I saw a clip of Obama yesterday telling an audience that the reason the Republicans are so hell bent on killing Obamacare is that they are afraid that if they let it through…people will actually like it…..making it impossible to do away with. He’s right you know….just look at Social Security, Medicare, Medicaid, Food Stamps….and dozens of other large federal programs…..How will we ever kill a program that gives free stuff to large voting blocks? We won’t….this, it seems is the Achilles heel of democracy….and will likely be the key to our downfall.

So let’s just admit it… Obamacare is just another government mechanism to give free stuff to a large voting block….probably Obamas voting block. I oppose Obamacare because it’s just another Welfare Program. Republicans, I suspect, oppose it primarily because it is Obama’s welfare program. So Republicans are on the right side of this, but they don’t exactly have the moral high ground.

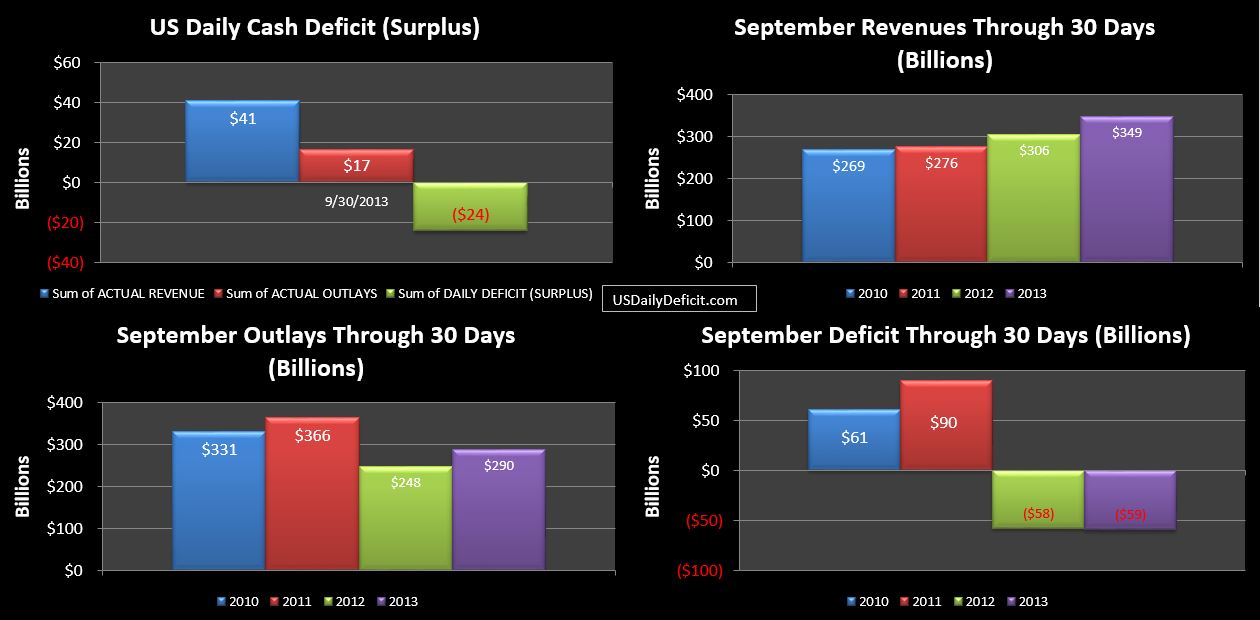

I don’t know the actual cost…I’ve seen anywhere from $0 to $150B per year. It’s not huge, in a $3.8T budget, but it’s big enough. For about 4 years now, federal outlays have more or less stabilized at around 3.8T. For how long?….probably not much longer, but it’s still a tiny bit encouraging. On the Revenue side, since bottoming out at 2.3T in 2009, annual revenues have risen 30% to $3.0T, including a 12% increase in FY 2013 that just ended.

Four years ago, we were sitting on a 1.8T deficit….it pretty much looked like the end. If you were an optimist….and sat down and penciled out a best case scenario….reality has pretty much followed that script for 4 years now with flat cost and growing revenue. Don’t get me wrong, we aren’t saved….we still have an $800B annual deficit, which is enormous, but an optimist might say hey…if I can keep this streak for another 5 years, who knows, maybe I will actually balance the budget after all(now what to do with this $20T+ debt??).

And then comes Obamacare. After so much progress restraining cost(well…relative progress)…. why come in and create a new entitlement program? Instead of creating feel good programs like this, why not just skip the show, and just write checks to people. Why not give every citizen $50k per year? Or better yet, why not just give everyone a check for $10M and be done with it. Problem solved right? Well…no. You see, if I got a check for $10M tomorrow, I’d quit my job the next day…and so would everyone else, leaving me with the little problem of having $10M in my bank account….but nothing to buy, not even food. That would end quite poorly wouldn’t it?

The bottom line is….despite all of their noble (I assume) intentions, there are problems that government simply can not fix, and their attempts to do so will only make things worse overall. And that’s the problem with Obamacare….sure there are some people who will be better off, but the losses overall will far outweigh the benefits. All government programs are like this…from social security to the Park Service. Taking money from one group and giving it to another will always incur net losses, especially when there is an army of incompetent bureaucrats in the middle.

Honestly, even without Obamacare, the odds of this four year streak continuing were pretty slim. My current forecast is that we are pretty close to a bottom at $700-800B per year deficits for 2014 and 2015 before heading back up as entitlement programs drive outlays to outpace revenue gains. Throw in a recession anywhere in the next 5 years and the numbers get a lot uglier fast…and that’s without any Obamacare costs. I’ll add them to the model once I find a reliable source….(probably actuals sometime next year)