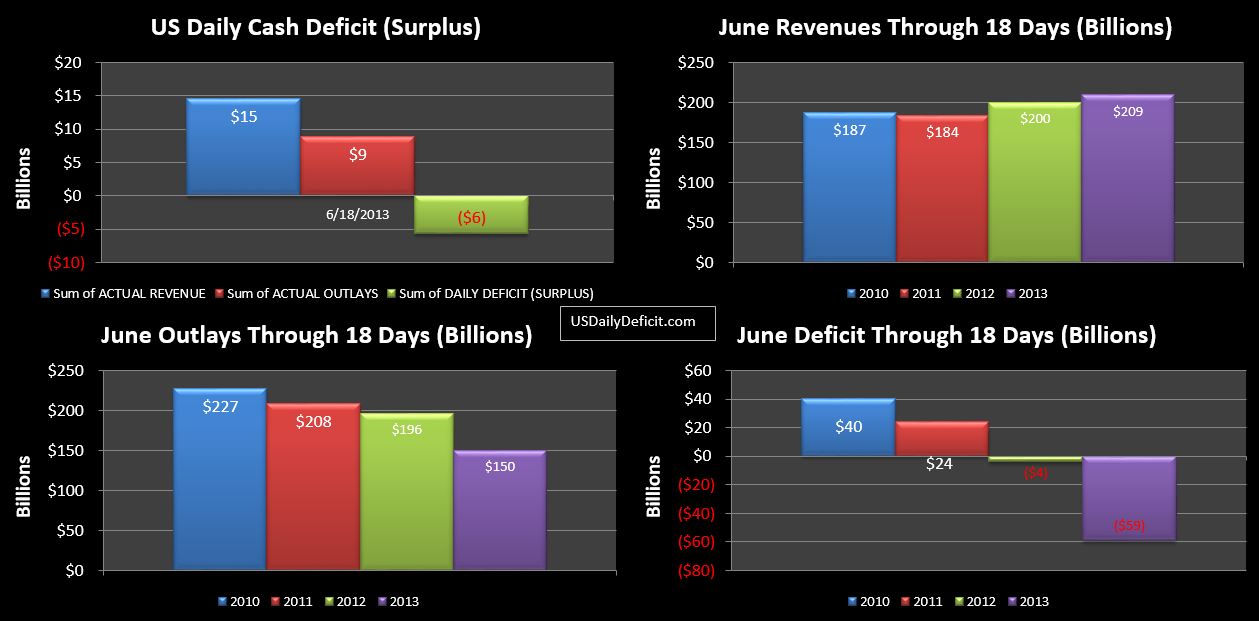

The US Daily Cash Surplus for 6/18/2013 was $5.7B as we got our first good glance at June “taxes not withheld” at $12.3B. There are still a few days of heavy inflows on deck, but at this time, we are down $6B, or 20% from last June. That’s not a good sign, but I’ll give it a few more days before I call it.

