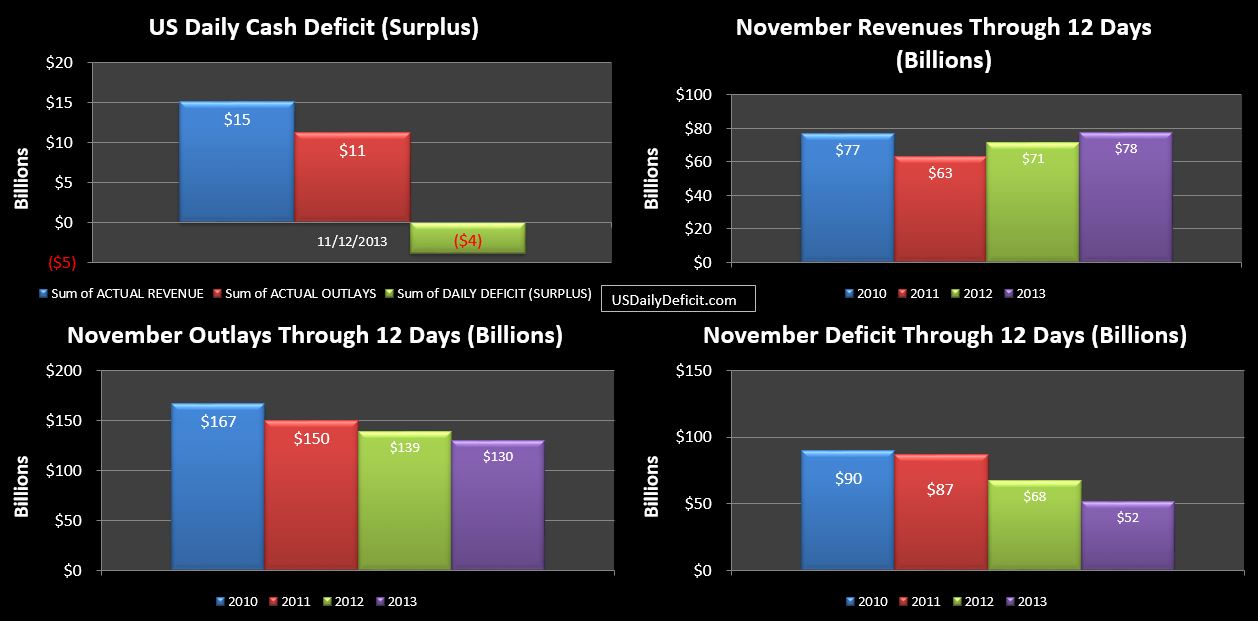

Although I’m a few days late, it’s time to make the November deficit forecast. Now…before I do, I think I should take a moment to toot my own horn….In October, I forecasted a $91B deficit and actuals came in at $87B….marking my best performance to date over the last five months (which is how long I’ve been doing a “formal” preview). The biggest miss was $18B in August and the average is 11. So…skill??? Probably not. We’ll chalk this one up to luck.

