Multiple news outlets are reporting that Fannie Mae did in fact make the $60B payment we’ve been discussing on and off…no surprises here….when we add Freddie into the picture, the total was $66B. Most of what I’ve read is just news clips…but this one by Daniel Gross at the Daily Beast takes the cake.

“That payment of $59.3 billion is real money—equal to about 2 percent of all expected federal revenues for the current fiscal year. And it all goes to deficit reduction.”

It’s a nice Kumbaya kind of article…Everything is getting better…the bailouts worked……. But it’s all bull$#@%…. as I documented here. I never know any more if the journalists are really just that ignorant, or if they are just lying SOB’s. Quick…Somebody flip a coin.

So…let’s take another look at what has really happened here. Fannie Mae is essentially a government run operation., so whatever “profits” they make get handed over to the government. So…let’s just say that in a given year, they make $10B before tax profit They would send in $3.5B to the Treasury as “corporate taxes” and $6.5B as a dividend payment.

Now…say they have a “tax asset” based on past losses that basically shields all of their income from income taxation. So…this time around, they make the same $10B…and send it all to treasury as a dividend. Hopefully the point is clear…the very idea of one government entity paying “taxes” to another is a bit silly…am I right? The cake is still the same size, no matter how you want to slice it. Tax assets are of no value to government owned entities….

Back to Fannie….I think we can agree from the above example that taxes are irrelevant to the future cash flows they will generate for treasury. Despite this….Fannie Mae…not doubt prodded by Treasury, decided to write up the value of previously written off tax assets (from when they actually were kinda sorta a public company) back up….recognizing an immediate $50B gain. It’s kind of neat…you should try it. So open up your personal balance sheet….and where you have the value of your 10 year old car at $3k…..just write it all the way back up to whatever you paid for it, say $33k. Instant $30k gain. Don’t you feel richer now? Didn’t think so.

After writing up their imaginary assets that are pointless for what is in reality not a public company…then…They went out and got a loan for the full amount….then wrote a check to Treasury on their “earnings” This is actually kind of what everybody was accusing Mitt Romney and his band of corporate raiders of doing back in the day. Take over a business….then lard it up on debt and use the cash to pay yourself big cash bonuses. Then, you take the company public again… and a few years later the whole thing goes bankrupt because they can’t pay the outrageous amount of debt they have.

When it comes down to it…from a cash flow perspective, all Treasury has done is pull forward future cash to today….trading a bigger cash payment today for smaller future payments. I don’t know what kind of interest rates Fannie will pay on $60B of debt, but it’s probably a lot higher than treasury would have.

Finally, I just want to take a minute to clear up one other thing I thought was silly, but is often repeated. Gross mentions that Fannie has now paid back $95B of the $116B they took in bailout money. I have no reason to doubt the numbers, but I feel it misses an important point. If you lent somebody $1000 back in 1980….and they came back in 2013 and said…here’s the $ I owe you. Technically, yes…they paid you all back. Obviously you are happy to get it, but in saying you are even forgets a very important component…opportunity cost. You could have invested that $1000 over the last 33 years, getting say 5%, and ended up with over $5k.

Now, 33 years haven’t passed, but this simplistic analysis by Mr. Gross is either amateur or just plain misleading. Treasury had to go out and issue an additional $116B of debt, and pay to service it for the last five years…And who knows how much cost they incurred printing up those pretty annual reports. At least twitter is free, so it didn’t cost them any money at all to announce their $66B funny money scheme to the world.

For more info on the shenanigans…check out my original post here. It’s a lot of trouble for perhaps…three weeks worth of deficit relief?

Finally…just some thoughts on the value of Fannie Mae. Let’s just ignore all of the other $3T of debt Fannie has, and pretend for a moment that as of 6/27, Fannie Mae was generating a bonafide $20B of cash per year, and that the market would value this cash flow at say 10X, for a total value of $200B. Just pretend that this is what treasury could sell Fannie Mae to a buyer for.

Now…it is 7/1, and the facts have changed a bit. They are more or less the same, but now they have $60B of unsecured debt. How much would somebody pay for them now? Probably about $140B or so. So…you see, Treasury hasn’t managed to pull money out of thin air like they want you to believe…all they have done is get a payday loan, and diminish whatever value Fannie Mae had by another $60B and I’m not sure if it was positive to begin with….

**Edit**

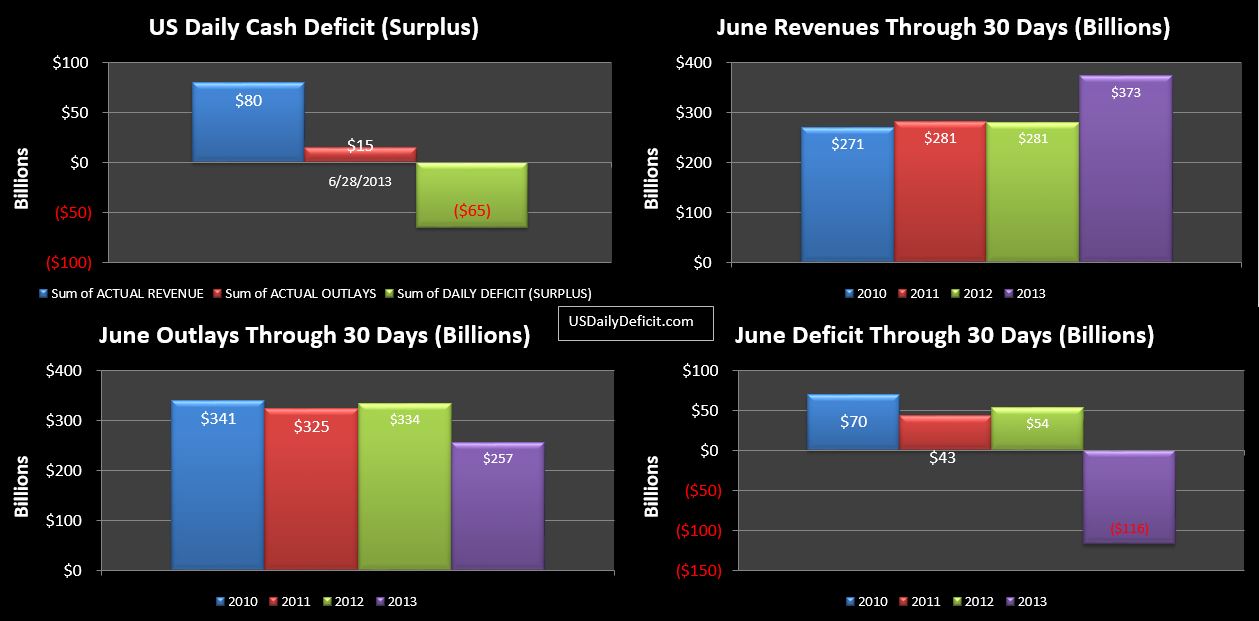

Just wanted to say…you can make an honest case that the budget deficit has improved a lot over the last 6 months, or even the last couple of years. Now…I would argue that it’s temporary, but facts are facts, and there is no denying that after topping out in 2009 at $1.6T, the deficit has steadily dropped and will probably end 2013 between $700B and $800B…huge numbers still, but clearly dramatic improvement. Fine…make that case. What pisses me off though, is someone using these Fannie Mae payments as evidence of deficit improvement, despite the completely shady way the payment came about.