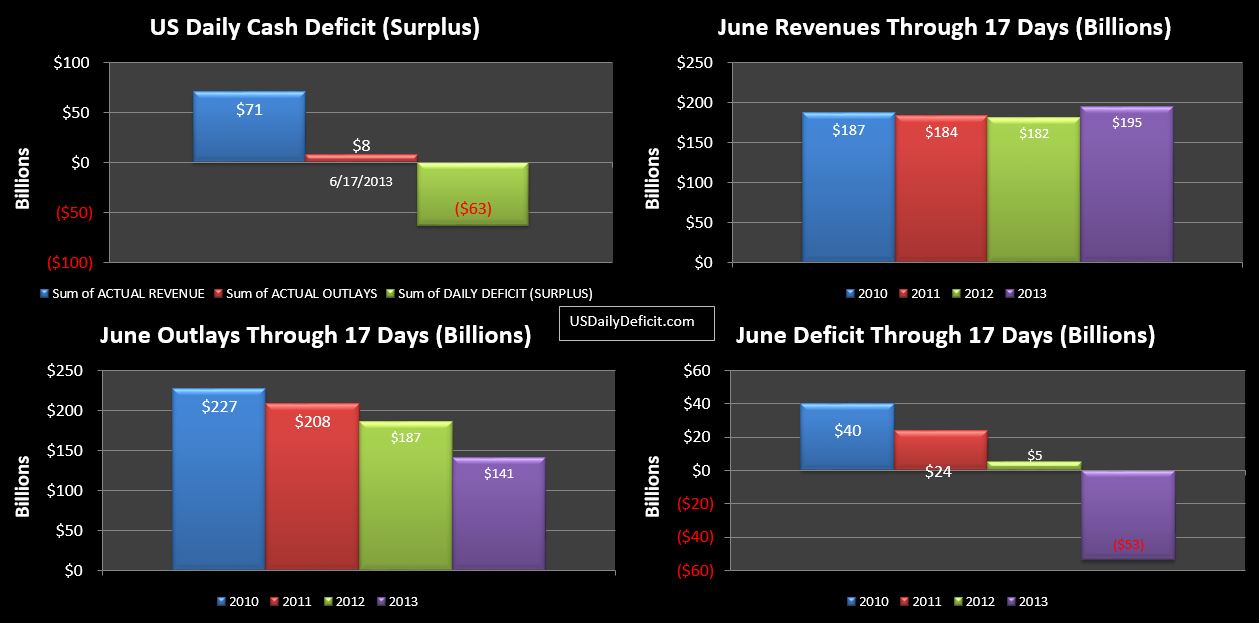

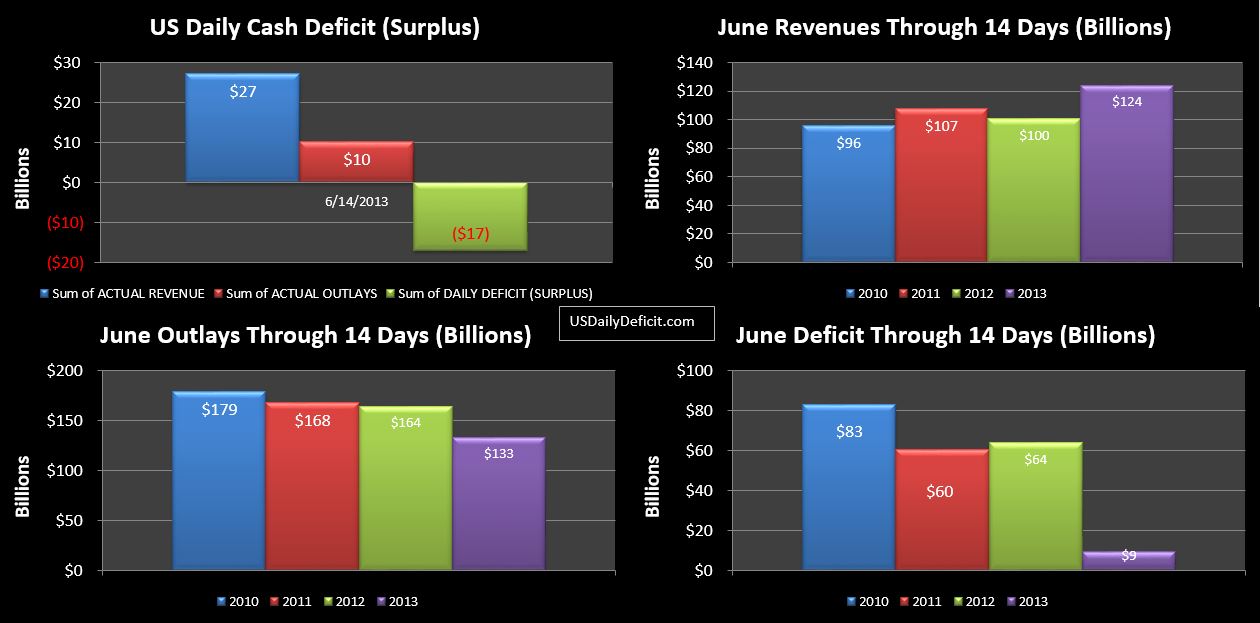

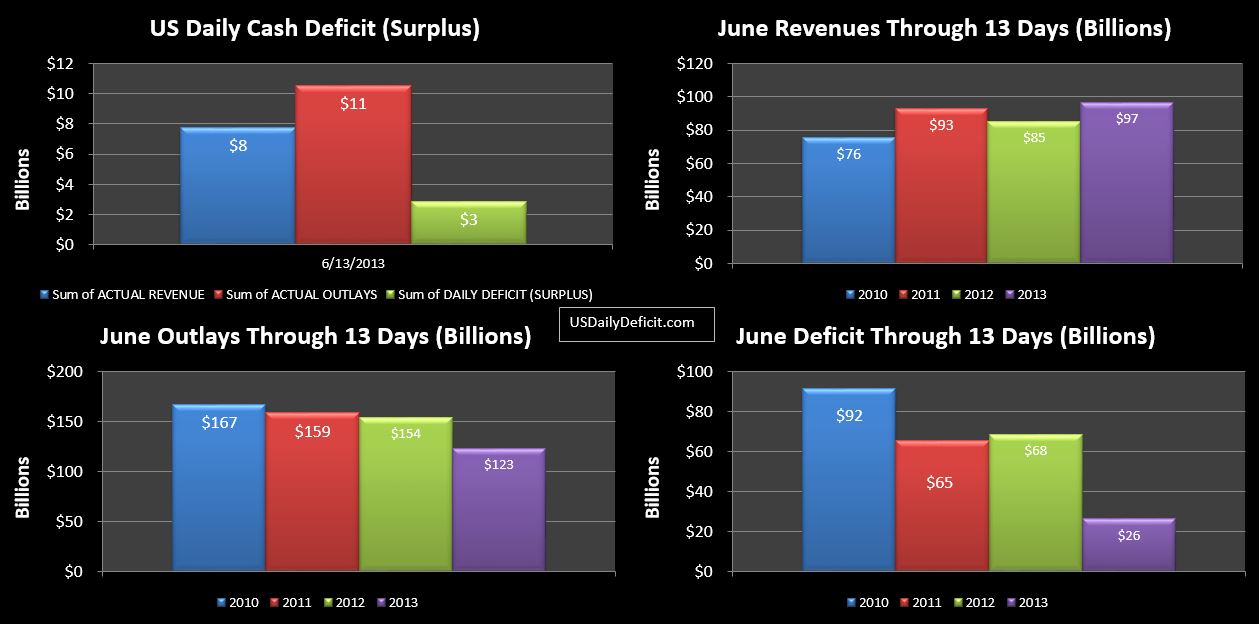

As it stands…the charts don’t look that bad…let’s walk through it. Net revenues are up $9B, which sounds good, but it’s only a 5% increase…our baseline is at 12%. Cost, on the other hand, look to be down an amazing $46B. Of that…$30B is timing related to 6/1 payments going out in May. $12B is related to social security payments…that should catch back up tomorrow…and the rest is because I have an additional business day (6/19) for 2012. This more or less sync’s up the months/days and since June 2013 is going to have one less business day anyway….I feel this is a more accurate presentation of the data.

All this leads to an apparent $55B YOY improvement in the deficit, and we haven’t even received the $60B payment from Fannie Mae yet. But if we back out the cost timing and social security payment, and we are really looking at a $13B improvement so far….not impressive at all compared to what we saw between January and April. We have 8 business days to go….it will be interesting to see where we end up. Two disappointing months in a row (backing out one off revenues and outlays) is not a trend line we want to be on but it is looking more and more likely.