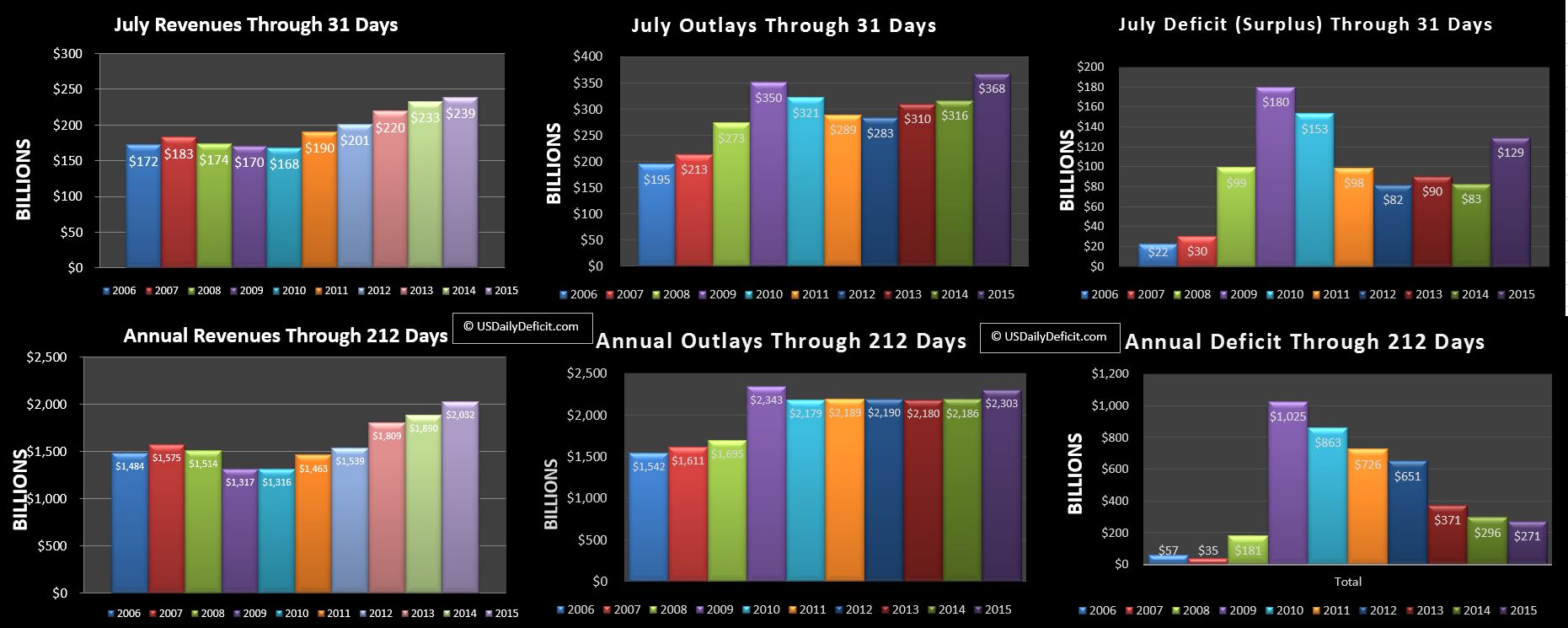

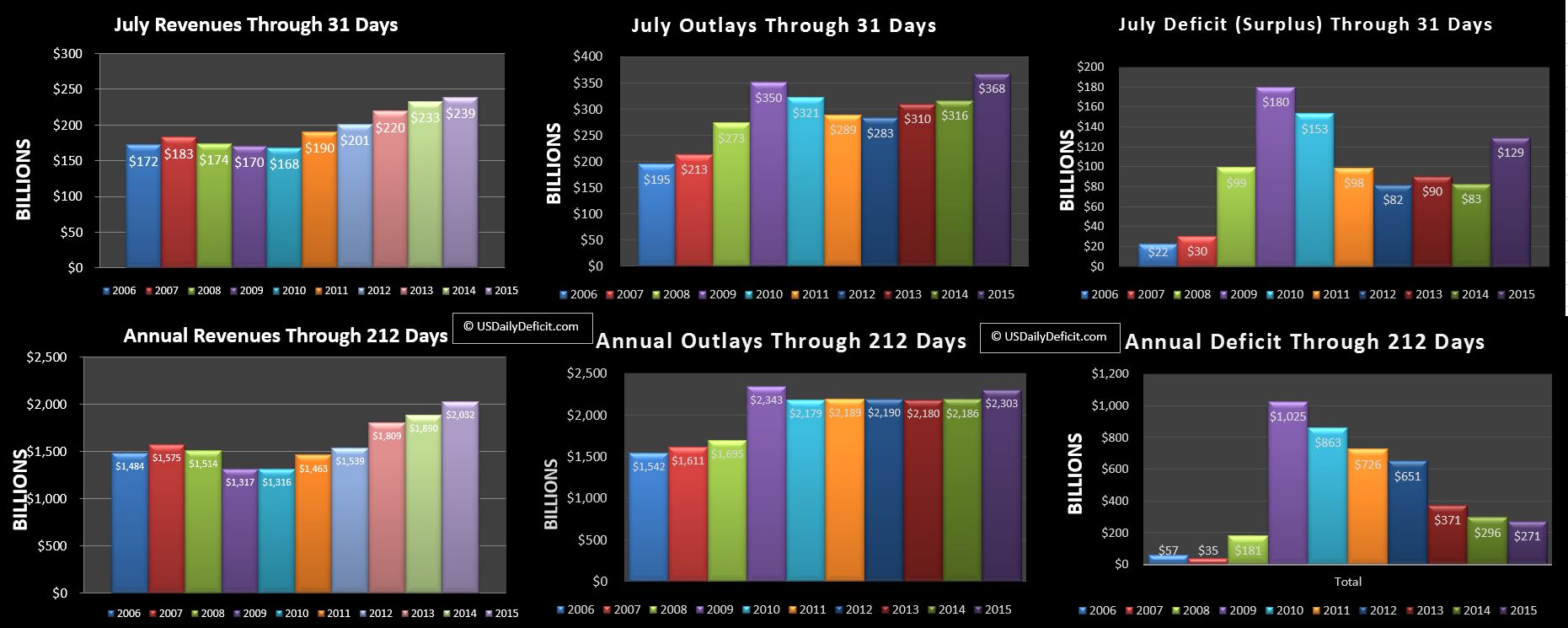

The US Daily Cash Deficit for July 2015 was $129B, topping my $115B forecast primarily due to a surge in Medicare and Medicaid cash outlays.

