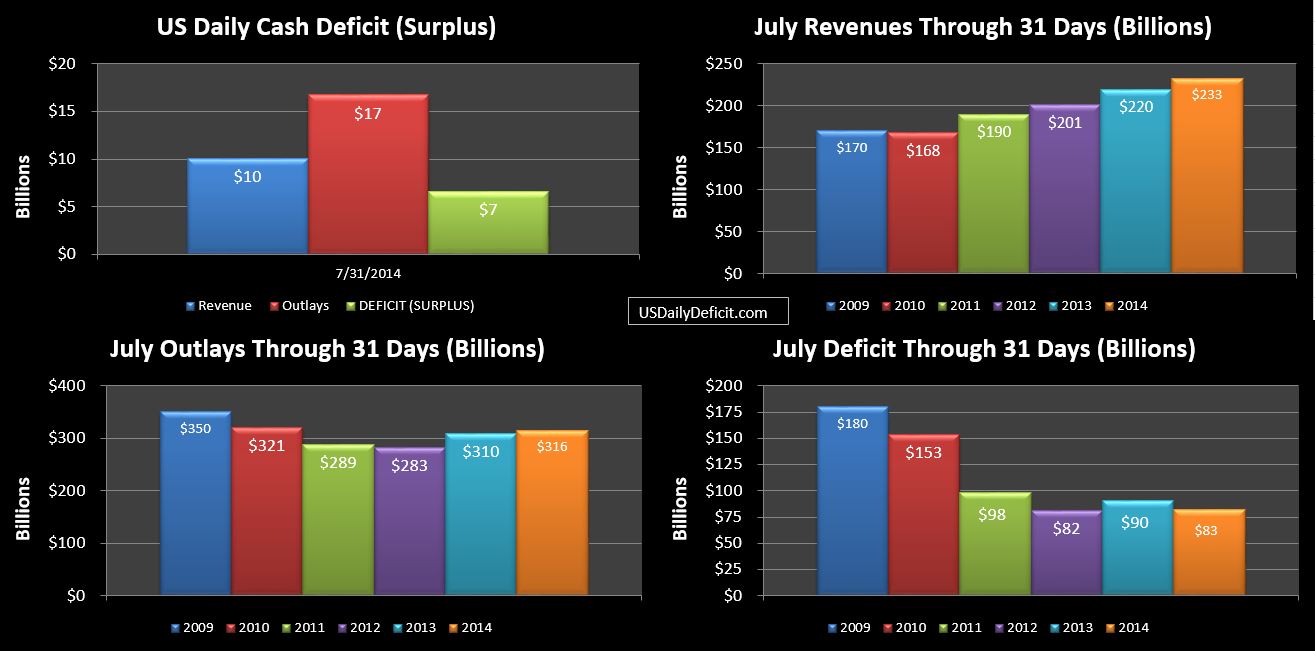

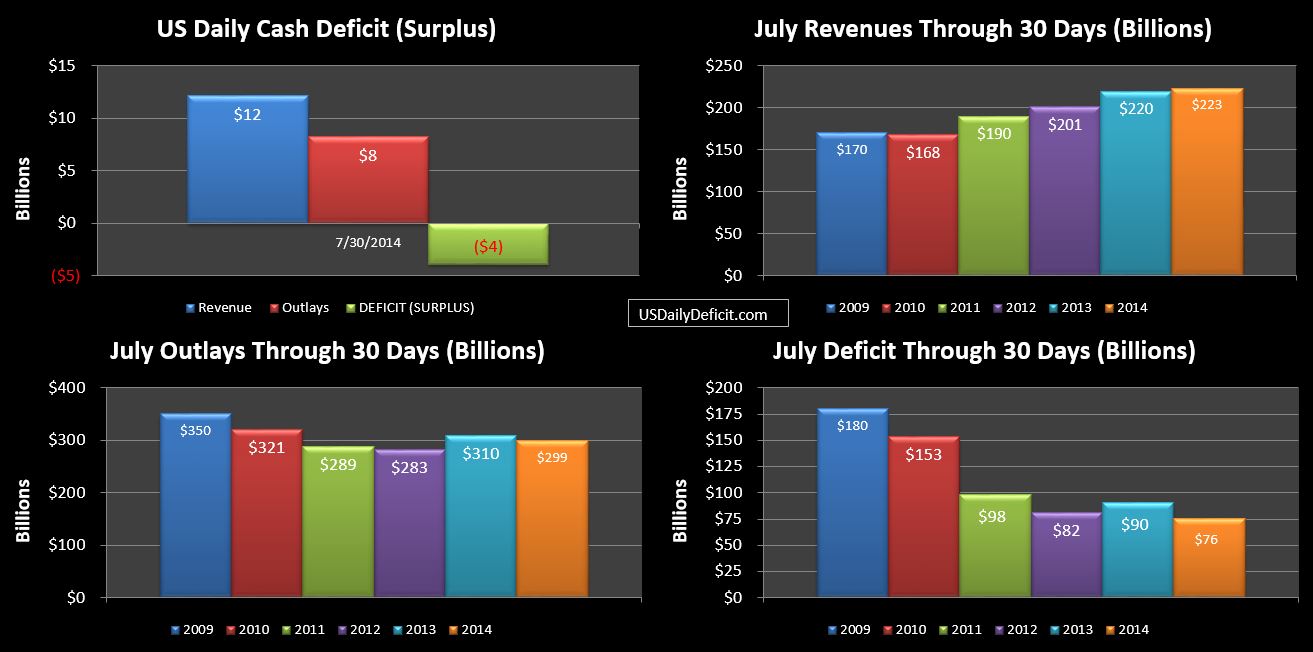

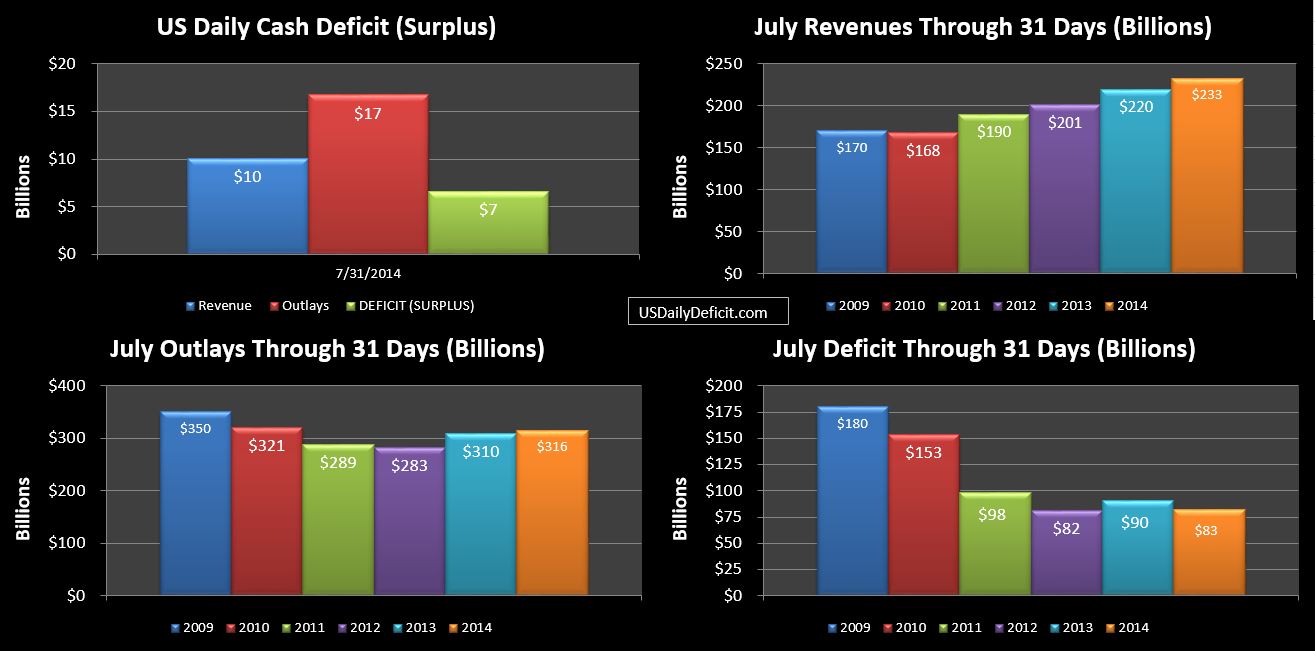

Looks like Treasury finally got the 7/31 DTS figured out and published…. The US Daily Cash Deficit for Thursday 7/31/2014 was $6.6B bringing the July 2014 deficit to $83B…just $7B under last July’s $90B deficit and $23B over my initial forecast of $60B.

Revenues ended up at +$13.5B…good for a 6% gain. This was about $4B under my initial estimate….and about $8B of it came from one time items I didn’t forecast…suggesting the fundamentals are a bit worse. Indeed…withheld tax deposits actually ended up down a fraction at $164.9B vs $165.2 last July. This makes the third month out of 4 with flat taxes withheld…with June being the exception at +13%. Combined…the average of the 4 is +3.7%. In the long run…ignoring recessions…I would expect typical revenue growth of 2-3%….so we are certainly headed in that direction.

