanigans.

Summary:

Another okay, but not great month. The first 4 months of 2015 started out with a YOY revenue growth of a little over 10%. Since then, the rate is 3.9%, barely enough to keep the deficit constant with outlays growing at 3%. I’ve been wrong on this before, but it is looking more likely that the 2016 deficit will surpass 2015 ending 6 straight years of improvement. As always…stay tuned!!