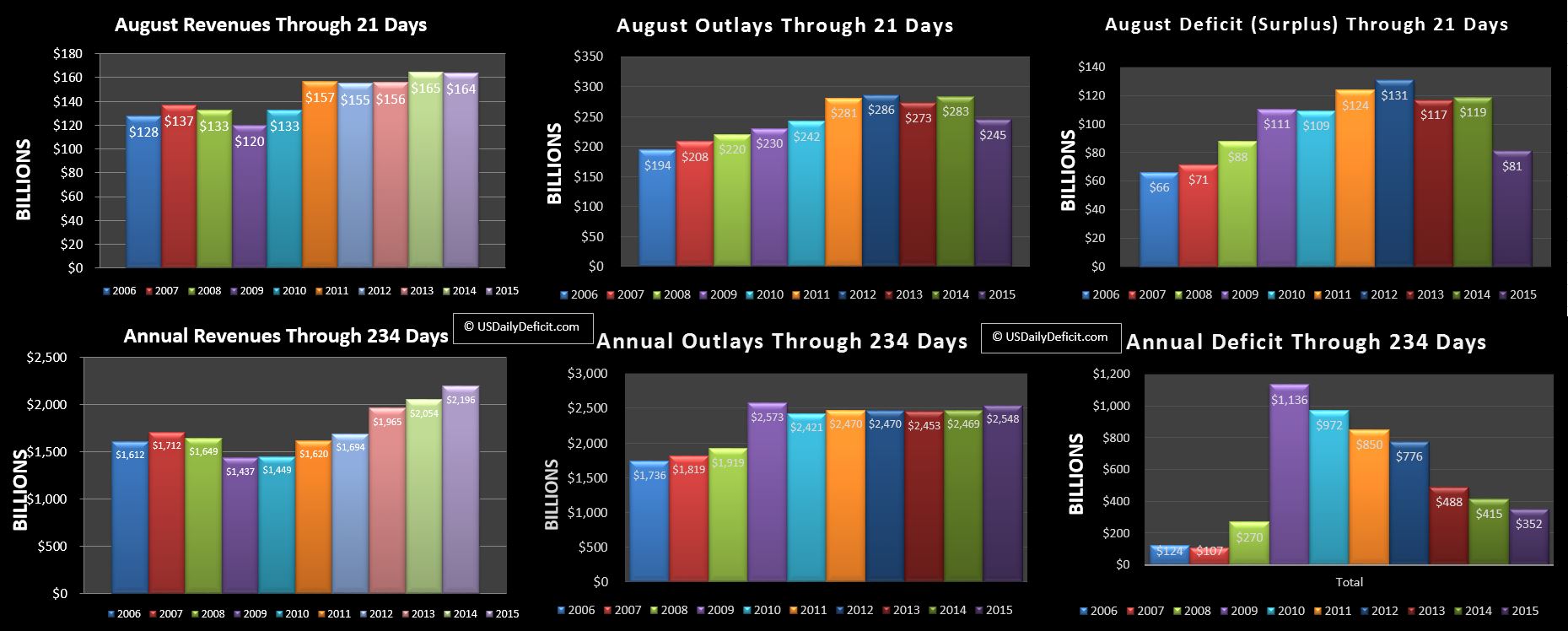

Revenues:

Revenue was up just 2.5% in July compared to the Annual of +7%. However some of that was due to one time cash receipts last year that did not repeat in 2015. Tax deposits were actually up 8%, though pulling out the additional business day would put us closer to +5%. So revenue was a mixed bag in July…not impressive at first glance, but decent after pulling out one time items and timing. For the year, revenues through 7 months are up $142B ggod for a 7.5% YOY gain. This continues to fall as the last 3 months have all been below +5%.

Outlays:

Outlays were up big on timing and outright increases in Medicare/Medicaid/Social Security. August 1 falling on a weekend pulled $40-45B of spending forward into July. Looking at the year through 7 months, cash outlays are up 5%, but pulling out the timing anomaly puts us closer to 3%.

Deficit:

At $129B, July 2015’s deficit tops last year by $46B….about the same as the timing event, so we should get most of that back in August. Three months doesn’t quite make a pattern, but after a solid start to 2015 with revenue at +10% through 4 months, we seem to be seeing ~5% revenue growth and ~3-4% outlay growth roughly offsetting each other and leaving the deficit itself relatively unchanged. The current trailing 12 month deficit is at $530B goosed a bit by the timing, but if current trends hold (and they never do) we would end the year at ~$450B, good for a YOY $100B improvement.

Default Day:

As we all know, the debt limit was hit back in March at $18.113T. Since then, Treasury has managed to keep the government going by drawing down the sizable cash stockpile (274B after the April tax haul) and by implementing “Extrordinary Measures” (EM) which allows them to essentially pretend some types of debt do not exist….thus pulling it off the balance sheet and issuing new debt in it’s place. My guess of the amount of total EM available to treasury is $350B, of which they have used about $200B based on some back of the envelope calculations. This plus the current cash balance…$210B at the end of July gives us the cash cushion available to cover future deficits. At the end of July, this amount was ~$360B, down from ~490B at the end of June. Looking forward using my model, $360B should last until about the middle of February 2016….just as tax refund season begins heating up again. This is also right in the middle of the early presidential primaries, so it could get (more) entertaining if they don’t manage to deal with it sooner. My advice to the political establishment would be to fix this ASAP. Nothing would send voters into the arms of Donald Trump faster than having tax refunds delayed right in the middle of primary season. That’s not an endorsement (of anybody)….just saying 🙂

August Forecast:

I’m going to stick with revenue at +5% and outlays at about +3.5%, so pulling out the timing issues, I have the August 2015 cash deficit at $100B compared to last year’s $155B. As always, stay tuned!!