Outlays have been more or less flat for years now…with increases in SS, Medicare, and Medicaid being offset by reductions elsewhere. This has made them fairly easy to forecast since we don’t see any wild unpredictable swings. Until now. While I only missed the revenue forecast by $4B…I missed outlays by $17B, $13B of which was related to Medicare and Medicaid. I’ve been discussing Medicaid for a while…and as expected, it broke the one month record….surging to $30.8B…an $8B and 36% increase over last July. Medicare was up nearly $5B YOY from $51.7B to $56.5B. I can’t explain it…maybe they got behind on accounts payable and finally caught up…causing the spike…this is a cash based report after all. For now, I have to assume the magnitude of these YOY gains is just an anomaly…let’s hope so.

All together….the month was a mixed bag. Revenue gains of +6% are nothing to sneeze at…If I was in charge I’d be happy with that all day long. But…there was weakness….and those one time items will make it that much harder to post a decent number next year. I’ll give it another few months for final confirmation…but it is starting to become quite clear that the +10% revenue growth period we saw between 1/2013 and 3/2014 is over and headed back to a normal range….hopefully 5% or so, but maybe not. Outlays showed some signs of picking up…perhaps the most solid signal in 4-5 years of relative stability. We should keep an eye on it, but for now it’s just one data point.

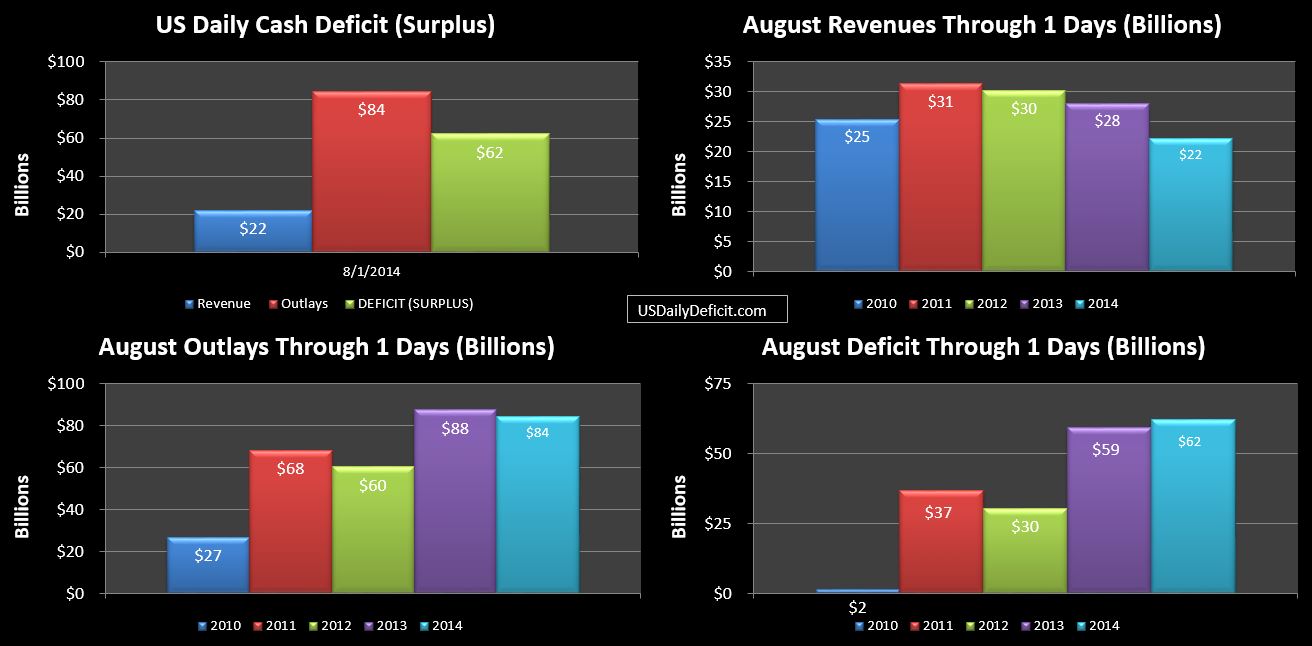

Looking forward to next month….August typically has one of the highest monthly deficits posting $173B last year. I haven’t fine tuned my official forecast, but ballpark it’s looking like $160B or so. Doh!!