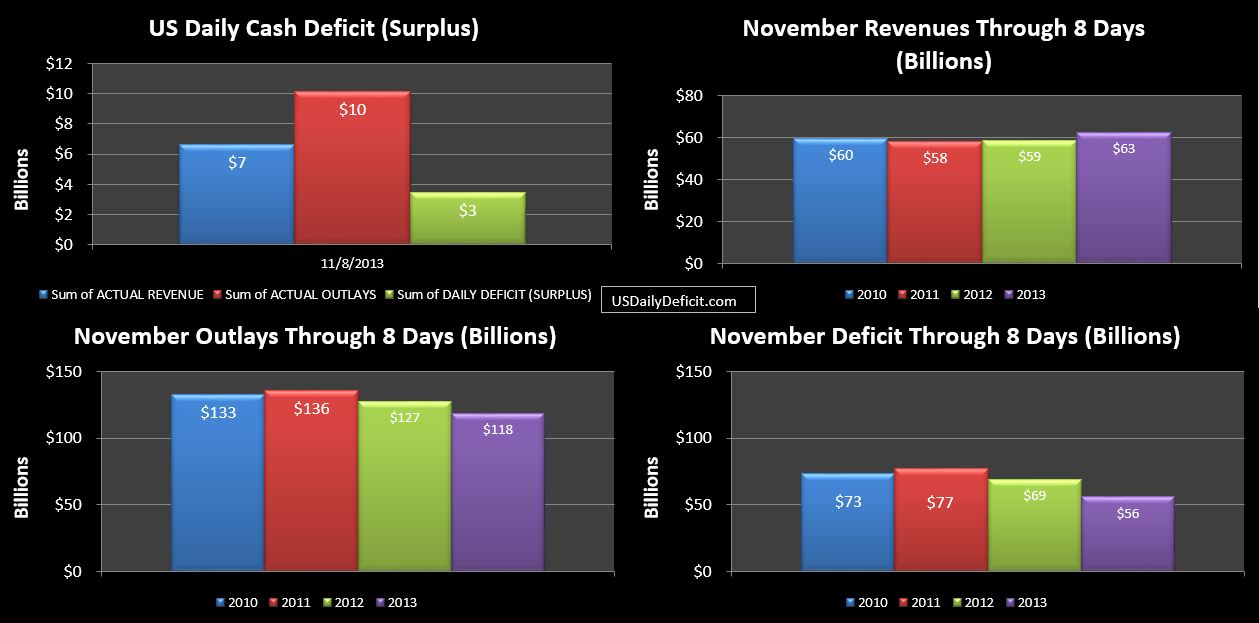

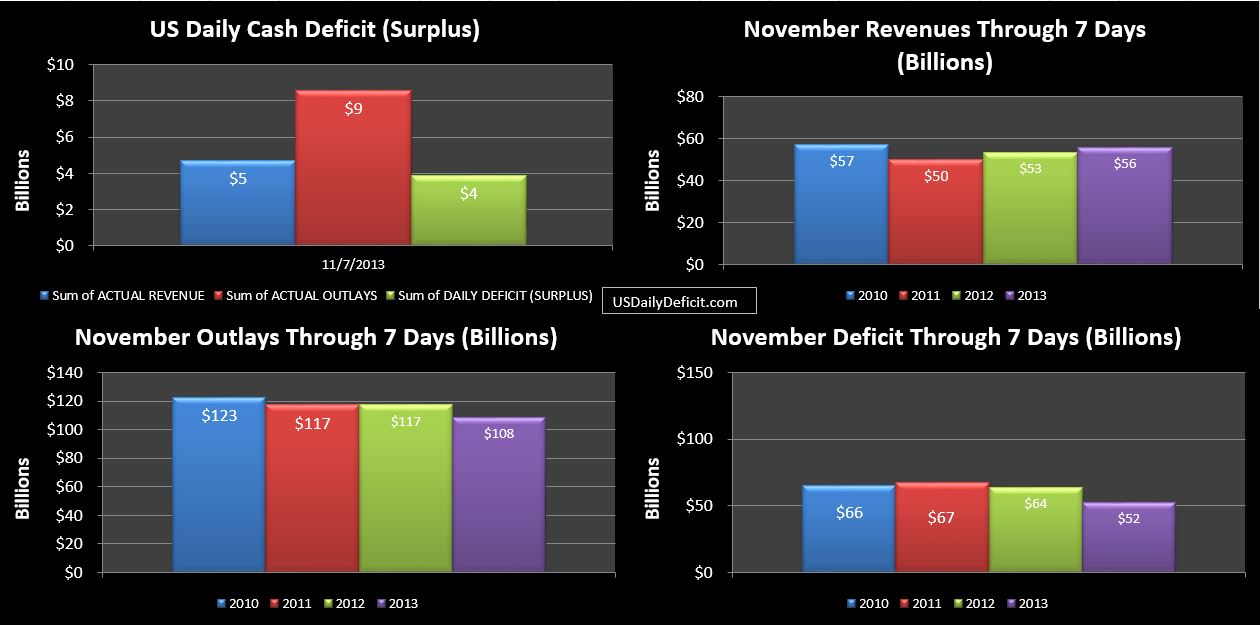

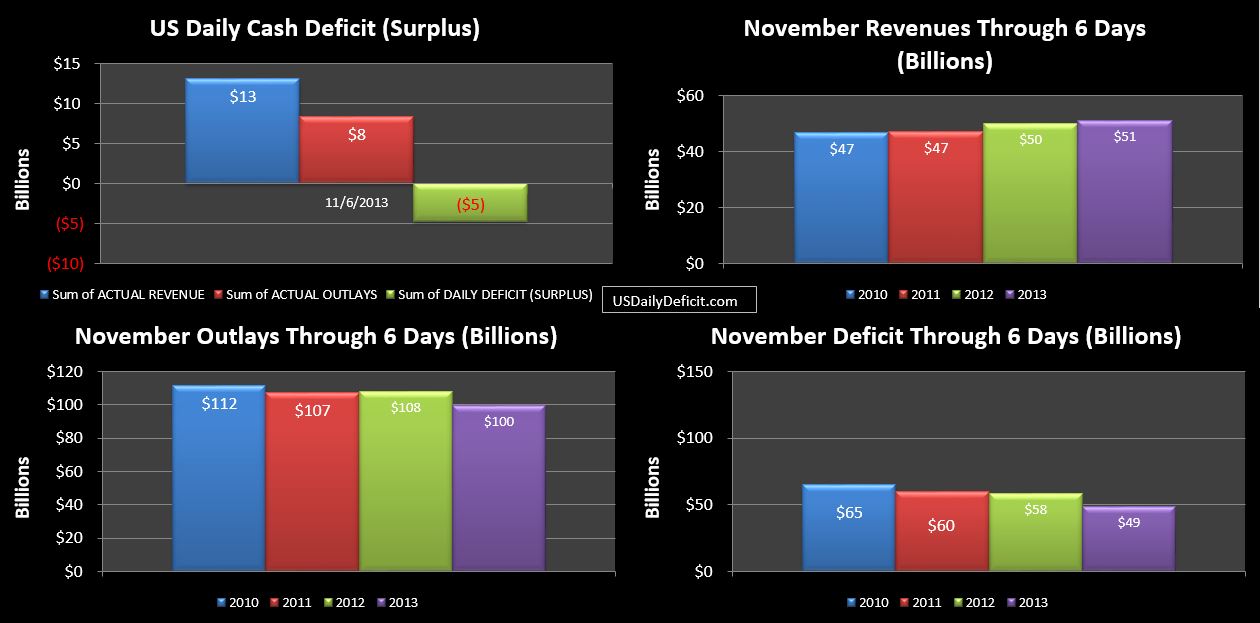

Remember…all we are doing here is taking a look at historical revenues and outlays by category and using that historical data to make a current forecast. For most categories, it’s just a matter of multiplying last year’s number by an increase or decrease that matches the trend. For example…last November, federal tax deposits were $145.408B. For 11/2013, I am forecasting $161.403B… an 11% increase, which is in line with the trend for this category. Moving out to this next January, my current forecast drops that growth down to 6%, though honestly I don’t really know what to expect…it’s essentially a whole new world.

So you can see, it’s not rocket science, but it is a bit tedious, especially once you start trying to adjust for timing. With 12/1 falling on a Sunday….a big chunk of those 12/1 expenditures like Medicare, Military Pay, pensions ect…all get pulled into November causing a headache, but it’s not too bad if you have the historical data to make appropriate adjustments.

So, while admitting November is a bit chaotic, and that I am unlikely to match my October success, I’ll go ahead and throw my dart. Revenues will end up at $202B(vs $180B 11/2012) and outlays will come in at $362B (down from $368B), good for a $160B cash deficit in November 2013…. a $28B improvement over last November. Happy Thanksgiving…hope you enjoy your household’s $1,400 share of the monthly deficit!!